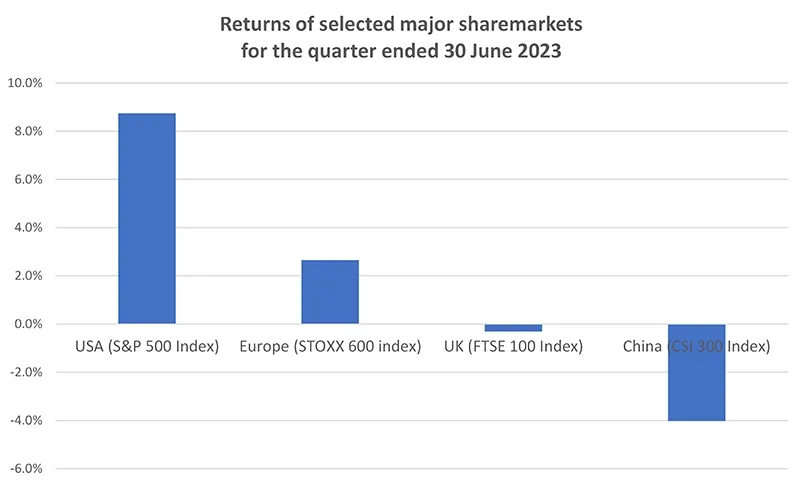

The quarter was another one dominated by investors changing views on whether central banks could engineer a slowing in economies sufficient to reduce inflation back towards official target levels, but without forcing a recession – the fabled “soft landing”. Increasingly, the answer is different for different countries and therefore the performance of individual countries’ share markets during the quarter were quite different.

For the world’s largest economy and share market, the United States (US), the market there overcame early fears about the stability of the banking system and a potential default by the US Treasury and rose more than 5% over the quarter (as measured by the S&P500 Index). In fact, the US share market is now officially in “bull market” territory, up more than 20% from its low in September 2022 when fears about the damage surging inflation might cause were high. But the performance of the US share market in the quarter was not broad based. Remarkably, the share price movements of just seven companies (mainly ‘Big Tech’ companies) accounted for more than 100% of the increase of the entire share market. This in turn was driven by a surge of enthusiasm by investors for companies that might benefit from the rapidly growing use of artificial intelligence (AI).

The performance of the US share market was driven by signs that inflation was continuing to moderate, while economic activity remained relatively healthy. The same could not be said for Europe and even more so Great Britain. Investors fear that these regions will experience stagflation – persistently high inflation but shrinking growth. This is a very bad mix for company profits and consequently their respective share markets struggled to deliver a positive return for the quarter.

The other major country that is disappointing investors is China. It appears that since it ended its long COVID-19 related lockdown, the economy is taking a lot longer to recover than originally expected. As a result, unlike most other central banks, the Chinese central bank is trying to stimulate the Chinese economy rather than trying to slow it to combat inflation. So far, it is having limited success and consequently the share market there was down modestly for the quarter.

The recent mixed fortunes of the major share markets are illustrated in the chart below. The chart illustrates the importance of having a diversified exposure to international share markets.

Note: Returns are in local currency terms.

Source: Refinitiv Datastream, JBWere Investment Strategy Group.

Here in New Zealand, the Reserve Bank slowed its rate of increase in the Official Cash Rate (OCR) from the 0.50% hike it made in April to 0.25% in May, bringing the OCR to a near 15 year high of 5.50%. While the smaller rate hike was expected, what was not expected by investors was the bank’s suggestion that it thought it may have done enough and would pause to observe how the economy responded to the previous rate hikes. This decision appeared wise as a few weeks later came confirmation that the New Zealand economy is in recession (defined as two consecutive quarters of negative economic growth), albeit just. The combination of weak growth, high interest rates and inflation still well above the official target of 1%-3%, is adversely impacting on company profitability. This led our share market to fall about 2% over the quarter.

What this all meant for returns

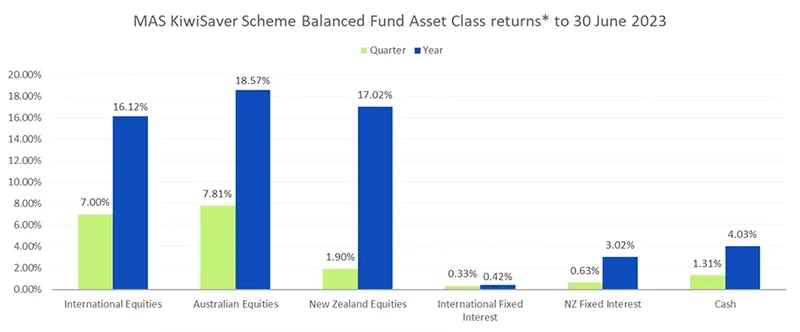

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

- For the first time since we reported as at 30 June 2021, the quarterly and annual returns for all asset classes are positive.

