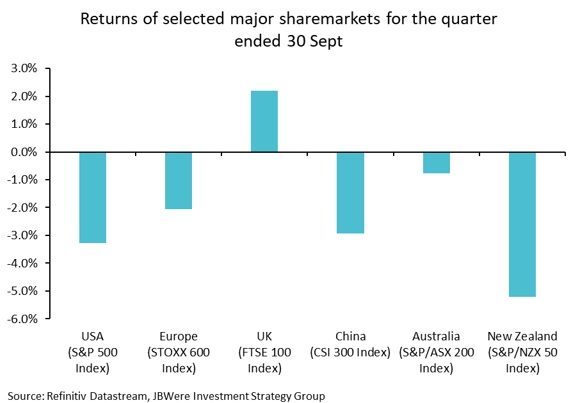

Market sentiment shifted during the September quarter, with share markets, both international and domestic, ending in negative territory. This was a considerable shift compared to the first half of the year where markets rallied on the back of general optimism that central banks may be able to bring inflation down without causing recessions, and excitement around technology companies, especially the benefits that artificial intelligence could bring. The September quarter saw some of this optimism fade.

The growing realisation over the past quarter was that while inflation around the world had come off its peaks and central bank tightening cycles were likely reaching an end, this does not necessarily mean that central banks will be cutting interest rates any time soon. This ‘higher for longer’ view saw longer-term bond yields increase to levels not seen in decades in some cases. This, coupled with concerns over the growth of China’s economy and rising oil prices, saw share markets pull back, reversing some of the gains experienced over the first half of the year.

Technology companies dominated the share market rally over the first half of this year; therefore, it was perhaps not surprising that this sector underperformed modestly when sentiment and broader markets softened. In the United States (US), the technology sector declined 5.6% over the three months to September, with many of the so called “Magnificent Seven” – Apple, Microsoft, Alphabet, Amazon, Telsa, Nvidia and Meta – declining. The broader US market, as represented by the S&P 500 Index, ended down 3.3%. The energy sector was an outlier, however, benefiting from the rising price of oil, ending 12.2% higher.

Share markets declined in the Eurozone, as interest rates and inflation remained high. However, data released at the end of the period showed inflation slowing to a two-year low of 4.3%. This increased investor optimism that the European Central Bank may now be able to pause its interest rate hikes. The FTSE 100 Index in the United Kingdom was one of a few share markets to record a positive September quarter. The large weighting to the energy and material sectors again benefited from the rising oil prices.

In emerging markets, China’s economic recovery continued to stutter, while its major domestic share market was hampered by concerns over elevated debt levels in the property market.

Note: Returns are in local currency terms.

Closer to home, the Australian share market held up better than most, returning -0.8% for the quarter, while the New Zealand share market followed the global trend, declining 5.2%. The Reserve Bank of NZ (RBNZ) left interest rates unchanged over the quarter, at 5.5%, while the NZ dollar continued its fall against the US dollar.

What this all meant for returns

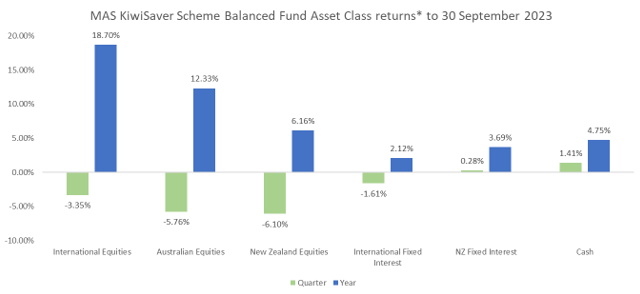

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

- After a strong run this year, September was the first quarter to experience negative returns.

- Strong international equity returns have led to very strong annual returns for the year to 30 September 2023.

- Reflecting currently high central bank policy rates, returns from cash for the year to 30 September remain above fixed interest. This is the reverse of the long-term historical position and is generally expected to revert back to this long-term pattern in the future.

