Over the past quarter, COVID-19 vaccines have been approved for use and are being rapidly rolled out around the world. As a result, countries are emerging from their various forms of lockdown and life is beginning to return to normal.

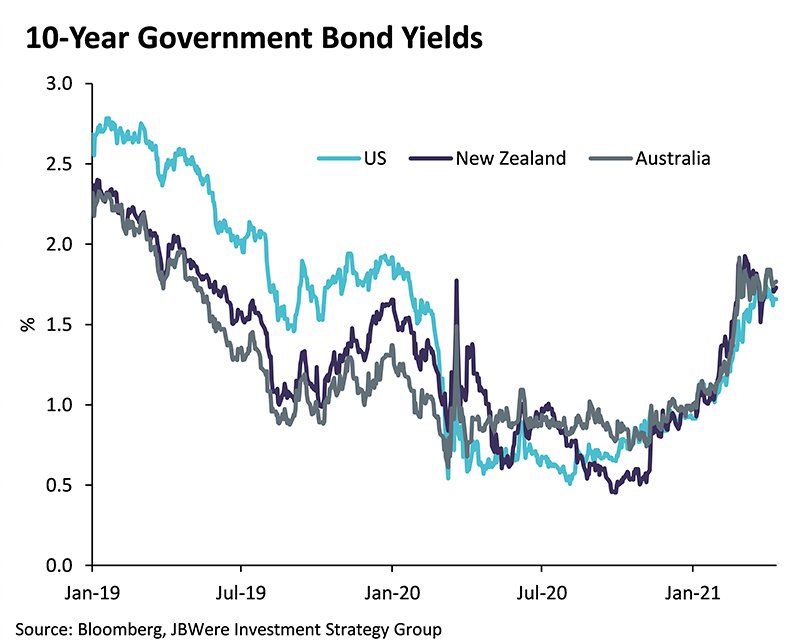

This means that the prospects for economic growth have significantly improved. At the same time, there is an increased risk that pent-up demand will lead to a rapid rise in inflation. This view is reflected in a sharp rise in long-term interest rates (yields) as investors demand higher returns to compensate them for the risk of higher inflation eroding the value of their investment. This is illustrated in the chart below.

Why higher inflation is bad news for bonds

Bond values typically move in the opposite direction to interest rates. This is because most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond. Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price.

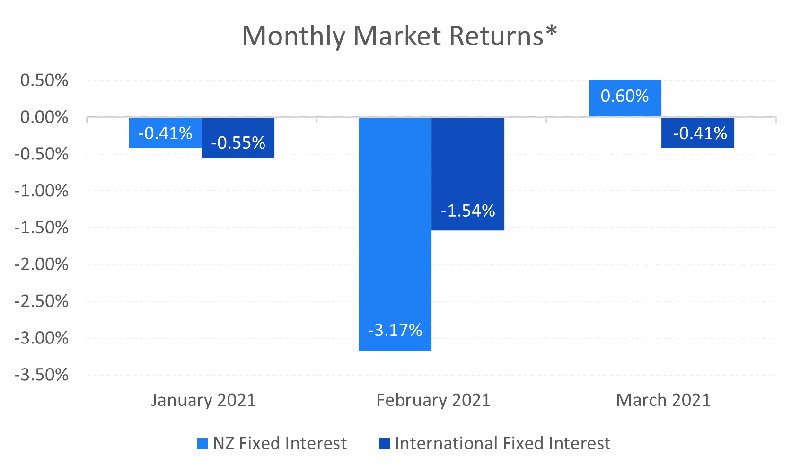

Given the relationship between interest rates and the value of bonds, these expectations of higher inflation led to recent falls in both the New Zealand and international fixed interest markets. In fact, the returns for the New Zealand fixed interest market in February were the worst for that month in the market’s history.

Returns for both the New Zealand and international fixed interest markets during the quarter are illustrated in the chart below.

* Note: Returns are based on the relevant market index.

