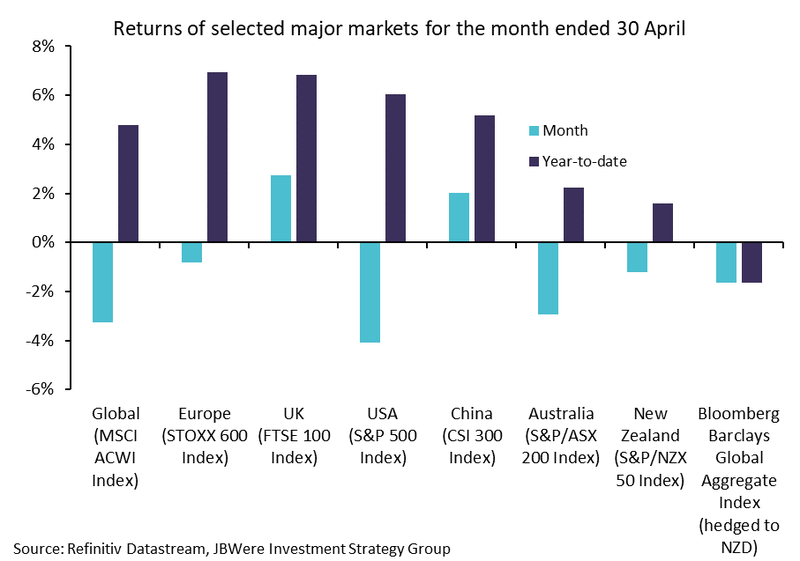

Five months of consecutive gains for global equities came to an end in April, with the market down -3.3% for the month. This is a good reminder that markets do not always go up in the short term. While this decline may cause some concern for investors, volatility in share prices is also associated with expected higher longer-term returns.

Market movements in April paint an interesting picture and the month could be described as a game of two halves. The first half of the month saw a decline in the all-important US share market followed by a partial reversal over the second half. During periods like this, it is good to remember to focus on your long-term investment goals, and try to avoid knee-jerk investment decisions based on short-term market fluctuations.

At one point during April, global equities were down around 5% as concerns grew that stubborn inflationary pressures could see the US Federal Reserve push interest rate cuts further out into the year, or even into 2025. The mounting tension and retaliatory action between Israel and Iran did little to improve investor sentiment or decrease the price of fuel, the latter flowing through to the UK’s annual inflation, which fell by less than expected.

The second half of the month was slightly more buoyant, as the market responded positively to some encouraging corporate earnings results. Investors took the weak first half of the month as a buying opportunity, capitalising on lower share prices. This saw global equities stage a partial recovery over the back half of April.

The energy sector in Europe and the utilities sector in the US were the best performing sectors in each region. With expectations of interest rate cuts being pushed out, the technology sector was one of the main laggards.

Solid US economic data, and especially some stronger-than-expected inflation figures, raised the market’s expectation that the Federal Reserve would need to keep interest rates at higher levels for longer, forcing other major central banks around the world to follow. This saw Government bond yields rise, with many hitting their highest levels this year. Bond prices move in opposite direction to yields. As yields rose around the globe, fully NZD hedged international bonds returned -1.6% over the month of April.

Closer to home, the New Zealand economy continues to struggle. Labour market figures for the first quarter of 2024 (released on 1 May) showed the unemployment rate rising to 4.3%, exceeding the Reserve Bank’s (RBNZ) forecast. Perhaps more concerning was the decline in the participation rate, suggesting more people are becoming disengaged from the labour market and are no longer actively looking for employment opportunities. Annual inflation falling from 4.7% to 4.0% appears positive, however the underlying components will not ease the RBNZ’s concern, as domestic inflation pressures remain elevated despite high interest rates. With this backdrop, domestic interest rates rose alongside global counterparts, while the local share market declined 1.2% over April.

Note: Returns are in local currency.

The outlook

Following recent stronger-than-expected US inflation figures, the market’s recent ‘not too hot and not too cold’, Goldilocks narrative (which contributed to the strong equity market gains over the March quarter), is facing its first real test. While we think falling inflation is still the most likely outcome, some of the stronger US economic data coming out has been inflationary. We see this as a risk to the trend of falling inflation. Until the market gets more clarity around where inflation is heading and the timing of possible central bank interest rate cuts, we suspect headwinds will continue. Ultimately, the road to sustainably bringing inflation back to target is likely to be a bumpy one. Because of this and due to currently elevated equity market valuations, we are maintaining a modestly cautious stance for the funds in each of the MAS Schemes.

After a challenging month, it’s important to keep the long-term in mind and see beyond short-term fluctuations. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser. To book an online or phone meeting, please complete this form and we will be in touch.

We have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

- Our MAS Investor Portal can help you manage your investments online.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form or for MAS Investment Funds investors, switch via the MAS Investor Portal:

- MAS KiwiSaver Scheme: KiwiSaver Documents and Forms – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms – MAS

- MAS Investment Funds: Investment Funds Documentations and Forms

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

- MAS KiwiSaver Scheme: KiwiSaver Funds – MAS

- MAS Retirement Savings Scheme: Retirement Savings Scheme Funds | MAS – MAS

- MAS Investment Funds: Investment Funds – MAS

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available: KiwiSaver – MAS

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available: Retirement Savings Scheme – MAS

The Product Disclosure Statement for the MAS Investment Funds is available: Investment Funds – MAS

Medical Funds Management Limited is the issuer and manager of the Schemes.

More news

MAS a finalist for Best Ethical KiwiSaver provider in Aotearoa New Zealand

20 May 2024 - MAS is delighted to have been announced as 1 of 4 finalists for Best Ethical KiwiSaver Provider in New Zealand, at the upcoming Mindful Money Awards on 12 June.

MAS reaches $2.5b investment funds under management

22 May 2024 - We’re excited to announce that we’ve hit a big milestone of $2.5 billion funds across the MAS KiwiSaver Scheme, MAS Retirement Savings Scheme, and new MAS Investment Funds.