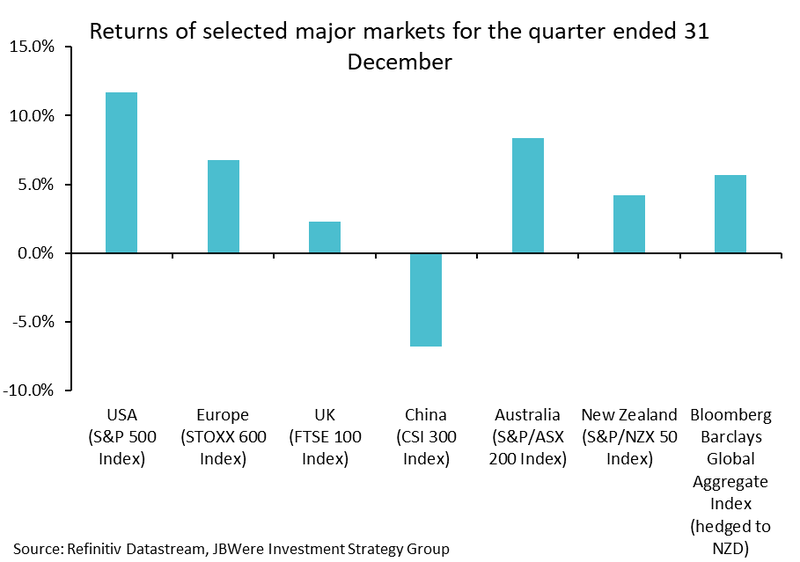

The December quarter saw a resurgence of positive momentum, driving strong gains in financial markets. In local currency terms, global shares rallied nearly 10%, while fully hedged global fixed interest finished up 5.6% over the last 3 months of the year. The boost in prices was driven by further evidence that global inflation pressures are retreating and major central banks hinting that interest rate cuts may be on the way in 2024. This saw the sectors most sensitive to interest rates perform well, led by real estate and technology, while the energy sector posted a negative return as oil prices fell despite some cuts to output and ongoing geopolitical tensions. The rally in the share market over the quarter was led by the US, with the S&P 500 Index returning 11.7%. This gain saw the US Index fall just short of its record high set early in 2022.

Annual inflation continued to trend lower for most developed countries. The Eurozone inflation fell to 2.4% in November, substantially lower than the 10.6% reading just over a year earlier. Global inflation readings have steadily dropped as global supply chains have repaired, economic momentum has slowed, and the heat has eased in many labour markets, seeing wage pressures begin to moderate. This has increased investor optimism that interest rates may not have only peaked, but cuts may be on the way in early to mid-2024.

In China, the ongoing real estate crisis and an economy that has failed to fire since reopening after COVID-19, continued to weigh on emerging markets, which, while still positive, generally underperformed their developed market counterparts. Additionally, heightened geopolitical risks, including concerns that the conflict in the Middle East might spread to other countries, also gave investors reason to be cautious.

Closer to home, the Australian share market followed the global trend higher. Supported by easing inflation and the potential for lower interest rates, the month of December saw the S&P/ASX 200 Index produce its best monthly return in 3 years. This took its quarter and annual returns to 8.4% and 12.4% respectively. The picture wasn’t as strong for the New Zealand share market, which has a greater prevalence of less cyclical (or economically sensitive) companies. Concerns over stubborn inflation is also leading to investor worries that the central bank will be slower to cut interest rates. The S&P/NZX 50 Index gained 4.2% over the quarter, lifting the annual return up to 2.6%. Domestic fixed interest outperformed shares, with government bonds returning 5.5% for the year.

The final quarter of 2023 marked strong returns for fixed interest investments globally. In fact, the end of December marked the best quarterly performance for the broader asset class in over 25 years. The major driver for lower rates (bond prices move in the opposite direction to interest rates) was a more accommodative tone from the US Federal Reserve, who then backed this up by its committee member projections showing an additional interest rate cut in 2024.

Note: Returns are in local currency terms.

