When we provided our regular quarterly investment update as at 30 June, we noted that “markets are now delicately poised as investors wait to see whether inflation has peaked or whether central bank efforts to curb inflation may force economies into recession.” For a period, this observation appeared prescient as evidence emerged that inflation appeared to be peaking, leading to speculation that central banks would be able to slow (and eventually reverse) their recent aggressive hikes in official interest rates. This coincided with a recovery in world share markets. However, in recent weeks, share markets have reversed those gains as inflation appeared not to be beaten and in response central banks indicated that they intend to raise official interest rates higher than previously expected to ensure inflation returns to targeted levels.

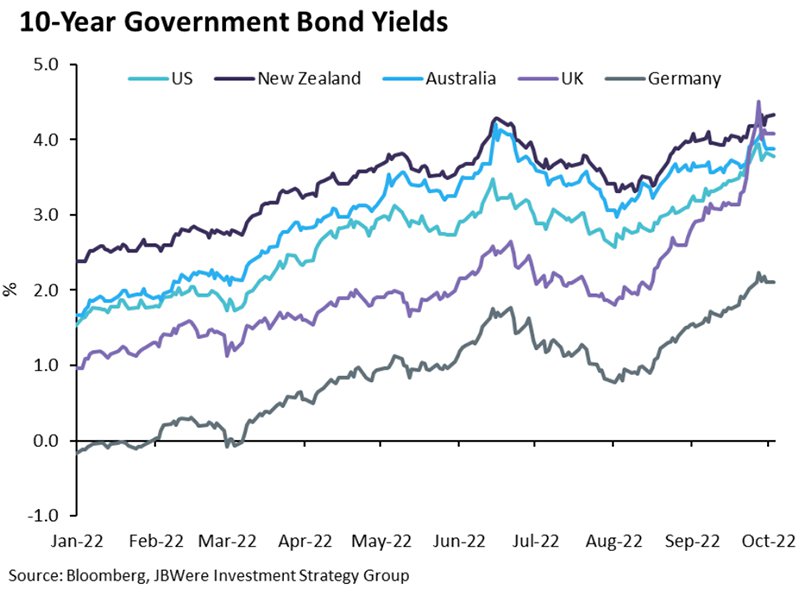

The change in the path of interest rates over the period is illustrated in the chart below using the yield (interest rate) of the 10-year government bond in selected markets. After initially falling from their mid-June highs, yields rose sharply from mind-August to close at the highest level since 2008.

Given the relationship between interest rates and the value of bonds, the jump in interest rates in the past quarter has led to falls in the valuation of bonds that have exceeded the contracted fixed return, meaning that overall returns for the period have been negative in both the New Zealand and international fixed interest markets.

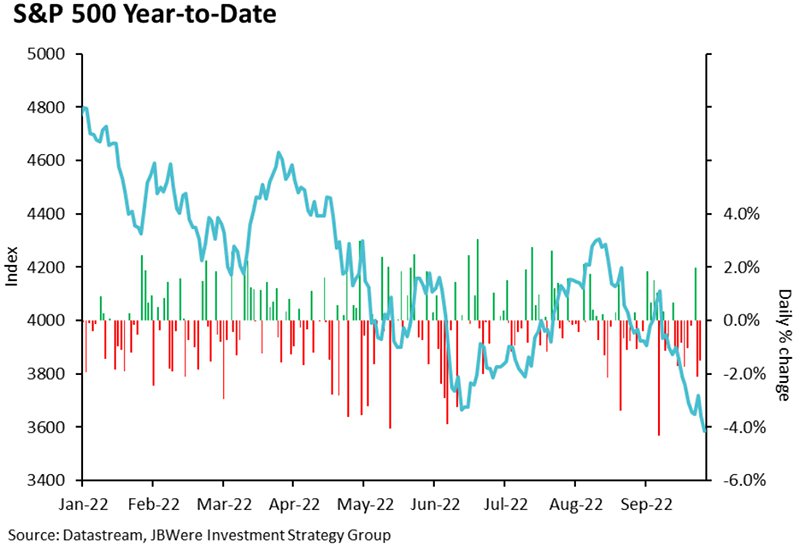

The roller coaster ride of changing expectations for inflation and interest rates impacted directly on share markets. This is illustrated in the chart below which shows the US share market (as measured by the S&P 500 Index) for the nine months ended 30 September.

