News of the approval of several vaccines for COVID-19 propelled international sharemarkets to record levels, boosting returns for the MAS funds and closing out an extraordinary year on a positive note for investors.

Investor sentiment was also buoyed by the results of the US election, which increased expectations of more government support for the US economy. In addition, the earnings results of companies in many countries were generally better than had been feared in the first few months of the COVID-19 crisis.

With central banks keeping interest rates exceptionally low and promising to do so for the foreseeable future, many investors are turning to the sharemarket to deliver the returns they seek rather than relying on fixed interest investments as they may have done in the past.

The New Zealand sharemarket was one of the many around the world to post a new record high, and the New Zealand dollar was up around 9% with international investors expecting economic growth in New Zealand to be better than elsewhere due to our success in controlling the virus.

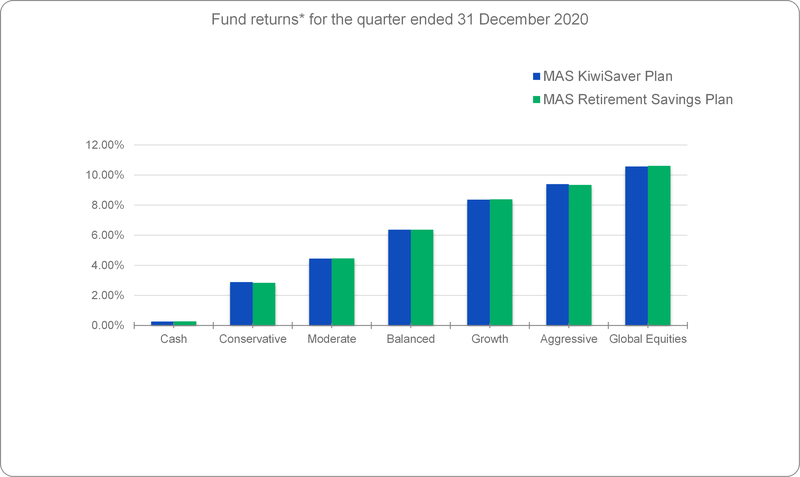

The strength of the financial markets over the December quarter is reflected in the performance of the MAS funds.

* Returns are after total annual fund charges and before tax

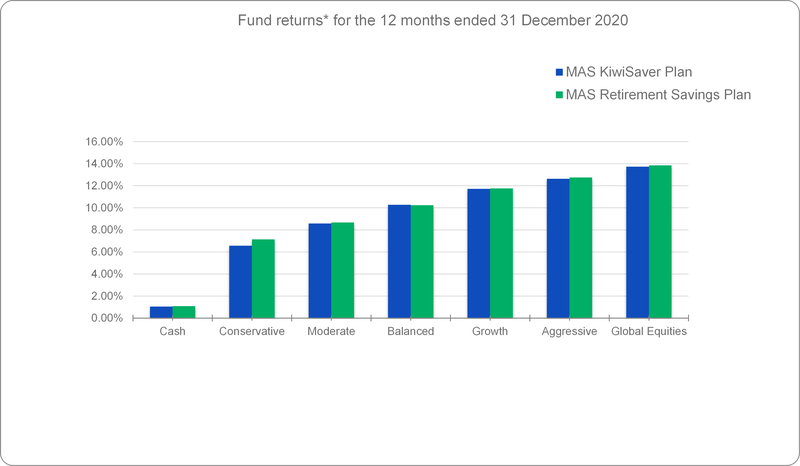

While fund returns went into negative territory in the March quarter of 2020 due to the outbreak of COVID-19, the subsequent recovery has been spectacular.

By the end of the year, for example, the KiwiSaver Global Equities Fund unit price had risen over 50% from its low in March to a record high. Other MAS funds also experienced dramatic recoveries, resulting in strong returns over the entire year, as the chart below illustrates.

* Returns are after total annual fund charges and before tax

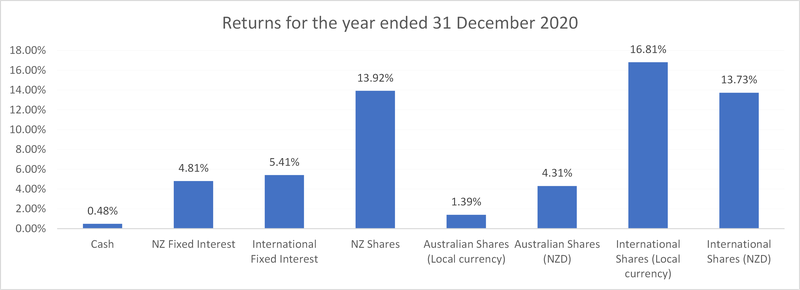

How individual asset classes performed in 2020

2020 was an extraordinary year for financial markets. The outbreak of COVID-19 in the first quarter caused world share markets to suffer some of their most severe losses in history. Remarkably, just a few months later, these losses had been more than recovered as governments and central banks responded to the risk to growth by flooding economies with cheap money in one form or another.