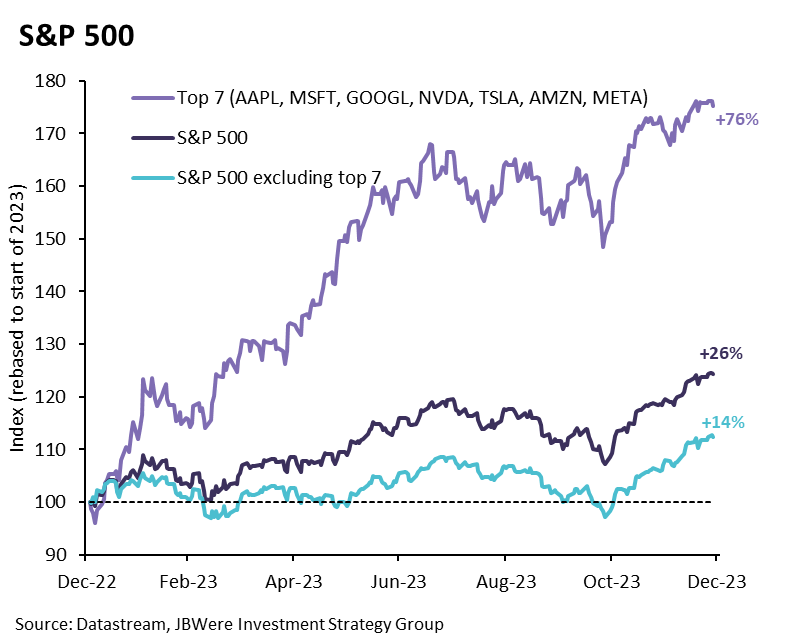

The gains experienced over the quarter capped off an impressive year, with global shares rallying more than 20%, a remarkable turnaround following a disappointing 2022. While at the headline level, these returns look impressive, they weren’t unfortunately representative of most of the market. Lifting the hood shows this strong performance was very narrow. While the US market finished up 26.3%, these gains were concentrated within the large technology (or technology-like) companies, coined the “Magnificent 7”. These 7 companies gained an impressive 76% over the year, while the remaining 493 companies returned a respectable, but far more modest 14%. Looking at the international equity fund over 2023 in the MAS Schemes, it was, unsurprisingly, the portfolio’s most tech-like exposures that performed the best, with themes such as US Technology, Automation & Robotics and Cybersecurity contributing well.

What this all meant for returns

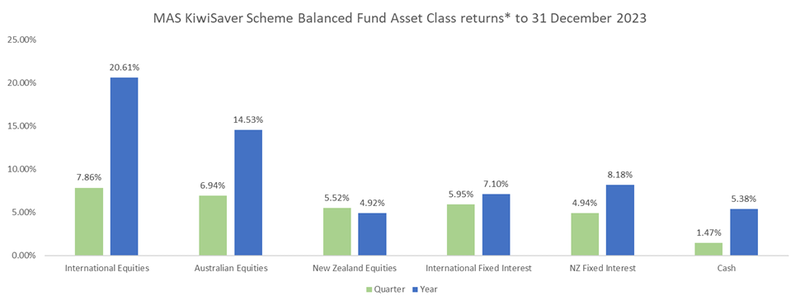

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third-party manager fees. Otherwise, returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

- December quarter returns were strong across all asset classes.

- Strong international equity returns led to very strong annual returns for the year to 31 December 2023.

- The historical long-term position of fixed interest investments providing higher returns than cash has been restored over the December quarter and 12-month period. This reflects the expectation that interest rates have peaked and central banks will likely start cutting rates (bond prices move in opposite direction to interest rates) in 2024.

What this means for our funds

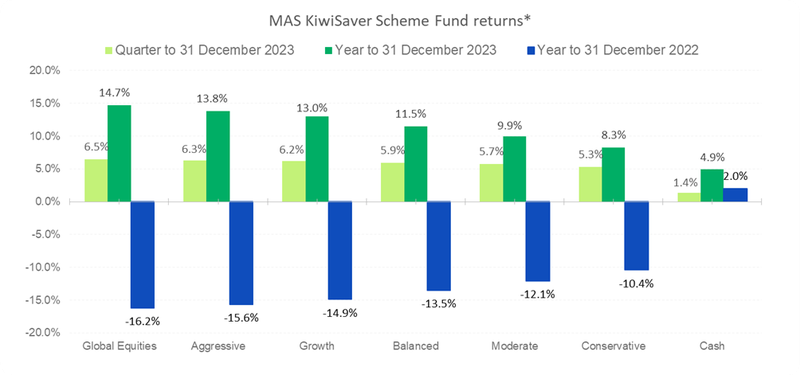

The chart below shows selected returns for all funds in the MAS KiwiSaver Scheme. Returns for comparable funds in the MAS Retirement Savings Scheme are very similar.

