COVID-19 defines the quarter and the year

The outbreak of the COVID-19 pandemic during the quarter saw virtually every country in the world go into lockdown as authorities sought to contain the virus. As a result, business activity plummeted and world share markets had their sharpest falls in modern history. In turn, this led to sharp falls in our Fund unit prices for the quarter, although the picture over 12 months is more positive.

Promising start to 2020

The quarter began on a promising note with useful progress on the US/China trade war and further signs of improving economic growth, particularly in Europe. The positive outlook was reinforced by very low interest rates and low inflation. Little wonder then that many world share markets hit record highs by the middle of February.

COVID-19 virus changes everything

Everything changed when the COVID-19 virus became a pandemic and when country after country was forced into lockdown in order to try and contain the virus. While this was necessary from a public health perspective, the economic damage is huge, with entire industry sectors such as airlines and hospitality brought to a standstill. The unprecedented actions taken to contain the virus saw an equally unprecedented fall in world share markets as investors worried about the future of many companies. As an illustration, from its record peak on 19 February 2020, the US sharemarket (as measured by the S&P500 Index) fell 35% by mid-March.

Authorities take drastic action

Just as governments were forced to take drastic actions to safe-guard public health, so they were forced to take extreme measures to try and offset, at least partially, the economic damage being caused by the lockdowns. Central banks slashed official cash rates and offered to provide liquidity to banks while governments instigated measures such as wage subsidies, loan guarantees and public works programmes.

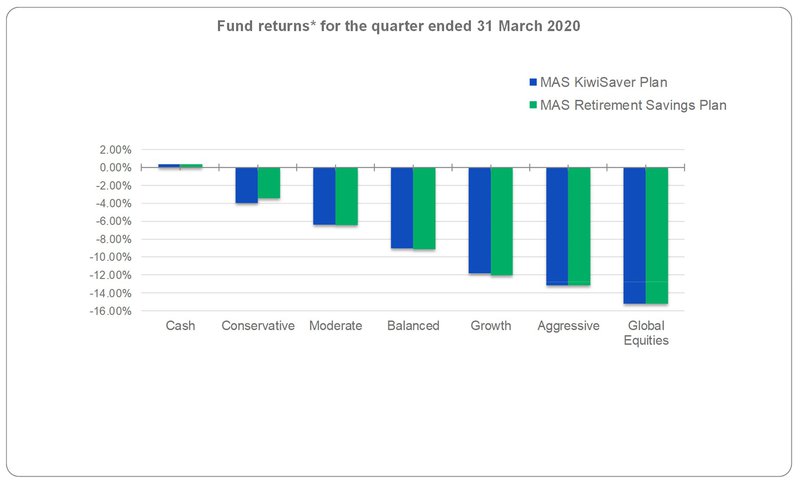

MAS Fund short term returns

The measure taken by authorities to stabilise economies were enough to see a sharp recovery in global financial markets in the second half of March, but not enough to prevent Fund returns for the quarter going into negative territory, as the chart below illustrates.

*Note: Returns are after total fund charges and before tax.

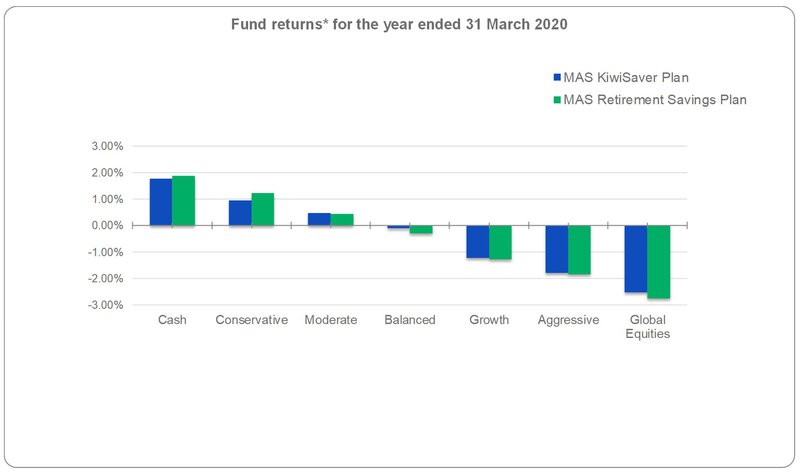

Given the strong returns early in the year, the full year returns held up remarkably well, although such was the slump in the last quarter, these returns are still negative in some cases.

*Note: Returns are after total fund charges and before tax.

