Changing expectations for inflation continue to drive financial markets

The quarter was another one characterised by volatile financial markets as investors’ expectations that inflation was near its peak see-sawed between optimism and pessimism. These changing expectations drove big swings in interest rates and share markets. These swings were exaggerated by China’s changing response to COVID and what this meant for world growth. Ultimately, returns for both fixed interest and shares were solidly positive, meaning the same for our funds.

The quarter began with rising interest rates and weak share markets as investors continued to respond adversely to the strident statements made by central banks in September on the need to keep raising official interest rates until economies slowed enough to subdue inflation.

This reaction was exaggerated by China’s “zero tolerance” COVID policy. China is the world's second largest economy and an important source of production for many other countries. The lockdown was seen by investors as reducing economic activity in China and damaging international supply chains.

The significant tightening of monetary policy that has occurred in many countries over the last year or so, was always going to eventually have an effect. The question was when and how much. In the case of the key United States economy, the answer became a little clearer in late October and November. A range of data releases showed the economy slowing and inflation beginning to moderate, albeit to still well above the official target. In response, investors began to speculate that the US central bank (the Federal Reserve or “Fed”) might pivot to a less aggressive position on future hikes to official interest rates. This optimism was boosted by news that China was abandoning its zero-tolerance policy to COVID, thereby potentially boosting growth in the huge Chinese economy. These developments saw long-term interest rates fall and the share market rise strongly.

But, as has been the case several times this year, the Fed spooked markets when in early December it said that it anticipated further, significant hikes in official interest rates were required to break the back of the current inflation spiral. This statement coincided with economic data that indicated that the US economy still had strong aspects that were inconsistent with falling inflation.

As a result, the US share market weakened into quarter end, but did not fully give up its gains for the quarter. Long-term interest rates in the US did not change much after the Fed announcement, as bond market investors judged that the Fed risked tipping the US economy into a hard recession which would mean that official interest rates would need to be cut soon after they peaked.

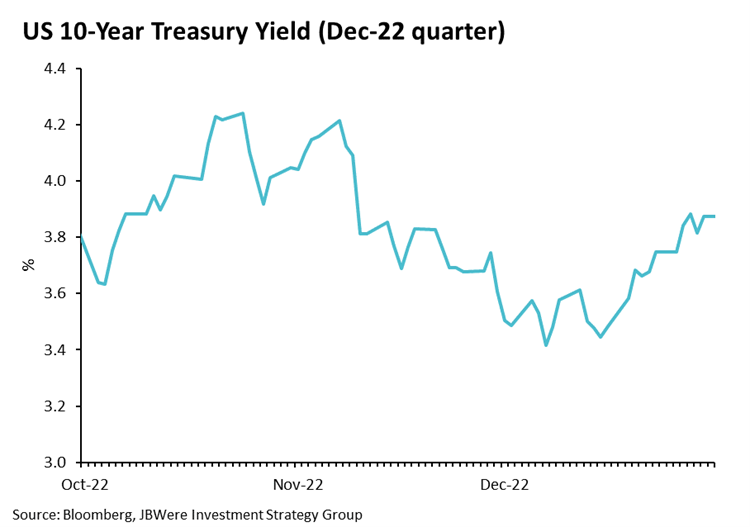

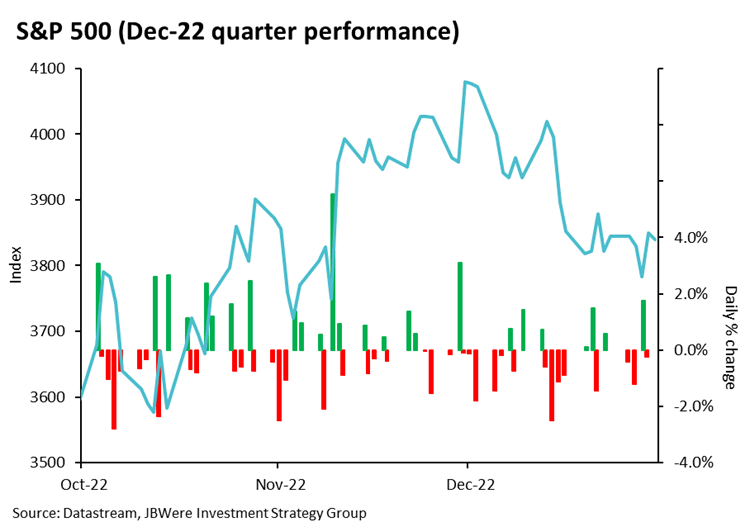

The roller coaster ride of interest rates and the share market during the quarter is illustrated in the charts below, using the US 10-year treasury yield/interest rate and the S&P500 Index respectively.

Key: The blue line represents the S&P500 Index (Left axis). The vertical lines represent the daily percentage change in the index (right axis). Green means a positive change while red means a negative change.

Here in New Zealand, the Reserve Bank has been quicker to raise official interest rates than other central banks. Nonetheless, in its November assessment of monetary policy, the Reserve Bank judged that the official cash rate (OCR) would need to be higher than previously thought, and for longer. Market expectations are for the OCR (currently at 4.25%) to reach about 5.4% by May and to decline only gradually to about 4.6% in May 2024. Higher interest rates are likely to put further downward pressure on house prices, which in turn impacts consumer confidence via the ‘wealth effect.’

