Changing expectations for inflation drive financial markets

The quarter was rather a "game of two halves". In the first half, evidence emerged that inflation appeared to be peaking, leading to speculation that central banks would be able to slow (and eventually reverse) their recent aggressive hikes in official interest rates.

Reinforcing this more optimistic scenario was data which showed a modest reduction in headline inflation as petrol prices dropped from their recent highs. A further fall in energy and grain prices, together with signs that global supply chains were recovering, and shipping costs falling (helping to lower durable goods inflation), also increased optimism that inflation pressures had finally begun to ease.

However, investor optimism was dented in late August as the US central bank, the Federal Reserve (Fed), perhaps mindful of having lost some credibility for being slow to respond to sharply rising inflation, took a harsher public tone. This change may have also been due to new data confirming the underlying drivers of inflation remained strong, the US labour market remaining extra tight and wage growth continuing at historic highs. It's now clear that the Fed would rather be too late in eventually cutting official interest rates than be too early to act when they think that inflation is beaten. In other words, the Fed appears willing to accept an even larger growth and labour market trade-off to ensure inflation sustainably returns to its target.

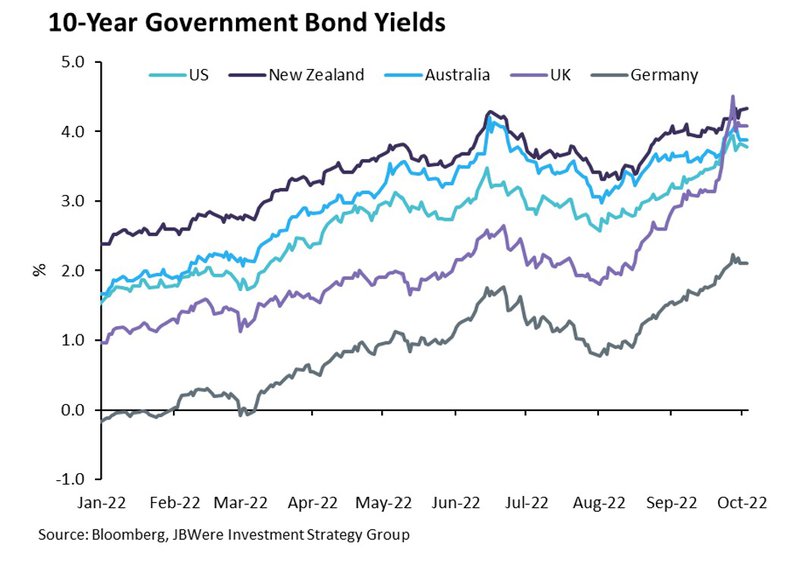

The change in the path of interest rates in reaction to the changing inflation outlook is illustrated in the chart below using the yield (interest rate) of the 10-year government bonds in selected markets. After initially falling from their mid-June highs, yields rose sharply from mid-August to close at the highest level since 2008.

Volatile interest rates mean volatile share markets

Changing interest rates impact share markets in many ways. Directly, interest rates (or bond yields) are an important input when calculating a company's long-term value. All else being equal, the higher the interest rate (or discount rate), the lower the companies' valuations. Indirectly, central banks are using higher interest rates to cool economic activity, which then impacts companies' profitability or earnings. This latter point has become a greater focus as central banks have become even more aggressive.

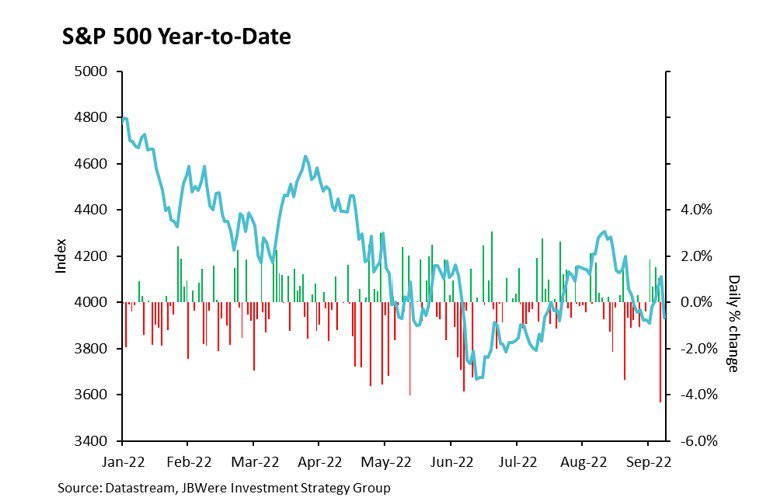

The impact of changing interest rates on share markets is illustrated in the chart below which shows the US share market (as measured by the S&P500 Index) for the first nine months of this year. Generally, it has gone up when interest rates have gone down, and vice versa.

