A correction or a reversal?

Many financial markets have performed poorly during the first quarter of 2022 as they reacted to surging inflation and the outbreak of war in Ukraine. Are these market movements simply an overdue, but temporary, correction to the long-term positive trend, or do they mark a more significant and protracted reversal to the long-term trend of favourable market conditions? In this article with our investment manager, JBWere, we explain what has caused this movement and what this can mean for our investors.

Where have we come from?

Firstly, it is worth considering where we have come from. It was quite an unusual period for share markets up until the end of 2021. Not only did aggressive policy stimuli and notable medical breakthroughs with respect to COVID-19 result in strong share market returns over the previous two years, but those returns were remarkably stable. Before the start of 2022, the world's largest share market, the US share market had gone 61 straight weeks without a fall of 6% or more (as measured by the S&P 500 Index). This is the third longest stretch over the past two decades.

It has been historically quite common for share markets to experience one or two 5-10% corrections a year. Therefore, the weakness and volatility through the start of 2022 could be seen as not only normal, but arguably overdue. The main question was not whether a correction would happen but what would trigger it.

What has caused the market correction?

Continued fears around multi-decade-high levels of inflation and the threat of substantial and rapid interest rate rises have spooked investors, which has led to the market weakness experienced over the first quarter.

High inflation is typically unwelcome news for share markets and investors as increased costs for companies can eat into the bottom line. Central banks typically turn less friendly as they attempt to cool demand in the economy to rein in inflation pressures. High inflation also makes it harder to get a 'real' return - one that outpaces the level of inflation.

What we do know is that inflation is elevated. In the US, annual CPI inflation is currently running at 8.5%, a 40-year high. As a result of the inflationary pressures around the world, central banks and especially the US Federal Reserve Board (Fed) have taken a sharp pivot from accommodating positions. Responding to the growing inflation risks, the Fed has begun to remove the monetary policy stimulus both earlier and more aggressively than previously expected.

The resulting increases to the expected path for interest rates has sent jitters across financial markets. Interest rates impact share markets in many ways, primarily as they are an important input into the calculation of a company's value. All else being equal, the higher the interest rate (or discount rate), the lower the valuation.

In New Zealand, the Reserve Bank raised the official cash rate (OCR) by 0.25% to 1.00% in February, its third consecutive increase, after a 0.25% increase in October 2021 - which was the first increase in seven years. Shortly after quarter end the Reserve Bank raised the OCR by another 50bps, taking the OCR to 1.5%. Some banks are forecasting the OCR to peak at over 3.50% in 2023.

The challenges posed by surging inflation have been magnified by the war in Ukraine. Apart from the human catastrophe that is unfolding, the war is causing massive disruption to energy and grain supplies. The potential for the war to escalate is causing investors to be more defensive and this is also weighing on international share markets, particularly in Europe. MAS has no investments in Russian companies that are involved in the war in Ukraine. You can find out more on our website here.

What has this meant for financial markets?

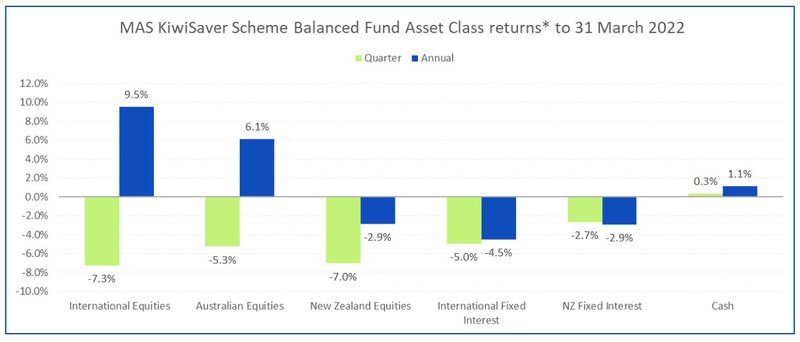

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for other MAS funds are very similar.

Notes

*The return for International Fixed Interest is after third party management fees. Otherwise returns are shown before fees and tax.

For illustrative purposes, the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above

- The big change in expectations for future central bank policy rate settings during the quarter contributed to higher long term interest rates. Consequently, because bond values move in the opposite direction to interest rates, returns from fixed interest were sharply negative in the quarter and led to negative annual returns as well.

- While in the quarter international share markets reacted negatively to the prospect of higher interest rates, the starting position was in many cases record highs. Consequently, the annual return from the international equities asset class was still comfortably positive.

- The relatively concentrated nature of the New Zealand share market and its sensitivity to interest rates has seen it significantly underperform international share markets over the year. This is a major reversal from previous years when interest rates were generally falling.

What this means for our funds

The performance of growth assets (such as international shares and Australian shares) compared with income assets (such as fixed interest and cash) was reflected in the relative performance of the funds.

