We last reported on investment markets for the quarter ended 31 March 2022. Since then, global share markets have weakened significantly, for instance, the US share market (the world's largest) has fallen over 15% (as measured by the S&P500 Index) – a decline not seen since the outbreak of COVID-19 in early 2020.

Closer to home, the New Zealand share market is a bit more insulated from global markets but is not immune to the declines we’re seeing overseas. The NZ market is down about 14% (as measured by the S&P/NZX50 Index) from where it started in 2022. But….the world is no longer shut down like it was in 2020, nor is there a financial system meltdown. So why are share markets acting as if we’re in crisis, and how should you respond?

Will slaying inflation kill economies?

The primary driver of the weakness in international share markets continues to be what we noted in our previous report – multi-decade-high levels of inflation and the threat of rapid interest rate rises as central banks respond.

Inflation shows little sign of reducing naturally. The war in Ukraine has led to huge spikes in energy and grain prices. On top of that, much of China is currently in lockdown as authorities there battle COVID-19, meaning that many factories and ports are closed (or facing restrictions) – exacerbating supply constraints and contributing to rising prices.

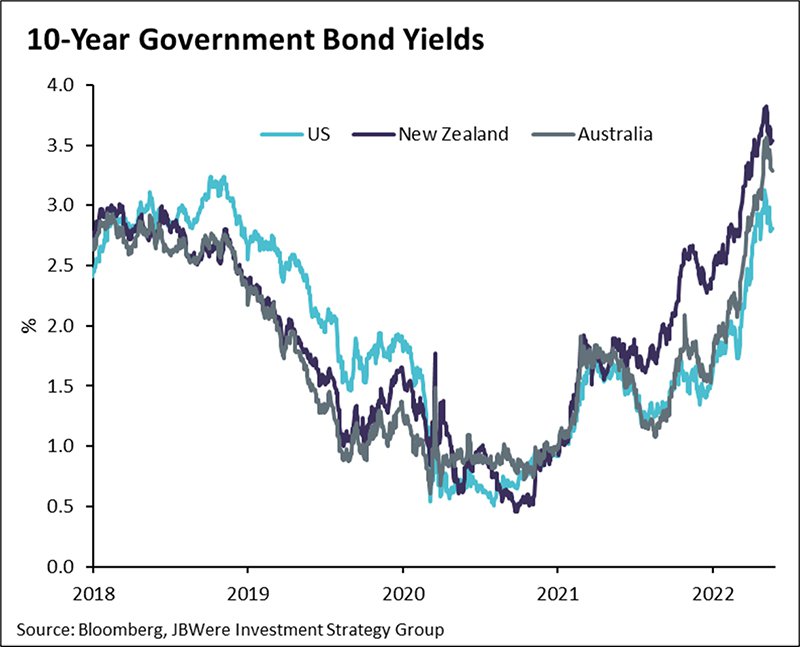

Central banks have responded to developments by becoming more aggressive in their plans for raising official interest rates to try to crimp demand and reduce inflation. This has led to a significant increase in long-term interest rates (bond yields), which is illustrated in the chart below for various 10-Year Government Bond Yields over the last five years:

Interest rates impact share markets in many ways, primarily as they are an important input when calculating a company's long-term value. All else being equal, the higher the interest rate (or discount rate), the lower the valuation.

Investors have been processing recent developments with a high degree of uncertainty about how it all plays out from here. Based on current levels of share markets and interest rates, it appears that investors fear a worse-case scenario whereby central banks, in seeking to quell inflation, overshoot and cause economies to slide into recession.

The outlook

With global share markets having fallen considerably from their highs, our investment manager JBWere judges them to be arguably beginning to offer an attractive risk/return proposition for long-term investors. However, JBWere is not yet prepared to add (or reduce) much in the way of exposure to share markets right now given that global economies are at a delicate juncture for their inflation and growth outlook.

If inflation shows signs of beginning to fall, shares (and probably bonds too) are likely to increase in value strongly as a lot of bad news on the inflation front is now already priced in by markets. However, if inflation proves more persistent, central banks are making it quite clear they are prepared to drive their economies into recession in order to tame inflation, which is hardly a favourable backdrop for share markets. Just last week US Federal Reserve Board Chair Jerome Powell stated that, “what we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that… If we don't see that, we will have to consider moving more aggressively.”

As a result, JBWere currently thinks investing in line with funds’ long-term target asset mixes, rather than holding more or less shares, is the appropriate strategy until we have further clarity on the inflation outlook.

What does this all mean for investors?

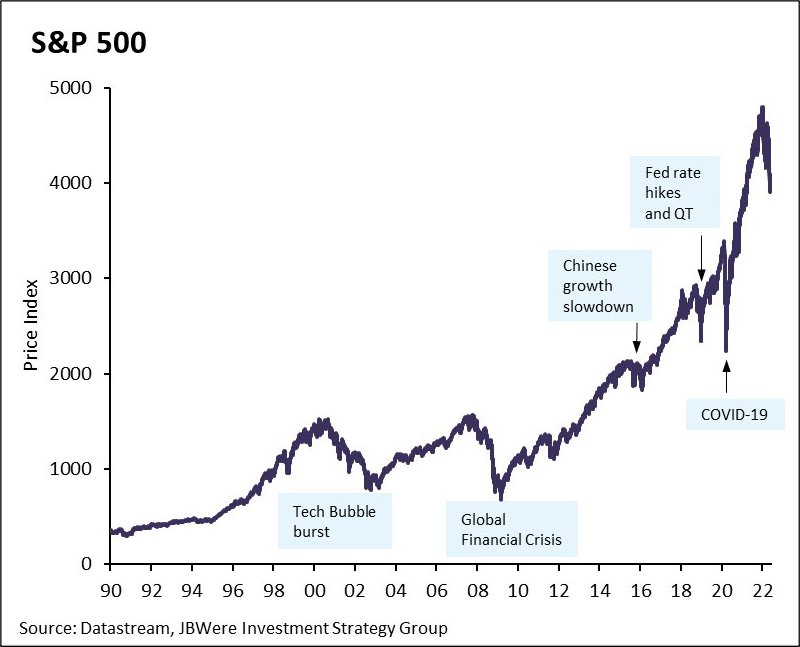

All this uncertainty can be unsettling for investors. However, history shows that share markets have overcome setbacks before. This is illustrated by the chart below, tracking the US share market (as measured by the S&P 500 Index) over a 30-year period:

It is important to have a sound investment strategy and to stick to it. To help you understand if your retirement savings are on track you can use our KiwiSaver retirement calculator on our website here, and you can also discuss your investment strategy by arranging a free consultation with a MAS adviser. To book an online or phone meeting, please complete this form and we will be in touch.

It's also important to make sure you're in the right fund for your risk appetite. You can use our risk profiler questionnaire to help see if you're in the right fund for your circumstances.

If you want to find out more about how your investment is performing, you can see weekly updates on fund unit prices and returns on our website here:

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited and JBWere (NZ) Pty Ltd, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

Medical Funds Management Limited is the manager and issuer of the MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme. The PDS for each of the Schemes can be found at mas.co.nz/investments

More news

MAS Life & Disability Insurance – Inflation adjustments

17 May 2023 - Your policy includes an inflation adjustment benefit. The rate of inflation MAS applies will depend on which policy type you have purchased. A summary of the rates to be applied to different MAS policy types is set out here.

Wellington tamariki off to a running start despite Omicron

02 May 2022 - A programme that helps Wellington tamariki participate in Brendan Foot Supersite Round the Bays has adapted its approach to the Omicron outbreak, ensuring students still have a chance to get active.