The dominant theme for financial markets during the year was the efforts of central banks to bring multi-decade high inflation under control and the risks that this presented to economies. During the year financial markets swung between pessimism and optimism about how far central banks would have to raise official interest rates to slow economies enough to reduce inflation back to target levels. This resulted in particularly volatile short-term returns for investors.

Why inflation has surged

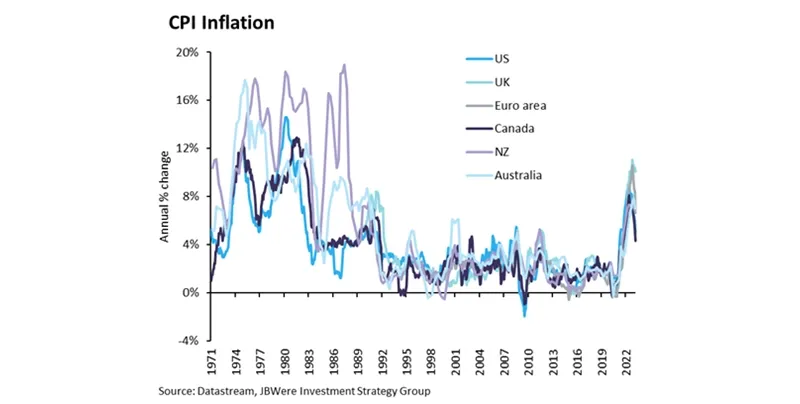

The spike in inflation has primarily been caused by central banks and governments being too slow to withdraw the unprecedented stimulus they provided to economies to soften the blow of COVID-19 related disruption. Economies have been quick to recover, but authorities have been slow to react. As a result, in many markets demand has outstripped supply, and pushed up prices. In addition, disruption to supply chains has increased costs, while the war in Ukraine has led to an enormous rise in energy prices in Europe, with flow on effects to other countries, including New Zealand. The chart below illustrates how significant the recent jump in inflation has been.

How central banks have reacted

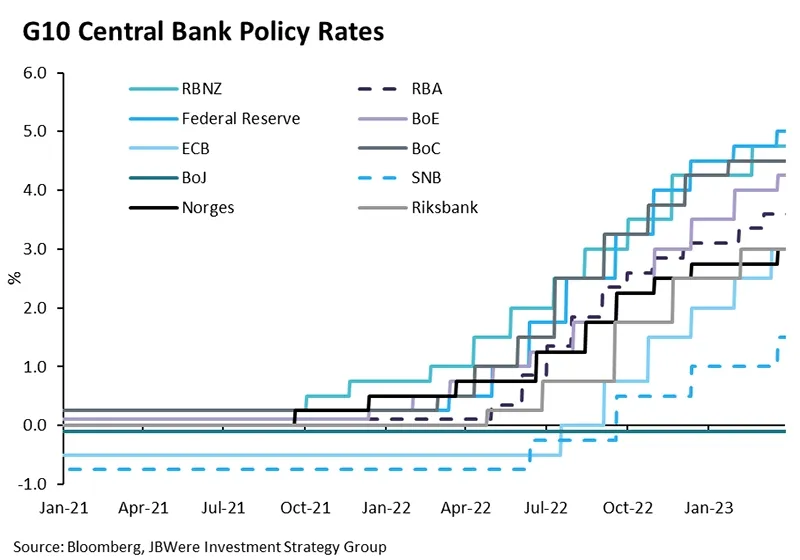

Initially, central banks thought that rising inflation would only be temporary. But when it became evident that this was not the case, they had to move rapidly to raise official interest rates to slow economies in an effort to reduce demand and in turn inflation. The unprecedented speed and scale of these hikes in official interest rates is illustrated in the chart below.

The battle against inflation has not been a simple one

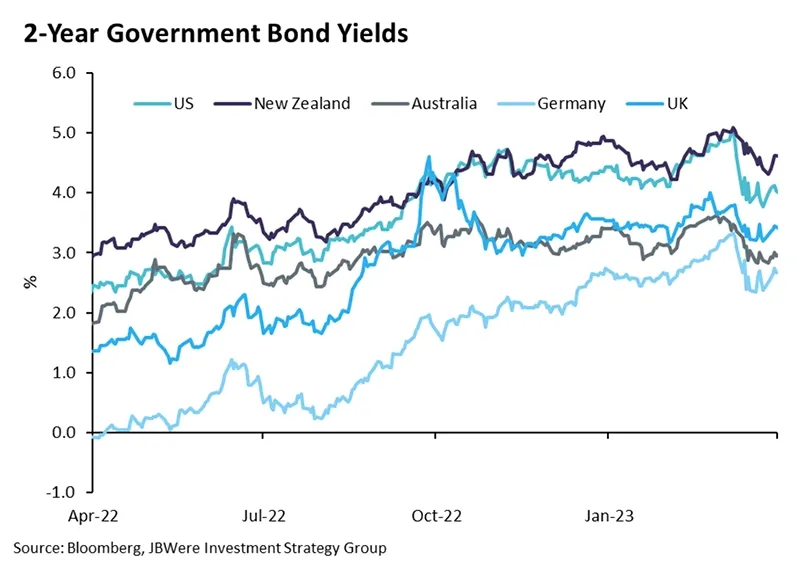

By the end of the year central banks had increased official interest rates substantially and indicated that more increases were likely, however this path was not a straightforward one. During the year as new data was released, financial markets swung between optimism and pessimism about the potential for inflation to be brought under control without significantly higher interest rates that might push economies into a deep recession. This volatility increased further in March 2023 when the failure of a handful of banks in the US and Switzerland raised fears of a full-blown banking crisis. While this didn’t eventuate by year end, it did lead to a major reduction in expectations for the future path of official interest rates. The changing outlook for interest rates is illustrated in the chart below.