Key: The blue line represents the S&P500 Index (left axis). The vertical lines represent the daily percentage change in the index (right axis). Green means a positive change while red means a negative change.

The United States is not the only major economy grappling with multi-decade high inflation. Europe is particularly challenged by surging energy prices, as Russia's invasion of Ukraine has led to severe restrictions on Russian natural gas exports in Europe, where natural gas is a key component of many nations' energy use. The European Central Bank has been forced to raise its official interest rate – despite the European economy being significantly weaker than the United States.

Elsewhere in Europe, the new UK Chancellor's recent radical proposed tax cuts and spending increases caused a crisis of confidence in the UK's credit worthiness. UK bonds and the British Pound reacted accordingly, further unnerving investors in other parts of the world.

Here in New Zealand, the Reserve Bank has been quicker to raise official interest rates than other central banks. Nonetheless, in its September assessment of monetary policy, the Reserve Bank judged that the official cash rate (OCR) would need to be higher than previously thought, and for longer. Market expectations are for the OCR (currently at 3.5%) to reach about 4.90% by May next year and to remain at this rate until at least February 2024. Higher interest rates are likely to put further downward pressure on house prices, which in turn impacts consumer confidence via the 'wealth effect'.

The US Dollar is king

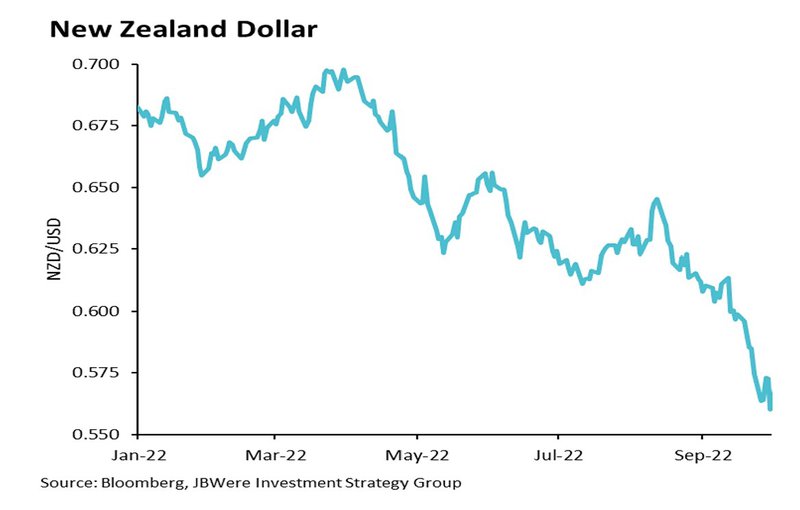

A notable feature of the quarter was the continued strength of the United States (US) Dollar. This was driven primarily by two factors. Firstly, as investors became more risk averse, they sought out "safe haven" assets. These are generally regarded to be US Dollar denominated i.e. the US Dollar is in effect the reserve currency of the world. Secondly, the relatively strong state of the US economy has meant that market expectations are for higher interest rates there than in many other countries – attracting capital flows seeking higher returns. The strength of the US Dollar against the New Zealand Dollar is illustrated in the chart below. The New Zealand Dollar finished the quarter at its lowest level against the US Dollar since 2009.

What has this all meant for returns?

For investors in funds with an allocation to fixed interest (bonds), higher interest rates have led to falls in bond values (at least on paper) and negative returns as the price or value of a bond moves inversely to changes in interest rates. While these declines in bond prices will be recovered over the remaining term of the bond when the bond is held to maturity, boosting future returns, they have created a highly unusual situation of both shares and bonds delivering negative returns during 2022. More commonly, at least over recent decades, negative returns from shares have been partly offset by positive returns from bonds (and vice versa).

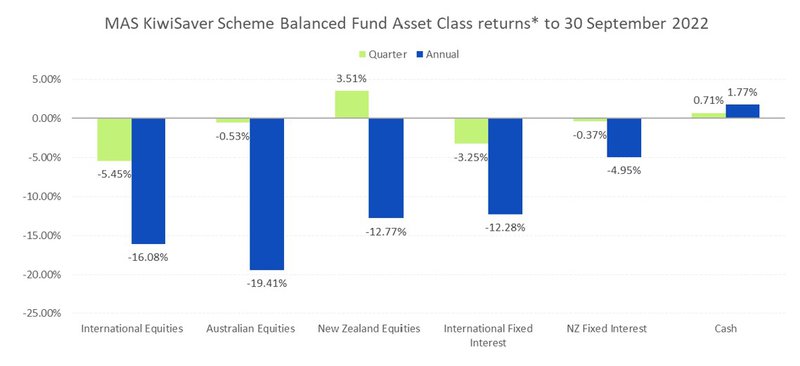

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

-

The annual return from international share markets is the weakest in over 10 years.

