Inflation continues to derail financial markets

The quarter was dominated by global inflation increasing further to new multi-decade highs. Interest rates rose sharply as central banks responded to the risk of inflation rising even further above the level they target. As a result, returns for both share markets and fixed interest (bond) markets were negative for the quarter – a highly unusual occurrence. Markets are now delicately poised as investors wait to see whether inflation has peaked or whether central bank efforts to curb inflation may force economies into recession.

Inflation proves persistent

Financial markets entered the quarter after having made a sharp and painful adjustment in the previous quarter to inflation jumping to multi-decade highs and an expectation that while central banks would respond with rapid interest rate rises, these issues were now largely already priced in.

Unfortunately, this proved not to be the case. In the United States, the world's largest economy and reference point for all financial markets, annual inflation for May 2022 rose to 8.6%, with broad-based increases across many categories. More worryingly, separate data showed households' expectations for where inflation could settle over the longer-term rising too, highlighting the risk of higher rates of inflation becoming entrenched.

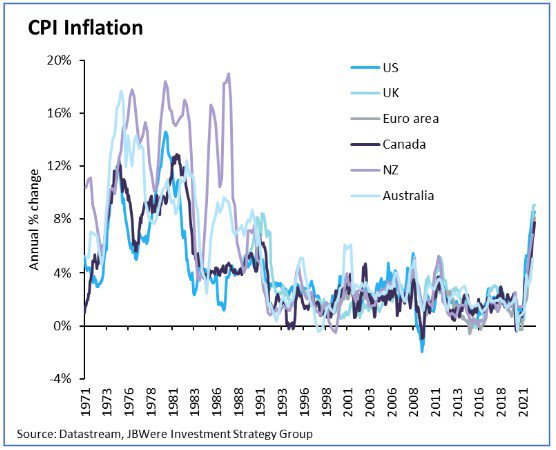

The scale of the recent explosion in inflation is evident in the chart below, which illustrates the consumer price index (CPI) percentage change (over a 50-year period) across various countries and economic regions.

Central banks responded to the continued increase in inflation by becoming more aggressive in their plans for raising official interest rates to try to crimp demand and reduce inflation. For instance, last month the board of the US central bank – the Federal Reserve (Fed) agreed to raise its official policy interest rate by 0.75% – the largest single move since 1994. Many other central banks have joined the Fed in raising their policy interest rates aggressively as they struggle to contain inflation. Further large increases from most central banks appear likely in the near term.

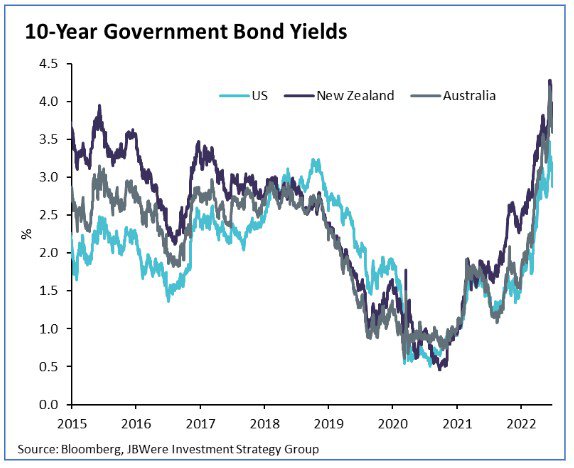

This expectation has led to further significant increases in long-term interest rates (bond yields), which are illustrated in the chart below for various 10-Year Government Bond Yields over the last seven years.

What has this meant for financial markets?

The sharp increase in interest rates impacts share markets in many ways. Directly, interest rates (or bond yields) are an important input when calculating a company's long-term value. All else being equal, the higher the interest rate (or discount rate), the lower the valuation. Indirectly, central banks are using higher interest rates to cool economic activity, which then impacts companies' profitability or earnings. This latter point has become a greater focus as central banks have turned ever more aggressive.

For investors in funds with an allocation to fixed interest (bonds), higher interest rates have led to falls in bond values and negative returns as the price or value of a bond moves inversely to changes in interest rates. While these declines in bond prices will be recovered over the remaining term of the bond, boosting future returns, they have created a highly unusual situation of both shares and bonds delivering negative returns during 2022. More commonly, at least over recent decades, negative returns from shares will be partly offset by positive returns from bonds (and vice versa).

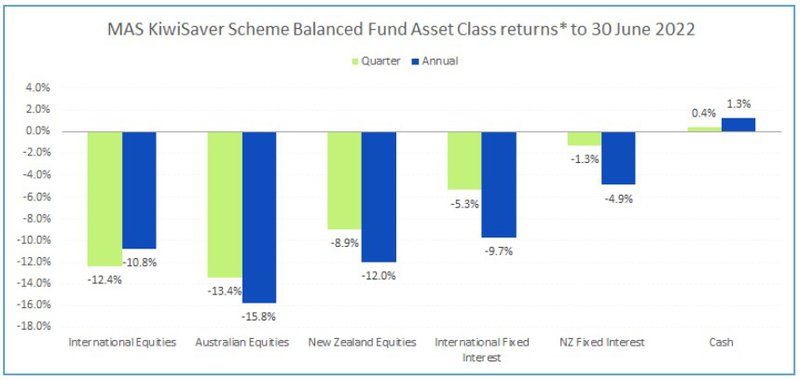

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for other MAS funds are very similar.