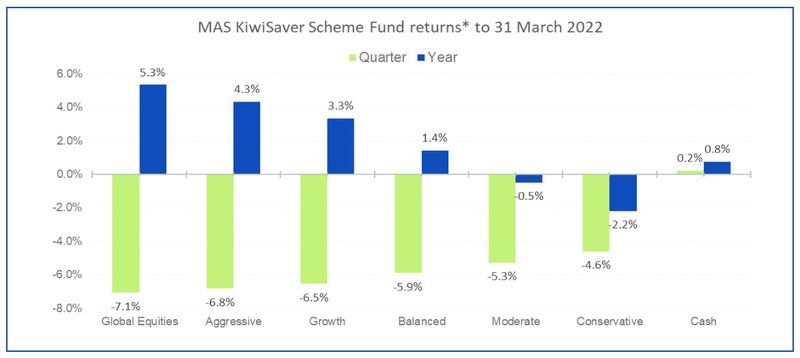

The chart below shows returns to 31 March 2022 for all funds in the MAS KiwiSaver Scheme. Note the bigger negative return over the quarter for the Global Equities Fund (with a target asset allocation of 100% invested in growth assets) compared with the Conservative Fund (with a target asset allocation of 20% in growth assets) and how the relative position of the performance of these funds reversed over the full year.

Notes

*Returns are after total annual fund charges and before tax.

The negative return for the financial year for the Conservative Fund and the Moderate Fund is highly unusual – it's the first time this has happened since 2009.

Actively seeking healthier returns

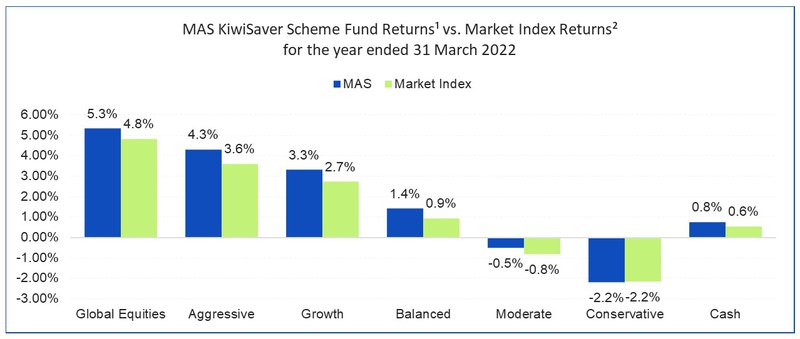

The MAS funds are invested in accordance with the MAS Responsible Investment Policy. We seek to invest both for a healthy planet and its people, and actively manage investments targeting an optimal mix of risk and return for investors. The recent success of our active management is illustrated in the chart below. This compares the annual return of each of the MAS KiwiSaver Scheme funds against the relevant market index i.e., the returns the funds would likely have achieved if they had followed an index/passive investment strategy with no fees charged (not something that an investor could achieve, but the broad-based, widely used type of benchmark required by regulation).

Notes

1. Returns after fees and before tax.

2. Returns are before fees ad tax.

With the exception of the Conservative Fund, the fund returns are higher than the relevant market index, illustrating the benefit of MAS' active investment strategy. You can find out more on the relevant market indices for the funds in the MAS KiwiSaver Scheme in the Statement of Investment Policy and Objectives (SIPO) available on our website here.

Outlook

We do not believe recent share market weaknesses will be sustained. Significant and sustained falls in share markets typically coincide with large economic downturns or recessions. However, while risks have increased, a global recession is not our expectation within the next 12-months, as we see the global economy recording cloase to trend rates of activity growth this year.

However, higher levels of market volatility, or the daily movements of market prices, are likely to continue this year given the many crosscurrents evident. Whilst it is impossible to know how and when geopolitical tensions will be resolved or how quickly inflation pressures will ease from today's elevated levels, we continue to focus on maintaining highly diversified funds. We have slightly lifted our cash positions within the MAS funds and are seeking to take advantage of investment opportunities that increased market volatility provides.

Our focus continues to centre on active management of the MAS funds, by continually assessing market conditions and making investment decisions that we believe will help the MAS funds achieve their return objectives over the medium to long term. You can find out more here.

We can help

It is important to have a sound investment strategy and to stick to it. To help you understand if your retirement savings are on track you can use our KiwiSaver retirement calculator on our website here, and you can also discuss your investment strategy by arranging a free consultation with a MAS adviser. To book an online or phone meeting, please complete this form and we will be in touch.

It is also important to make sure you are in the right fund for your risk appetite. You can use our online risk profile questionnaire to see if you are in the right fund for your circumstances.

If you decide to change your fund after reviewing your risk profile or meeting an adviser, you will need to complete an investment strategy change request form:

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of each of the Schemes.

More news

MAS Presents: Jehan Casinader and The Power of Stories

23 March 2022 - Join us for a free online wellbeing event with award winning journalist Jehan Casinader and Registered Clinical Psychologist Dr Dougal Sutherland.

Iconic Wellington event moves to digital model during outbreak

17 March 2022 - Brendan Foot Supersite Round the Bays moved to an innovative digital delivery model rather than its usual fun run/walk event around the Wellington waterfront which was due to take place on Sunday 20 February.