What higher interest rates mean for the performance of our funds

Higher interest rates impact our funds in two major ways:

- They reduce the current value of fixed interest securities (bonds) that the funds own as their contracted interest rates are less attractive compared to new securities at current, higher interest rates. This has led to unprecedented negative returns from these securities during the year. But, as these existing securities mature, the proceeds can be invested at higher interest rates in new securities, increasing long-term returns.

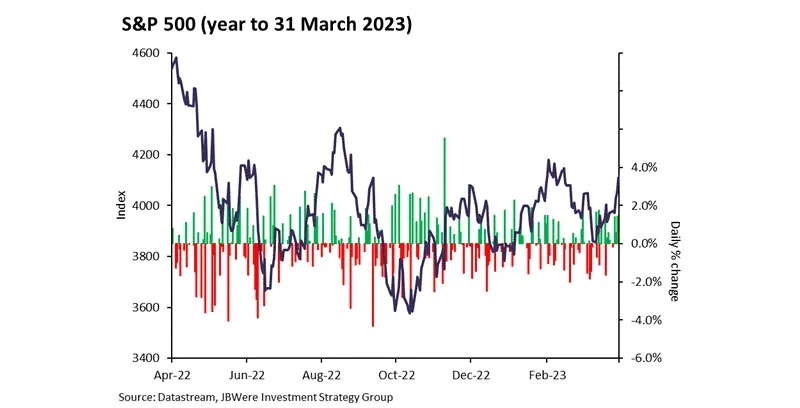

- Interest rates are an important factor when calculating a company's long-term value. All else being equal, the higher the relevant interest rate (or discount rate), the lower the valuation. Indirectly, central banks are using higher interest rates to cool economic activity, which then impacts companies’ profitability or earnings. Given the volatile path of interest rates during the year, this contributed to big swings in share markets, as illustrated in the chart below for the US share market.

Key: The back line represents the S&P500 Index (Left axis). The vertical lines represent the daily percentage change in the index (right axis). Green means a positive change while red means a negative change.

What this all meant for returns

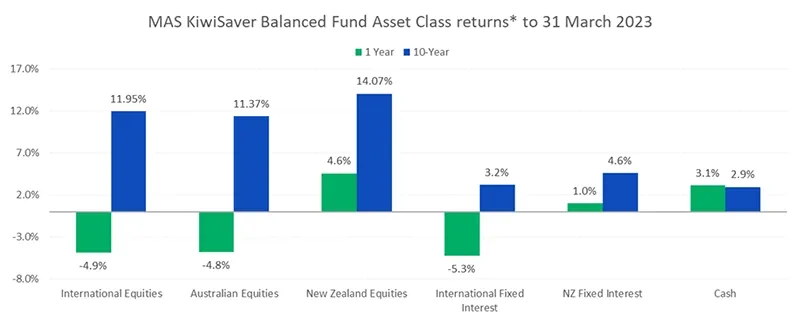

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

• Despite a very weak year for returns (other than for cash), long-term returns for all asset classes are all higher than cash.

• The highest long-term returns come from those asset classes that had the worst short-term performance.

• Over both the short-term and the long-term, the returns that the fund achieved from New Zealand asset classes in the year exceeded those from equivalent international asset classes. This primarily reflects the significant value added by the skill of our active investment managers.

What this meant for our funds

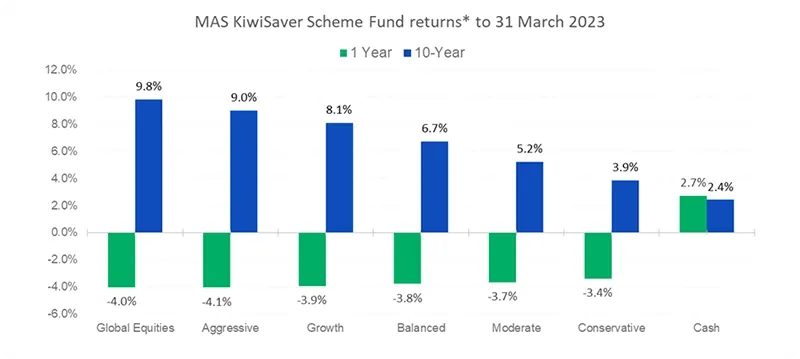

The chart below shows returns to 31 March 2023 for all funds in the MAS KiwiSaver Scheme.

Note: *Returns are after total annual fund charges and before tax. The returns for 10 years are annualised returns after total annual charges and before tax.

Key points to note from the chart above are:

• The Cash Fund was the only fund to have a positive return for the year.

• For the year, there was little difference between the returns of lower risk funds versus higher risk funds – an unusual occurrence.

• Despite the Cash Fund’s recent outperformance, its return over the long-term (10 years) is well below that of our other funds. In other words, investors in those other funds for the full past 10 years have been rewarded for taking on additional risk.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it’s comforting to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of members.

At times like these, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice. To book an online or phone meeting, please complete this form and we will be in touch.

We also have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form:

MAS KiwiSaver Scheme: KiwiSaver Documents and Forms

MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

MAS KiwiSaver Scheme: KiwiSaver Funds

MAS Retirement Savings Scheme: Retirement Savings Scheme Funds

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

Call for Nominations 2023

31 May 2023 - MAS is calling for nominations for the role of Practitioner Trustee of MAS Members’ Trust 2023

Sustainable Business Awards entries open

31 May 2023 - Entries are now open for the 2023 Sustainable Business Awards, Aotearoa New Zealand’s biggest sustainability awards. For the fourth year running, MAS is sponsoring the Social Impactor category.