What this all meant for returns

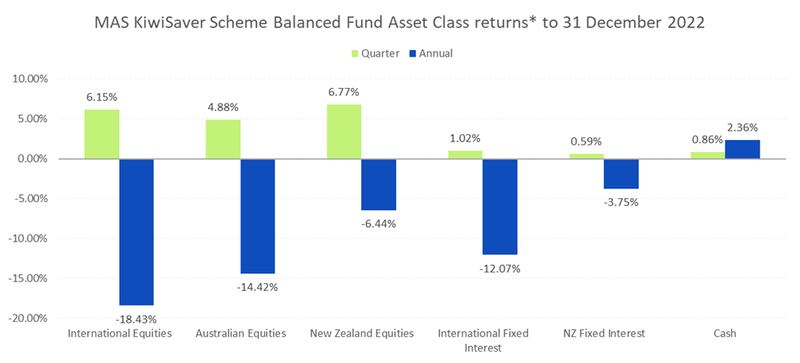

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

- While the returns for the quarter for international equities were strong, the annual return is the weakest in over 10 years.

- The relatively defensive nature of the New Zealand share market has seen it do better than international share markets – recovering some of its underperformance in the past couple of years when international (predominantly US) technology companies were in vogue.

- Returns for fixed interest were the best for a calendar quarter in the past two years. Despite this, annual returns were still near record lows.

What this all meant for our funds

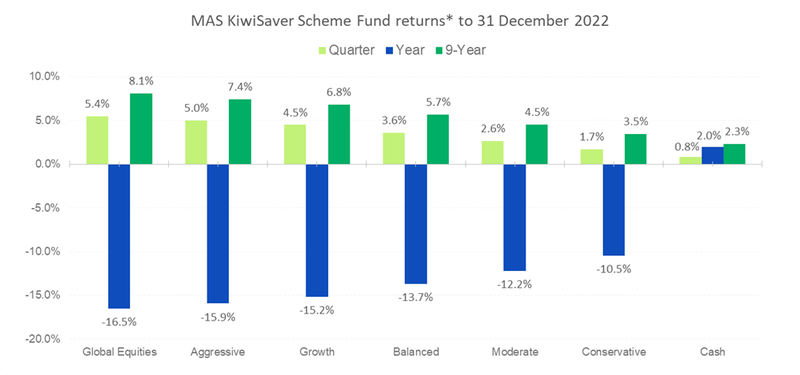

The chart below shows returns to 31 December 2022 for all funds in the MAS KiwiSaver Scheme.

Note: *Returns are after total annual fund charges and before tax. The returns for nine years are annualised returns.

Key points to note from the chart above are:

- No fund other than the Cash Fund had a positive return for both the quarter and year.

- Despite the Cash Fund’s recent outperformance, its return over the long-term (nine years) is well below that of our other funds. In other words, investors in those other funds for the full past nine years have been rewarded for taking on additional risk.

The outlook

We asked JBWere, our lead investment manager, for their outlook for financial markets for 2023, their commentary is outlined below.

Whether 2023 ushers in an improved backdrop for markets and investment portfolios will depend on how much progress central banks make in sustainably lowering inflation, the ultimate damage this has to economic growth, and what markets have already discounted.

Central banks have made gradual progress, as the list of indicators that point to a moderating pulse of inflation continues to grow. For instance, the latest US consumer price index (CPI) figures for December were consistent with this, with the data showing the average monthly increase in core prices over the past three months now running at a ~0.25% pace, versus over 0.50% over the prior 12 months. In regions like Europe, natural gas prices have fallen substantially, suggesting the worst of their inflation shock may also be behind them too. While central banks will quite rightly be reluctant to declare victory over inflation just yet, given the amount of monetary policy tightening already delivered, we are approaching a point where central banks will naturally slow the pace and magnitude of their rate hikes, and eventually pause to assess their impact. As such, the marginal inflation and central bank policy news going forward will look different to what investors had to grapple with in 2022.

However, the path back to price stability is likely to be a bumpy one, especially with labour markets remaining tight (which could continue to put pressure on wage growth and prices for services). The trajectory of inflation, central bank policy rates, and the ultimate scale of the economic growth slowdown, are all interlinked and uncertain. We can still see plausible ways some major economies may avoid recession (i.e. achieve a ‘soft landing’), which would come as a positive surprise to markets. China’s recent reopening following stringent COVID restrictions should also provide a positive impulse to global activity momentum. However, on balance, significant adverse risks to global growth remain, mainly because of potential inflation stubbornness and in turn central banks maintaining restrictive policy settings for longer than currently expected by markets.

Share markets are already priced for some further economic weakness, and for long-term investors, there is value emerging after the large fall in share prices seen over 2022. However, economic conditions look set to remain challenging for a while longer, keeping risks and potential market volatility elevated. At some point during 2023, the conditions to allow central banks to become more constructive on growth assets will begin to emerge. But right now, as a way to reduce the impact of perceived risks on them, the MAS funds are continuing to hold higher levels of cash and a reduced exposure to international shares relative to their long-term targets. Also, we continue to run an ‘up in quality’ strategy, where we prefer companies and sectors that exhibit greater earnings and margin stability. These are companies and sectors that have historically exhibited far less share price volatility, but still offer attractive investment attributes.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of members.

At times like these, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. While falls in your account balance can be unsettling, it’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to help you make an investment choice that aligns to your risk appetite in these challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice. To book an online or phone meeting, please complete our form and we will be in touch.

We also have useful online tools to help you:

- Our Risk Profiler Questionnaire can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form:

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available

here: KiwiSaver - MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available

here: Retirement Savings Scheme - MAS

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

New Life and Income Security Policies to support Sustainability

2 February 2023 - MAS has joined the Trees That Count movement to create a healthier future for Aotearoa New Zealand, MAS will fund native trees on the Member’s behalf.

Flood and weather damage: important information

Updated: 15 February 2023 - Are you affected by the weather around the North Island? We have a team standing by to take your call and assist you with claims.