Protect what matters most.

Imagine your family after your death. What do their lives look like? Is there a mortgage, and who will pay it? If you were the major income provider, where does that income come from now?

Life Insurance helps give your family the financial freedom to be able to make the choices you intended and move on with their lives.

Why choose MAS Life Insurance?

We pay 98% of all life claims*

Peace of mind that we’re there for you and your family when it matters most.

100% owned by our Members

We're a New Zealand owned mutual that's here for our Members, not overseas shareholders.

Advice when you need it

Our nationwide network of advisers are here to help protect what's important to you.

Features of MAS Life Insurance

Special Events Increase

You can increase your life cover following major life events such as marriage, having a child or getting a mortgage, irrespective of your state of health.

Terminal Illness Benefit

If you are diagnosed as terminally ill with less than 12 months to live, a maximum of $1,000,000 of your life insurance can be paid early.

Advanced Assistance

Our Life Insurance cover can pay up to $15,000 immediately, in advance of the sum insured, upon written notification of death.

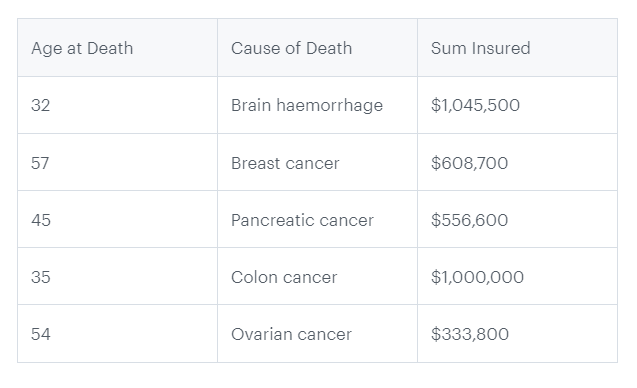

Recent MAS Life Claims

Life Insurance is important for people of all ages, as a wide range of unexpected events can and do occur. Here's a sample of Life Insurance claims paid by MAS between 2015 and 2023.

*In the 12 months to 31 March 2024 we paid 98% of all life and income claims received which includes claims that were approved, declined or withdrawn.

This webpage is intended as an information guide only and does not form part of the policy document or any contract with MAS. This webpage does not take into account your own personal financial situation or goals. If you would like more detailed financial advice we can get one of our advisors to contact you. Normal underwriting criteria apply for all insurance products. Special conditions and/or excesses may apply to the situations that meets your specific needs.