-

The relatively defensive nature of the New Zealand share market has seen it do better than international share markets – recovering some of its underperformance in the past couple of years when international (predominantly US) technology companies were in vogue.

-

Returns from fixed interest were negative for the fifth successive calendar quarter and led annual returns to be amongst the worst on record.

What this means for our funds

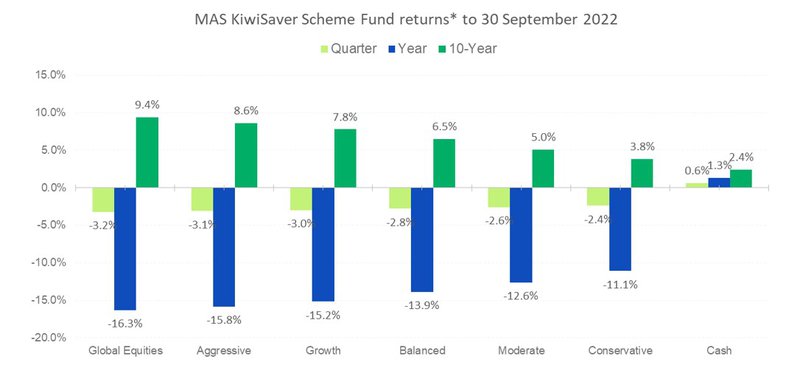

The chart below shows returns to 30 September 2022 for all funds in the MAS KiwiSaver Scheme.

Note: *Returns are after total annual fund charges and before tax. The returns for 10 years are annualised returns.

Key points to note in the chart above are:

-

No fund other than the Cash Fund had a positive return for both the quarter and year.

-

Despite the Cash Fund's recent outperformance, its return over the long term (10 years) is well below that of our other funds. In other words, investors in those other funds for the full past 10 years have been rewarded for taking on additional risk.

-

The September 2022 quarter was the third calendar quarter in a row where the return of the Conservative Fund and the Moderate Fund were negative – an unprecedented occurrence.

The outlook

In the view of our lead investment manager, JBWere, signs that inflation has peaked and is beginning to moderate is a necessary condition for financial market volatility to ease and for share markets to sustainably recover. However, in their view, it is not a sufficient condition. To have more confidence in the timing of a sustainable share market recovery, they believe investors will need to be able to make a judgement on when the worst of the economic pain is behind us. For that to happen, it will likely require a signal from central banks that they believe they have raised official interest rates enough. Given recent remarks from central bank officials and the tightness of labour markets, JBWere don't believe central banks are close to making that judgement yet.

Importantly, there are signs that aggressive hikes in official interest rates by central banks are gaining traction, with housing markets cooling and economic growth slowing. The necessary slowdown in demand is underway. That will help get inflation under control in time. However, central banks need to be confident that inflation pressures are not just moderating, but that they are moderating enough to get inflation from today's elevated (~7% - 9% p.a.) rates back towards target bands (~2% - 3% p.a.). It will take more time (and data) for central banks to make that assessment.

Although global equity markets have fallen considerably this year and are therefore arguably beginning to offer value for long-term investors, risks remain skewed towards the downside. This is owing to the dogged focus of central banks to return inflation sustainably to target levels, with the ensuing risks to the economic outlook and hence to corporate earnings.

As a result, JBWere believes financial market volatility is likely to persist. To help protect MAS funds from some of this volatility, the funds are currently holding higher levels of cash and reduced exposure to international shares relative to their long-term targets. And in accordance with wanting to add defensiveness, JBWere have a tactical preference to the relatively defensive New Zealand share market over the more cyclical Australian and international share markets. Where JBWere are looking at opportunities to invest and alter positions within funds, they are choosing companies and sectors where they have more confidence in those companies' future earnings and margins.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of Members.

At times like these, it's important to keep the long-term in mind and see past any shorter-term peaks and troughs. While falls in your account balance can be unsettling, it's reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice.

You can book an online or phone meeting with a MAS Adviser here.

We also have useful online tools to help you:

Our Risk Profiler Questionnaire can help you see if you're in the right fund for your circumstances.

Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form. There is no fee for switching.

MAS KiwiSaver Scheme investment strategy change request form

MAS Retirement Savings Scheme investment strategy change request form

You can seek weekly updates on fund unit prices and returns on our website:

MAS KiwiSaver Scheme weekly fund unit prices updates

MAS Retirement Savings Scheme weekly fund unit prices updates

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JB Were (NZ) Pty Ltd, and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees).

Our financial advice disclosure statement is available below or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both Schemes.

More news

Why rising interest rates reduce your fixed interest returns

14 October 2022 – We unpack the reason why interest rates have risen sharply and why this may have caused short-term pain but potentially long-term gain.

New MAS Head of Investments and Business Development

14 October 2022 – MAS welcomed Helen McDowall into the newly-created role of Head of Investments and Business Development in late July.