Cover for your car, bike and trailer

No matter what your type of transport, we're committed to providing you with peace of mind on every journey, ensuring that you're protected wherever the road takes you.

There for you when you need to make a claim

We're owned by our Members, so we make it a top priority to get you back on the road as soon as possible.

Choose from 3 levels of cover:

Additional benefits

- Comprehensive

- Third party, fire and theft

- Third party only

Comprehensive

Claims for accidental breakage of windscreens, window glass, sun roofs and other body window glass will not have an excess applied and your No Claims Bonus will not be affected.

We will cover the reasonable cost of replacing locks and keys (including electronic access cards, transponders and remote door openers) if they have been lost, damaged, stolen or duplicated.

If another party is found to be completely at fault for an accident, we will refund your excess and ensure your No Claims Bonus remains unaffected.

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation. A $3,000 per policy limit for comprehensive applies.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

We will pay up to a maximum of $1,000 to cover any necessary and reasonable additional accommodation and travel expenses that you need to pay to complete your journey following an accident.

If a vehicle is considered uneconomical to repair and it is less than 1 year old, or less than 2 years old with no more than 40,000 km driven, we will replace it with a new vehicle of the same make, model and specification.

If you, your spouse, or any member of your family who normally lives with you is injured and, as a result, dies because of a sudden accidental event while driving the vehicle or as a passenger, we will pay $20,000 to the estate of that person. A $20,000 sub-limit applies.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Any replacement vehicle purchased is automatically covered for 30 days on the same terms and conditions as the existing policy.

We will provide up to a maximum of $1,000 cover for vehicle spare parts and accessories that are stored at home in a secure location.

We'll automatically provide cover for a trailer you own or is in your care for its current value up to $2,000.

If your vehicle can't be driven away from an accident site, we'll pay the reasonable cost for removing it and transporting it to the nearest repairer or place of safety.

For a small additional premium on your policy, if you make a claim, we'll provide you with hire car cover while your vehicle is being repaired or replaced. We'll contribute up to $100 per day, for up to 30 days, towards the cost of hiring a temporary replacement vehicle.

Third party, fire and theft

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

If your vehicle can't be driven away from an accident site, we'll pay the reasonable cost for removing it and transporting it to the nearest repairer or place of safety.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Third party only

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Additional benefits

Comprehensive

Claims for accidental breakage of windscreens, window glass, sun roofs and other body window glass will not have an excess applied and your No Claims Bonus will not be affected.

We will cover the reasonable cost of replacing locks and keys (including electronic access cards, transponders and remote door openers) if they have been lost, damaged, stolen or duplicated.

If another party is found to be completely at fault for an accident, we will refund your excess and ensure your No Claims Bonus remains unaffected.

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation. A $3,000 per policy limit for comprehensive applies.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

We will pay up to a maximum of $1,000 to cover any necessary and reasonable additional accommodation and travel expenses that you need to pay to complete your journey following an accident.

If a vehicle is considered uneconomical to repair and it is less than 1 year old, or less than 2 years old with no more than 40,000 km driven, we will replace it with a new vehicle of the same make, model and specification.

If you, your spouse, or any member of your family who normally lives with you is injured and, as a result, dies because of a sudden accidental event while driving the vehicle or as a passenger, we will pay $20,000 to the estate of that person. A $20,000 sub-limit applies.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Any replacement vehicle purchased is automatically covered for 30 days on the same terms and conditions as the existing policy.

We will provide up to a maximum of $1,000 cover for vehicle spare parts and accessories that are stored at home in a secure location.

We'll automatically provide cover for a trailer you own or is in your care for its current value up to $2,000.

If your vehicle can't be driven away from an accident site, we'll pay the reasonable cost for removing it and transporting it to the nearest repairer or place of safety.

For a small additional premium on your policy, if you make a claim, we'll provide you with hire car cover while your vehicle is being repaired or replaced. We'll contribute up to $100 per day, for up to 30 days, towards the cost of hiring a temporary replacement vehicle.

Third party, fire and theft

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

If your vehicle can't be driven away from an accident site, we'll pay the reasonable cost for removing it and transporting it to the nearest repairer or place of safety.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Third party only

If another party is found to be completely at fault for an accident, we will pay for damages totalling up to a maximum of $3,000 for your vehicle that would otherwise be excluded under a third party or third party, fire and theft policy. With a comprehensive policy, full cover already applies in this situation.

In the event of a genuine medical emergency, we will provide cover for a driver who would otherwise be excluded, or cover you while driving another vehicle for which you do not have insurance.

You can choose to either use one of our preferred repairers and we'll guarantee their repairs, or you can select a repairer of your choice.

Get a premium estimate now

Premium estimatePrefer to talk to someone?

0800 800 627

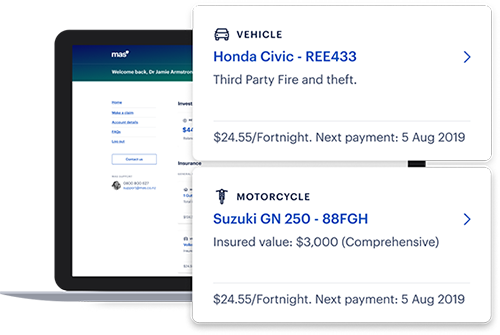

Manage your insurance with us online

Check out your policies, update your details and more in the MAS Member Portal.

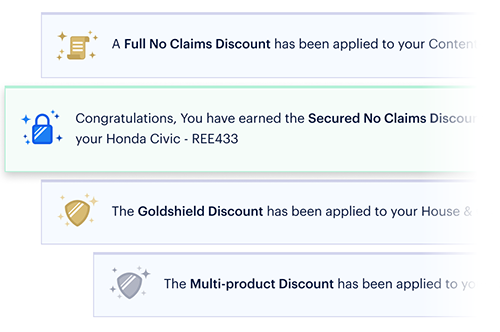

Take out multiple policies and save

Insure your car and your house or contents and you may be eligible for our multi-product discount. Insure your car, house and contents and you may be eligible for our Goldshield discount.

Useful links

This webpage is intended as an information guide only and does not form part of the policy document or any contract with MAS. This webpage does not consider your specific financial situation, needs or goals. You can find out more about financial advice at MAS here. Normal underwriting criteria apply for all insurance products. Special conditions and/or excesses may apply to the situations that meets your specific needs.