The outcome of the year for individual asset classes is illustrated in the chart below.

Notes:

- Returns are based on individual market benchmark indices and are before fees and tax.

- The returns differ from what the MAS funds return for these asset classes were.

Some key observations of ours on the chart above are:

- A weak United States Dollar (meaning a stronger New Zealand Dollar) reduced the return of international shares for New Zealand investors. We used foreign currency hedging strategies to reduce the impact of this on international shares (we fully hedge international fixed interest against movements in the New Zealand Dollar).

- The New Zealand Dollar weakened against the Australian Dollar over the period – boosting potential returns for New Zealand investors. We anticipated this and captured much of this benefit.

- The New Zealand sharemarket has a very different composition than the Australian sharemarket. Our market is dominated by reliable, dividend paying utilities such as electricity companies that became more attractive as interest rates fell sharply. In contrast, much of the Australian sharemarket is made up of resources companies which struggled as the outlook for global growth deteriorated.

- The substantial decline in interest rates over the year, from already very low levels, produced capital gains that boosted returns from fixed interest securities. Future returns though are likely to be very much lower.

- Cash returns are at record lows and unlikely to significantly increase for the foreseeable future.

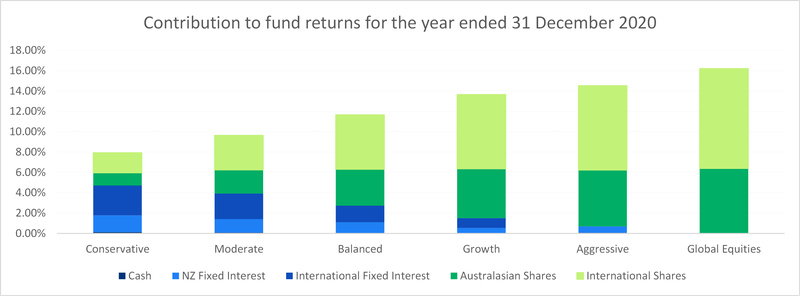

The strong returns from growth assets such as international shares and New Zealand shares meant that these were the major source of returns for many of our KiwiSaver funds, even those with a relatively low weighting to sharemarkets – as the chart below illustrates. The chart shows for each fund the return that each asset class contributed to the total fund return. As an example, the Moderate Fund has a 35% allocation to a combination of International shares and Australasian shares. These contributed 5.7% to the fund return of 9.6% i.e. nearly 60% of the total return.

Notes:

- Returns are based on the actual asset class return of the funds, rather than the individual market benchmark returns used in the previous chart.

- Returns are before fees and tax.

- The weighting applied to each asset class return is based on the benchmark asset allocation rather than the actual asset allocation, which may differ. Consequently, the returns illustrated may differ from the actual fund returns for the year.

Outlook

Our investment manager JBWere has a positive outlook on the future performance of international share markets and are investing more to take advantage of this by investing in more international shares than we regularly target. You can learn more about JBWere’s investment outlook here.

We can help

The big swings in financial markets over the past year show it’s important to have a sound investment strategy and to stick to it. To help you formulate your own strategy for your MAS KiwiSaver Plan or MAS Retirement Savings Plan, arrange a free consultation with a MAS adviser. To arrange an online or phone meeting, simply contact us and we’ll be in touch.

It’s also important to make sure you’re in the right fund for your risk appetite. You can use our risk profile questionnaire to see if you’re in the right fund for your circumstances.

If you decide to change your fund after reviewing your risk profile or meeting an adviser, you will need to complete an investment strategy change request form:

There is no fee for switching.

Once you are comfortable with your investment strategy, you can see weekly updates on fund unit prices and returns on our website:

Disclaimer

The Trustees of the Medical Assurance Society KiwiSaver Plan and the Medical Assurance Society Retirement Savings Plan are the issuer and manager of each of those Plans.

The Product Disclosure Statement for the Medical Assurance Society KiwiSaver Plan is available here.

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Assurance Society KiwiSaver and Retirement Savings Plan Trustees, Medical Assurance Society New Zealand Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

More news

MAS receives Consumer NZ People’s Choice Award for fifth consecutive year

17 December 2020 - MAS has been awarded the Consumer NZ People’s Choice Award for its house, car, contents and life insurance – for a fifth consecutive year.

We've updated our privacy policy

16 December 2020 - We have updated our Privacy Policy. Please read this document as it describes our privacy policies and processes, and explains what information we collect from you; how we collect this information; and what we use this information for.