Changes to the oversight arrangements of the Schemes

Previously, you could only join the Schemes if you met certain MAS eligibility criteria. From 23 June 2021, we have opened eligibility to join our Schemes to all New Zealanders who meet the broader Government eligibility requirements.

As a result, Medical Funds Management Limited (MFM), a wholly owned subsidiary of Medical Assurance Society New Zealand Limited (MAS), became the Manager of the Schemes, replacing the previous Trustees. MFM is licenced under the Financial Markets Conduct Act 2013 as a manager of registered managed investment schemes.

As part of this change, we’re required to have an independent supervisor, and we have appointed Public Trust to carry out this role. Public Trust is a Crown Entity who will monitor your investments and MFM as the manager of the Schemes, and make sure we’re meeting all our responsibilities under the law. Public Trust also needs to give their approval for any significant changes to the Schemes we may want to make in future, such as altering the fees.

We also use the term ‘Schemes’ rather than ‘Plans’, and we will refer to ourselves as MAS rather than Medical Assurance Society.

These changes do not change the way in which your money is invested. The changes will mean more New Zealanders can benefit from investing with MAS.

Fee changes

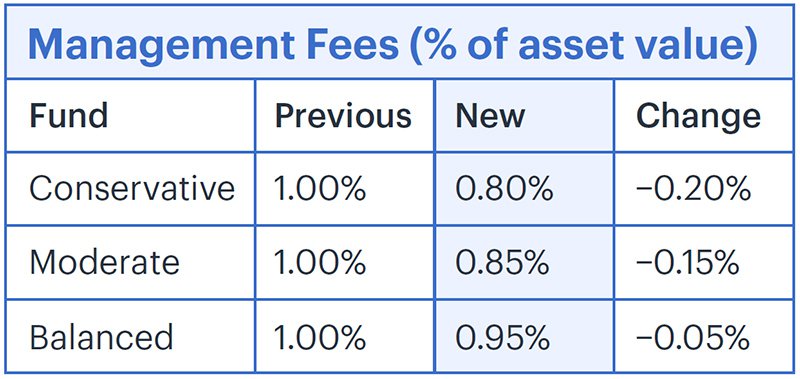

We carry out regular reviews of the fees we charge you to look after and manage your investments. As a result of the latest review, we have reduced the fees on some of our Funds.

The table below shows the previous and the new management fees for the relevant Funds in both Schemes.

If you’re a Member of the MAS KiwiSaver Scheme and under the age of 25, we have removed the minimum quarterly management fee of $12.50 ($50 per annum) entirely.

You can find more information about the fees and charges for your Scheme in the Product Disclosure Statement (PDS) available here MAS KiwiSaver Scheme and MAS Retirement Savings Scheme.

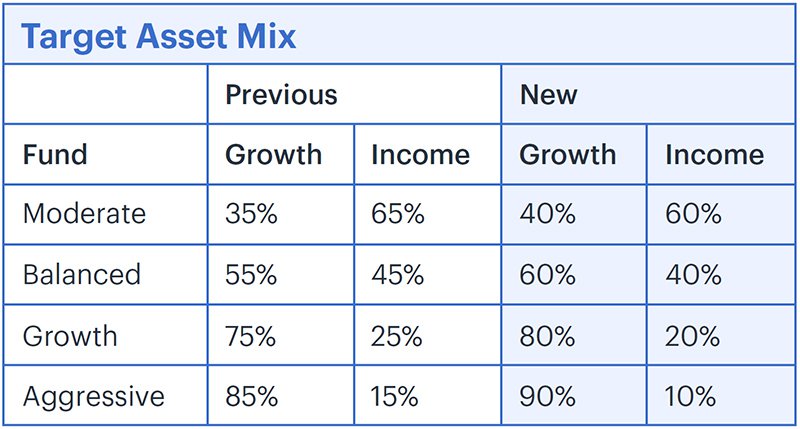

Target asset mix changes

We regularly review the target asset mix for our Funds to optimise the potential for returns while balancing investment risk. As a result of the latest review, we have increased the target growth asset allocation by 5% across some of our Funds. Growth assets can include international shares and Australasian shares. The corresponding mix of income assets in these Funds has been reduced.

The table below shows the previous and new target asset mix for the relevant Funds in both Schemes.

The changes to the target asset mix do not necessarily change the most suitable Fund for you. We have assessed the effect of the target asset mix changes and the Risk Indicators for each Fund remain the same. However, we recommend that you regularly review your Fund(s) choices, especially if your attitude to risk or circumstances have changed since your last review.

For help reviewing whether your choice in Fund(s) remains appropriate for you, visit our investment Risk Profiler.

Changes to our investment timeframes

We have also updated our minimum suggested investment timeframes for the Funds in both Schemes. The investment timeframes help you understand what kind of fund might work best for you depending on your personal circumstances and investment goals.

The table below shows the previous and new minimum suggested investment timeframes for the Funds in both Schemes.

You can find out more information, including about the target asset mix, minimum suggested investment timeframes and the Risk Indicators in the PDS for each Scheme available here MAS KiwiSaver Scheme and MAS Retirement Savings Scheme.

You can also find the latest actual asset mix and Risk Indicator in the fund updates for the Schemes, as set out below.

We’ll be reporting more regularly on the performance of your investment

It’s now easier to track the performance of your funds through our fund updates and holdings reports. These will be published on our website quarterly rather than annually.

To find out more information about your Funds you can visit the resources page for your Scheme available here MAS KiwiSaver Scheme and MAS Retirement Savings Scheme.

Privacy statement changes

We have made some changes to our Privacy Statement to describe what information we collect from you, and how we collect and use your data. You can find out more about the Privacy Statement changes on our website.

For more information about the changes or to discuss your own investment strategy in more detail with one of our MAS advisers, you can also contact us on 0800 800 627 or email info@mas.co.nz

More news

Privacy Statement Changes

23 June 2021 - We have made some changes to our Privacy Statement.

Connecting with rural healthcare

14 June 2021 - One in four New Zealanders live rurally, and these rural communities face unique issues when accessing healthcare. Each year, the National Rural Health Conference brings together health workers to discuss key issues facing rural healthcare.