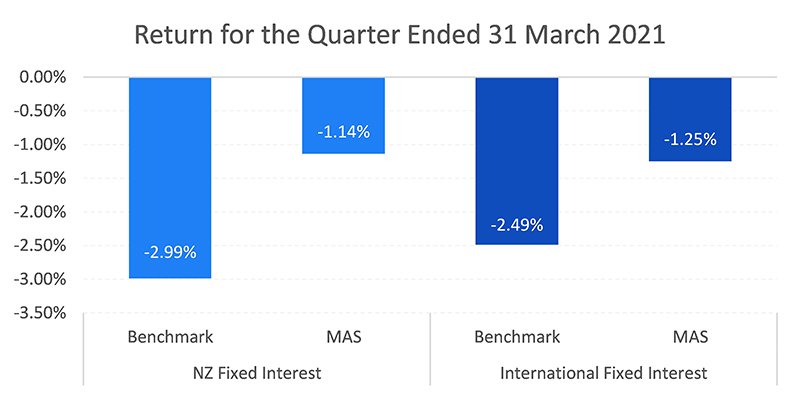

Active management in fixed interest pays off

Despite the poor performance of fixed interest markets for the quarter, our investment managers navigated the challenging market environment and reduced losses for our funds with their decisions. This is illustrated in the chart below.

Note: Returns are for the MAS KiwiSaver Balanced Fund and are before fees and tax. Returns for other MAS funds are very similar.

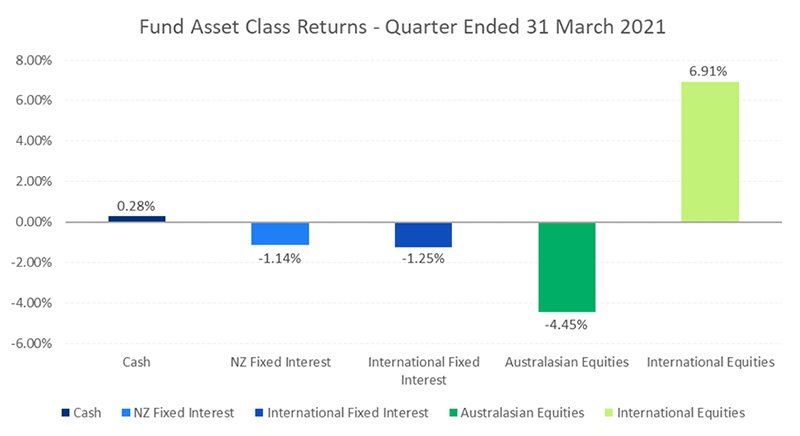

But higher growth is generally good news for share markets

Improved growth prospects might be bad news for fixed interest markets, but it’s generally good news for share markets. This is because more growth often means higher sales and increased profitability – leading to higher share prices. Australasian equities were the exception this quarter, primarily due to weakness in the New Zealand share market. This was brought about by a sharp correction in the share prices of many of the electricity companies, or ‘gentailers’, - following a similarly sharp rise before the end of 2020 as international ‘clean energy’ index funds bought shares to meet investor demand during a period when many local potential sellers were on holiday.

The contrasting fortunes of individual asset classes over the quarter is illustrated in the chart below. This shows the return that our KiwiSaver Balanced Fund achieved in each asset class, before fees and tax. Returns for other MAS funds are very similar.

What this all means for our funds

The developments in the quarter affected our funds in different ways, since each of our funds holds a different mix of assets. More conservative funds generally hold more investments in fixed interest assets. This means they produced a lower return for the quarter than more aggressive funds, which invest more in share markets.

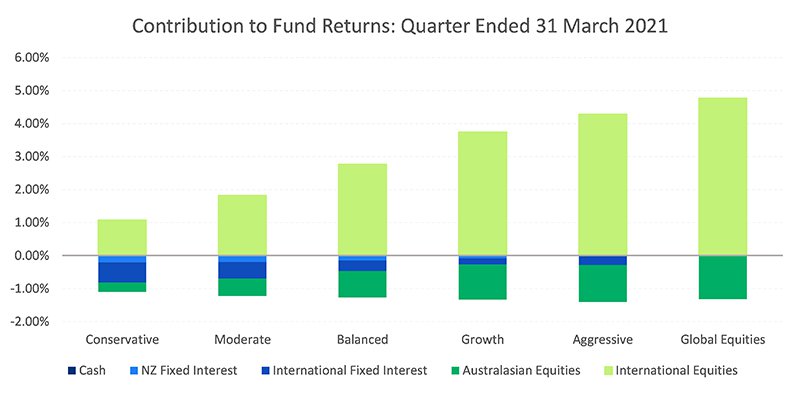

This is illustrated in the chart below which shows the return that each asset class contributed to the total return for each fund. As an example, the Balanced Fund had an allocation of around 42% to international equities during the quarter which contributed about 2.8% to the Fund’s return. In contrast, the Fund’s remaining 58% invested in other classes of assets detracted about 1.3% from the Fund’s return. This means that the total return for the quarter for the Fund was 1.5%.