*The return for International Fixed Interest is after third-party manager fees. Otherwise, returns are shown before fees and tax. For illustrative purposes, the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above:

- Sharp weakness in international share markets during the quarter led the annual return to be negative – the first time in a calendar quarter since the fear associated with the outbreak of COVID-19 in the March quarter of 2020.

- The relatively concentrated nature of the New Zealand share market and its sensitivity to interest rates has seen it underperform international share markets over the year. This is a major reversal from recent years when interest rates were generally falling.

- Returns from fixed interest were sharply negative in the quarter and led annual returns to be the worst in decades.

What this means for our funds

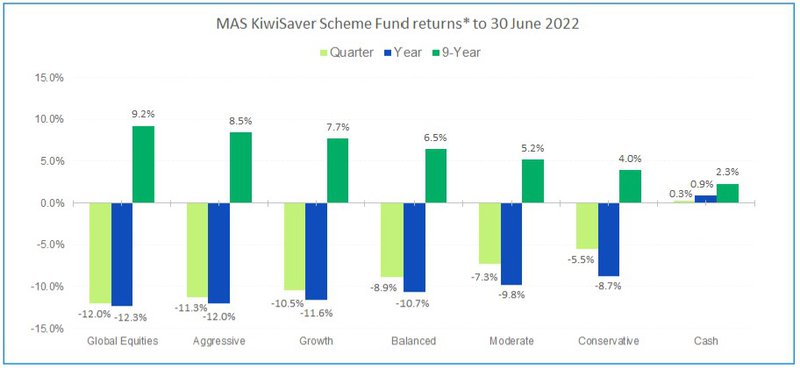

The chart below shows returns to 30 June 2022 for all funds in the MAS KiwiSaver Scheme.

*Returns are after total annual fund charges and before tax. The returns for nine years are annualised returns.

Key points to note from the chart above are:

- The June 2022 quarter was the second calendar quarter in a row where the annual return of the Conservative Fund and the Moderate Fund was negative – an unprecedented occurrence.

- No fund other than the Cash Fund has a positive return for both the quarter and year.

- Despite the Cash Fund's recent outperformance, its return over the long term (nine years) is well below that of our other funds. In other words, investors in those other funds for the full past nine years have been rewarded for taking on additional risk.

The outlook

With global share markets having fallen considerably from their highs in late 2021, our investment manager, JBWere, judges them to be arguably beginning to offer an attractive risk/return proposition for long-term investors. However, JBWere is not yet prepared to change much in the way of overall exposure to share markets given that global economies are at a delicate juncture for their inflation and growth outlook.

If inflation shows signs of beginning to fall, shares (and probably bonds too) are likely to strongly increase in value as a lot of bad news on the inflation front is already priced in by markets. However, if inflation proves more persistent, central banks are making it quite clear that they are prepared to drive their economies into recession to tame inflation, which is hardly a favourable backdrop for share markets (although this would be expected to benefit bond investments). Ultimately, the near-term performance of financial markets hinges on this balance between inflation and growth, which remains highly uncertain.

As a result, JBWere currently thinks investing in line with funds' long-term target asset mixes, rather than holding fewer or buying more shares, is the appropriate strategy until they have further clarity on the inflation and growth outlook. That said, within the equity asset classes, JBWere has a modest tactical preference to the relatively defensive New Zealand equity market as opposed to the more cyclical Australian and international equity markets, and where appropriate is looking to selectively increase the relative exposure to New Zealand equities within the funds.

You can find out more on JBWere's outlook and strategy here.

What does this all mean for Members?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of Members.

It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy. There is no additional cost to speak to a MAS Adviser and they don’t receive commissions.

Please complete this form to book an online or phone meeting, and we will be in touch.

We also have useful online tools to help you:

Our Risk Profiler Questionnaire can help you see if you're in the right fund for your circumstances.

Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form.

MAS KiwiSaver Scheme investment strategy change request form

MAS Retirement Savings Scheme investment strategy change request form

There is no fee for switching.

You can seek weekly updates on fund unit prices and returns on our website:

MAS KiwiSaver Scheme weekly fund unit prices updates

MAS Retirement Savings Scheme weekly fund unit prices updates

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd, and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees).

Our financial advice disclosure statement is available here or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

ILANZ and MAS partner to support in-house lawyers

28 June 2022 - In-house lawyers will benefit from a new partnership agreement between ILANZ and MAS.

Investment market update - June 2022

17 June 2022 - Since we last reported on investment markets, the global share markets have continued to weaken significantly with the New Zealand share market not immune to the same decline.