The United States is not the only major economy grappling with multi-decade high inflation. Europe is particularly challenged by surging energy prices, as Russia’s invasion of Ukraine has led to severe restrictions on Russian natural gas exports to Europe, which are a key component of many nations’ energy use. The European Central Bank has been forced to raise its official cash rate – despite the European economy being significantly weaker than the United States.

In the UK, the new Chancellor’s recent radical proposed tax cuts and spending increases caused a crisis of confidence in the credit worthiness of the country and UK bonds and currency reacted accordingly, further unnerving investors elsewhere in the world.

Here in New Zealand, the Reserve Bank has been quicker to raise official interest rates than other central banks. Nonetheless, in its September assessment of monetary policy, it judged that the official cash rate (OCR) would need to be higher than previously thought, and for longer. Market expectations are for the OCR (currently at 3.00%) to reach about 4.70% by May next year and stay there through to at least February 2024. Higher interest rates are likely to put further downward pressure on house prices.

The outlook

In the view of our lead investment manager, JBWere, signs that inflation has peaked and is beginning to stabilise is a necessary condition for financial market volatility to ease and for share markets to sustainably recover. However, their opinion is that it is not a sufficient condition. To have more confidence in the timing of a sustainable share market recovery, JBWere believe investors will need to be able to make a judgement on when the worst of the economic pain is behind us. For that to happen, it will likely require a signal from central banks that they believe they have raised official interest rates enough. Given recent remarks from central bank officials and the tightness of labour markets, JBWere don’t believe central banks are close to making that judgement yet.

Importantly, there are signs that aggressive hikes in official interest rates by central banks are gaining traction, with housing markets cooling and economic growth slowing. The necessary slowdown in demand is underway. That will help get on top of inflation in time. However, central banks need to be confident that inflation pressures are not just stabilising, but that they are stabilising enough to shift inflation from today’s elevated (~7% - 9% p.a.) rates back towards target bands (~2% - 3% p.a.). It will take more time (and data) for central banks to make that assessment.

Although global equity markets have fallen considerably this year and are therefore beginning to offer value for long-term investors, they remain skewed towards the downside. This is owing to the dogged focus of central banks to return inflation sustainably to target levels, with ensuing risks to the economic outlook and hence to corporate earnings.

As a result, JBWere believes financial market volatility is likely to persist. To help protect MAS funds from some of this volatility, the funds are currently holding modestly higher levels of cash and reduced exposure to international shares relative to their long-term targets. And in accordance with wanting to add defensiveness, JBWere have a tactical preference to the relatively defensive New Zealand share market over the more cyclical Australian and international share markets. Where JBWere are looking at opportunities to invest and alter positions within funds, they are choosing companies and sectors where they have more confidence in those companies’ future earnings and margins.

Medical Funds Management Limited is the manager and issuer of investments in the MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme (the Schemes). The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here. The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here. If you would like to talk to a MAS adviser, phone 0800 800 627 or email info@mas.co.nz.

More news

Appointment of new Chief Executive Officer for MAS

11 October 2022 – The Board of Medical Assurance Society (MAS) is pleased to announce the appointment of Jason McCracken as its new Chief Executive Officer. Jason will succeed Martin Stokes, who earlier in the year announced that he wished to retire.

Funds performance for the quarter ended 30 September 2022

14 October 2022 – The quarter was a volatile one for financial markets as investors' expectations that inflation was near its peak seesawed between optimism and pessimism.