What this means for our funds

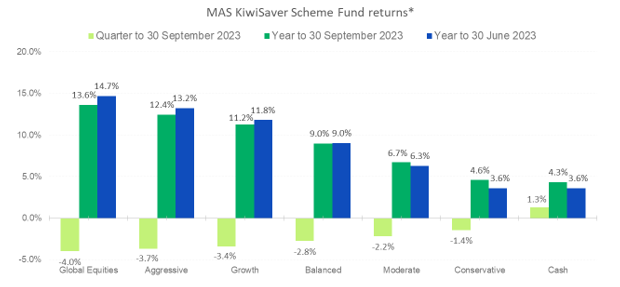

The chart below shows selected returns for all funds in the MAS KiwiSaver Scheme. Returns for comparable funds in the MAS Retirement Savings Scheme are very similar.

Note: *Returns are after total annual fund charges and before tax.

Key points to note from the chart above are:

- All funds have achieved strong positive returns for the past 12-months despite markets taking a breather in the September quarter.

- Over the past 12-months, investors have been rewarded for taking on additional risk, as the higher a fund’s allocation to growth assets (such as international equities), the higher the fund return has been.

The outlook

We asked JBWere, our lead investment manager, for their outlook for financial markets for the remainder of 2023, and their commentary is outlined below.

Even though global economic activity has proven more resilient than many thought was possible at the start of this year, we still believe there remains heightened uncertainty over the economic outlook. Recent tragic geopolitical events are of course part of that uncertainty, but ultimately, the biggest question for financial markets is still whether central banks have done enough to sustainably get on top of inflation. While we are keeping an open mind to the possibility of the fabled soft landing being achieved (that is, inflation returning to central bank targets without too much damage to economic growth and labour markets), we are also very mindful of what history teaches us; that inflation is unlikely to sustainably fall and remain near central bank targets without more economic pain being felt. With this yet to really emerge, we think the “tighter for longer” theme regarding monetary policy that has recently emerged in markets is the appropriate one. And when central banks are keeping their foot near the brake so to speak (as opposed to near the accelerator), it raises the risk that a hoped-for economic soft landing eventually becomes a harder one, especially as the impact of already delivered interest rate hikes are still yet to fully work their way through economies.

We are not overtly negative on equity markets from here, and we note that valuations have retreated from recent highs following the pull back over the September quarter. However, we do believe, for the time being at least, there is somewhat of an unfavourable skew in equity markets given the building potential for downside risk to economic growth not being balanced by potential for upside surprises. Even if a soft landing is achieved, without greater spare capacity in economies, it is difficult to see what could propel broad corporate earnings growth meaningfully higher from here. But even beyond this, it is fair to say that the significant increase in interest rates this year now creates a much higher bar for equities to beat. From a risk-adjusted basis, the returns available in cash and fixed interest look attractive.

Ultimately, we think an element of caution regarding the economic and markets outlook is still very much warranted, and we continue to reflect that caution in the way the MAS funds have been positioned. We have held higher levels of cash and have had smaller allocations to international equities and fixed interest asset classes relative to their strategic asset allocation targets. While we think that positioning remains appropriate, given where bond yields have now risen to, we are actively looking to deploy some of the funds’ higher levels of cash into the defensive fixed interest asset classes when opportunities present themselves. Bond yields as high as they are currently, are not only offering respectable rates of return, but also a buffer against the possibility for weaker than expected economic growth, and the risks of a sell-off in equities.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of members.

After a challenging quarter, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice. To book an online or phone meeting, please complete this form and we will be in touch.

We also have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form:

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms - MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms - MAS

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds - MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS - MAS

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statements are available below or by calling 0800 800 627.

- The Product Disclosure Statement for the MAS KiwiSaver Scheme

- The Product Disclosure Statement for the MAS Retirement Savings Scheme

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

We’ve lowered our fees for the MAS KiwiSaver Scheme and MAS Retirement Savings Scheme

1 November 2023 - As part of our continued focus on enhancing our members’ investment experience, MAS has made some fee changes to our Schemes.

MAS measures its carbon footprint with Toitū Envirocare

9 November 2023 - Environmental responsibility has always been important at MAS so we've become a Toitū net carbonzero certified organisation.