What does this mean for Conservative Fund and Moderate Fund investors?

Fixed interest securities (bonds) have traditionally been important for investors seeking stable returns, and for many years bonds have produced returns well above returns from bank deposits. Benign inflation pressures, moderate rates of economic growth, and central banks around the world keeping their policy rates near historic low levels meant that bonds all contributed to this outcome. But times have changed.

Why is inflation rising?

In response to the outbreak of COVID-19 back in early 2020, central banks slashed their policy rates to record lows, while governments provided trillions of dollars in subsidies and handouts. As the world has worked through the impact of COVID and vaccines have been rolled out over the last 18 months, the financial stimulus provided by central banks and governments has created massive pent-up demand amongst consumers. This has collided with major bottlenecks in global supply chains. As a result, inflation around the world has risen sharply, in many cases to multi-decade highs.

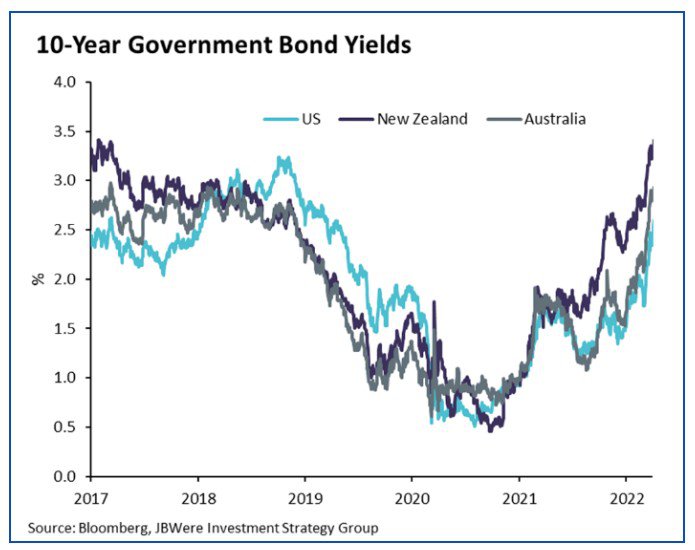

Central banks are now expected to rapidly reverse their emergency interest rate cuts, and this has been reflected in a sharp rise in long-term interest rates (bond yields). This is illustrated in the chart below for various 10-Year Government Bond Yields over the last five years:

How does this impact the value of bonds?

The price or value of a bond moves inversely to changes in interest rates. This is because most bonds pay a fixed interest rate (or coupon). Those fixed payments become more attractive to investors as interest rates fall, driving up the demand and price of the bond, and vice versa.

Given the relationship between interest rates and the value of bonds, the big jump in interest rates in the past quarter has led to falls in the valuation of bonds that have exceeded the contracted fixed return, meaning that overall returns for the period have been negative in both the New Zealand and international fixed interest markets. In fact, the annual return of these fixed interest markets has been negative.

To illustrate how unusual this event is, between 2005 and 2020, the S&P NZX Investment Grade NZ Corporate Bond Index recorded a compound annual return of 6.2% pa and 2021 is the first-time negative returns have occurred since the index began in 2001.

What does this mean for investors?

As highlighted earlier, with interest rates rising, the value of bonds falls, which lowers the reported returns for investors.

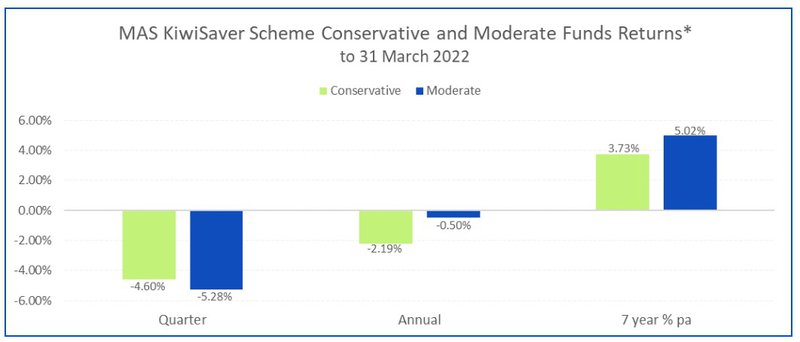

The MAS KiwiSaver Scheme Conservative and Moderate funds have a high weighting to fixed interest securities (or bonds) with a target asset allocation of 70% and 55% of their respective investments. As a result of these higher weightings to bonds, returns have fallen, in particular in the last quarter. This chart shows the returns of the MAS KiwiSaver Scheme Conservative and Moderate funds over various time periods:

Note

*Returns are after fees and before tax.

Outlook

The path of interest rates (and by implication returns from fixed interest securities) from here depends on whether the expected path of hikes in central bank policy rates already factored in by bond markets are sufficient to return inflation over the medium term back to the levels targeted by central banks. Our investment manager, JBWere, judges that this is the most likely scenario. However, there is a risk that inflation proves more persistent or the war in Ukraine escalates to an energy war whereby Russia withholds energy exports, leading to a further spike in inflation that may in turn force central banks to lift interest rates further, potentially lowering returns from fixed interest.

If you want to find out more about how your investment is performing, you can see weekly updates on fund unit prices and returns on our website by clicking the links below:

Medical Funds Management Limited is the manager and issuer of investments in the MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme (the Schemes).

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

If you would like to talk to a MAS adviser, phone 0800 800 627 or email info@mas.co.nz.

More news

Your money is now mindful

28 April 2022 - Well-known charity, Mindful Money recognises MAS Funds.

Funds performance for the quarter ended 31 March 2022

27 April 2022 - In this article with our investment manager, JBWere, we explain what has caused the recent market movements and what this can mean for our investors.