Note: *Returns are after total annual fund charges and before tax.

Key points to note from the chart above are:

- The December quarter capped off a healthy year for financial markets.

- Growth assets (shares) outperformed income assets (bonds) which led to the more growth orientated portfolios outperforming the more conservative portfolios over the 12 months.

- The 12 months ending December 2023, saw a major reversal from the disappointing 2022 calendar year. This reminds us that financial markets can be volatile, and investing is about long-term investment goals.

The outlook

We asked JBWere, our lead investment manager, for their outlook for financial markets for 2024, and their commentary is outlined below.

As 2024 gets underway, a case could be made that the macroeconomic landscape is less threatening than it has been for some time. Both inflation and interest rates have likely peaked, and global economic growth (largely thanks to the US) has held up better than feared. Against widespread expectations of weaker outcomes, there has been a so-called ‘Goldilocks’ feel to the macroeconomic landscape recently (i.e. not too hot and not too cold). Given the progress that many central banks have made in taming inflation without too much damage to economies and labour markets, we don’t believe it is an unreasonable starting point to assume these relatively benign macroeconomic conditions can continue this year.

Perhaps the biggest challenge for investors right now is that this is a scenario that is already well-reflected across markets, especially after the broad-based asset price strength experienced over the December quarter. A ‘soft landing’, to use economists’ parlance, has increasingly become a consensus view. This interpretation matters. The past few years have reminded investors that large asset price moves don’t just occur at random. They are the result of surprises. During 2022, market complacency towards inflation laid the groundwork for big negative surprises and poor market outcomes. Conversely, concerns towards the growth outlook in 2023 set the stage for positive surprises, supporting equity market performance. So, while having a reasonably benign base case for 2024 is all well and good (and if it eventuates could result in respectable returns for multi-asset portfolios overall), what is arguably far more important for investors, especially when the market seems to be sharing a similar view, is an understanding or at least appreciation of the distribution of risks around that base case.

To us, plausible positive alternative scenarios certainly exist, such as an even faster fall in inflation or earlier-than-expected productivity gains from recent AI advancements. However, we’d still assess the risks overall to economies (and therefore equity markets) as skewed to the downside. The expected return from equities, over and above less risky assets, is low by historic standards, especially in the context of the past 20 years, suggesting that investors are not being rewarded for taking equity risk relative to more defensive sources of return.

Ultimately, this leaves us happy to maintain a cautious mindset overall, which is reflected in how the MAS Funds are currently positioned, with modestly higher allocations to cash and domestic fixed interest and lower allocations to international equities versus strategic targets. Our cautiousness largely stems from our assessment of the distribution of risks, and the fact that the level of current interest rates now means there are competitive alternatives to equities.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of members.

It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy. There is no additional cost to speak to a MAS Adviser and they don’t receive commissions.

We also have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our MAS KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you can do so online through the MAS Investor Portal. There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website KiwiSaver Funds page and Retirement Savings Scheme Funds page.

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

Medical Funds Management Limited is the issuer of the MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme. The MAS KiwiSaver Scheme Product Disclosure Statement and the MAS Retirement Savings Scheme Product Disclosure Statement are available to view.

More news

MAS launches MAS Investment Funds offering easier and more flexible investing

31 January 2024 - MAS has launched MAS Investment Funds, a new actively managed investment scheme for people seeking more flexibility and control over their investments.

Suzanne Wolton appointed new MAS Chief Executive Officer

9 April 2024 - It was MAS’s values that first attracted Suzanne Wolton to the company, and after 3 years on the MAS Board, she’s recently stepped into the role of Chief Executive Officer.