Returns are for MAS KiwiSaver funds and are before fees and tax. Returns for MAS Retirement Savings Plan funds are very similar.

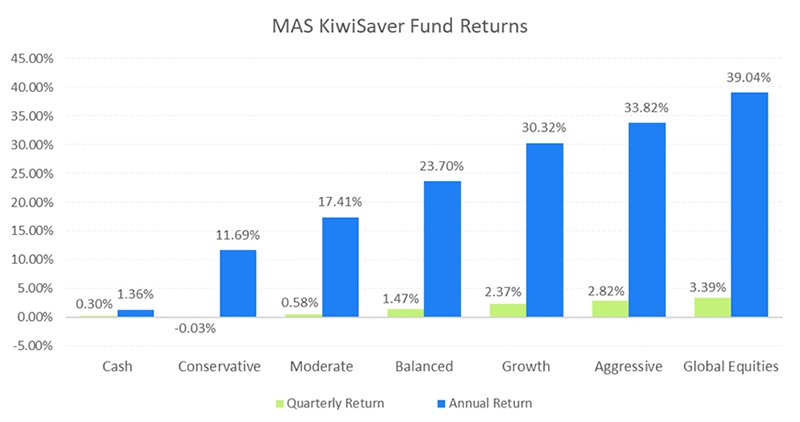

The chart below gives further detail on fund returns. It shows that the quarter was an unusual one with negative returns for the Conservative Fund, and positive returns for higher risk funds such as the Global Equities Fund. Despite this unusual quarter, the return for all funds were comfortably in positive territory over the full 2020/21 financial year. The full year returns are abnormally high - largely due to coming off a large COVID-19 related market drop in February and March of last year.

Returns are after fees, before tax. Returns for MAS Retirement Savings Plan funds are very similar.

Outlook

Our investment manager, JBWere, do not expect interest rates to rise much further over the coming year. As such they do not expect returns for the funds to be as severely affected by slumps in the fixed interest market as they were in this quarter.

Our funds have a higher-than-usual allocation to growth assets such as Australasian and international equities. This reflects JBWere’s positive view on the long-term prospects of these asset classes compared with more defensive asset classes such as fixed interest and cash.

However, JBWere do expect continued volatility in financial markets over the next quarter or two as investors try to assess the anticipated economic recovery. The main question will be whether the recovery continues at a rate that boosts company profits or whether share markets will become overheated, forcing central banks to raise official cash rates more than anticipated, crimping company profits and reducing share price valuations.

You can learn more about JBWere’s investment outlook here.

We can help

The big move in financial markets over the past year show it’s important to have a sound investment strategy and to stick to it.

To help you formulate your own retirement investment strategy, arrange a free consultation with a MAS adviser. To book an online or phone meeting, complete this form and we’ll be in touch.

It’s also important to make sure you’re in the right fund for your risk appetite. You can use our online risk profile questionnaire to see if you’re in the right fund for your circumstances.

If you decide to change your fund after reviewing your risk profile or meeting an adviser, you will need to complete an investment strategy change request form:

There is no fee for switching.

Once you are comfortable with your investment strategy, you can see weekly updates on fund unit prices and returns on our website:

Disclaimer

The Trustees of the Medical Assurance Society KiwiSaver Plan and the Medical Assurance Society Retirement Savings Plan are the issuer and manager of each of those Plans.

The Product Disclosure Statement for the Medical Assurance Society KiwiSaver Plan is available here.

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Assurance Society KiwiSaver and Retirement Savings Plan Trustees, Medical Assurance Society New Zealand Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

More news

MAS leads the car insurance pack

MAS is one of the most affordable car insurance providers in New Zealand with outstanding customer satisfaction, according to a recent report by Consumer NZ.

MAS Foundation tackles implicit bias in the health sector

30 March 2021 - Dr Julie Wharewera-Mika and Ms Mafi Funaki-Tahifote have been appointed joint Heads of Foundation for the MAS Foundation, the philanthropic arm of insurance and investment provider MAS.