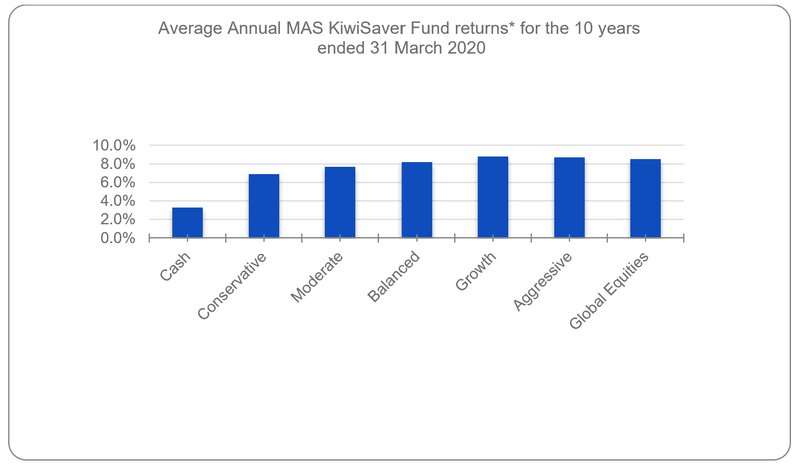

At times like this it's important to take a long-term view

Despite the alarming fall in Fund unit prices in the March quarter, it's important to take a long-term view as the quarter was an extraordinary one. As the chart below illustrates, returns remain healthy for our KiwiSaver Funds over the past decade, which is a more meaningful investment timeframe. Similarily, the more aggressive investment Funds continue to perform better than the more conservative ones.

*Note: Returns are after total fund charges and before tax.

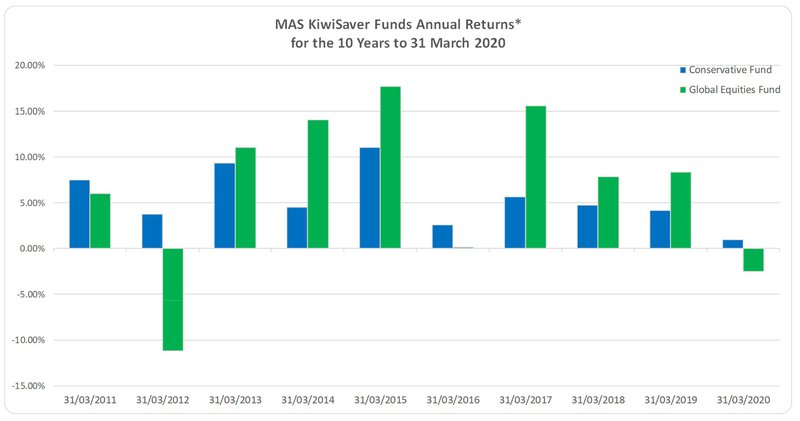

Of course, over shorter timeframes the return of the Global Equities Fund has been more volatile than that of the Conservative Fund, as the chart below illustrates. That's why it's so important to ensure that your investment strategy is consistent with your investment timeframe and your appetite for risk.

*Note: Returns are after total fund charges and before tax.

What's next?

The MAS Funds are actively managed and our investment managers are working hard to reduce the potential for capital loss while seeking opportunities to take advantage of opportunities that the current dislocation in economies and financial markets may present.

The Funds are currently more defensively positioned – they hold fewer growth assets than usual and more cash. Our investment managers will be looking for signs of containment of the COVID-19 virus and evidence of international economies stabilising before they return to a more positive investment strategy. You can read here their full report on the implications of coronavirus for their investment strategy.

We can help

Recent events reinforce the importance of having a sound investment strategy and sticking to it. To review your KiwiSaver and retirement savings goals, speak to a MAS Adviser. To arrange an online or phone meeting, complete this form and we'll be in touch.

It's also important to make sure you're in the right Fund for your risk appetite. You can use our online risk profiler questionnaire to see if you're in the right fund for your circumstances.

If, after reviewing your risk profile and speaking with an adviser, you do decide to change your investment strategy, you will need to complete an investment strategy change request form:

Find out more about MAS's broader approach towards the COVID-19 pandemic here.

Disclaimer

The information contained here is of a general nature and is not a substitute for professional and individually tailored advice. Medical Assurance Society KiwiSaver and Retirement Savings Plan Trustees, Medical Assurance Society New Zealand Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guaranteee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

The Trustees of the Medical Assurance Society KiwiSaver Plan and the Medical Assurance Society Retirement Savings Plan are the issuer and manager of each of those Plans.

The Product Disclosure Statement for the Medical Assurance Society KiwiSaver Plan is available here.

More news

MAS is monitoring the reaction of financial markets to coronavirus

3 March 2020 - The spread of coronavirus - or Covid-19 - has been the focus of media attention for several weeks. As well as the global health implications, there is increasing speculation about the impact of the virus on financial markets.

MAS changes pricing to more fairly allocate costs for house insurance

3 February 2020 - MAS has now moved to a risk-based pricing model, which means taking into greater account of the particular risks faced by houses in different regions around the country when it comes to setting premiums.