- A second consecutive generally strong quarter for our Schemes’ equity (share) portfolios has led to very strong annual returns for the year to 30 June 2023.

- Returns from cash for the year to 30 June have exceeded those from fixed interest - the reverse of the long-term historical position and what is generally expected over the long-term in future.

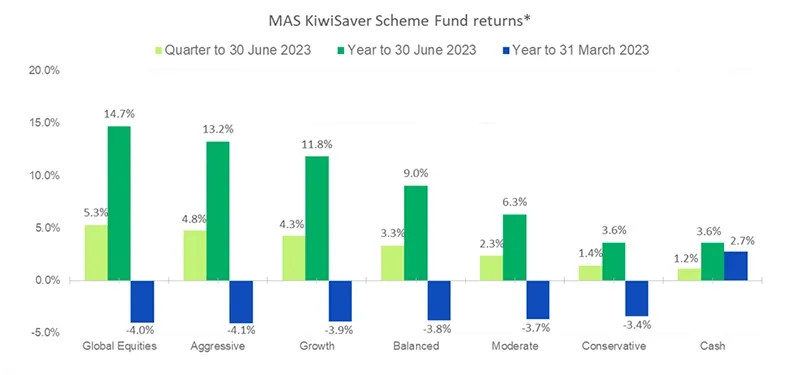

What this means for our funds

The chart below shows selected returns for all funds in the MAS KiwiSaver Scheme. Returns for comparable funds in the MAS Retirement Savings Scheme are very similar.

Note: *Returns are after total annual fund charges and before tax.

Key points to note from the chart above are:

- After a difficult first half of 2022, all funds now have positive returns for both the quarter and year – a significant reversal from just a quarter ago.

- Over the quarter and year, investors have been rewarded for taking on additional risk, as the higher a fund’s allocation to growth assets (such as international shares), the higher the fund return has been.

The outlook

We asked JBWere, our lead investment manager, for their outlook for financial markets for the remainder of 2023, and their commentary is outlined below.

Heading into 2023, we judged that a cautious stance towards financial markets and portfolio construction was warranted. This was because, in our view, inflation would prove stubborn and central banks resolute in their inflation fight and therefore the risks to the global economy, and hence corporate earnings, were skewed to the downside. So, we were comfortable holding a modestly lower exposure to international equities and higher levels of cash in the MAS funds versus their strategic targets. Within equities, we preferred companies, sectors, and regions where we had more confidence in earnings and margin outlooks, which naturally gave us a bias towards quality and less cyclical exposures.

Reflecting on these core views six months on, inflation has indeed proved challenging to bring lower and central banks still appear a long way away from declaring victory. The recent message from most policymakers (with the Reserve Bank of New Zealand arguably now an exception) is that key policy rates will need to head even higher to bring inflation sustainably lower. In this regard, macro developments have been broadly in line with our expectations.

What has been the main surprise, and a positive and welcome one at that for investors, is that despite these ongoing challenging macro settings, global equity markets have performed solidly this year. Part of this performance reflects that some major economies, and the US especially, have been relatively resilient in the face of interest rate hikes, and so markets have been reducing the odds they place on the global economy falling into recession and increasing the odds of central banks engineering a soft landing. However, the strength also reflects the positive tailwinds that some parts of the market are currently enjoying from possible new secular growth themes like AI.

So, what could be in store for the next six months and beyond? We are keeping an open mind to the prospects of a soft-landing, and of course the burgeoning AI theme. It is quite possible that these forces continue to support equity markets in the near term. But there are clear risks. The path to a soft landing remains a narrow one, especially if inflation continues to prove stubborn. It is also a scenario that increasingly looks priced in when we assess equity market valuations, creating risks of disappointment. The AI theme is admittedly more of a wildcard, but it is also not without its risks as markets attempt to gauge (at this very early stage) the winners and losers.

Ultimately, despite the resilience that equity markets have shown this year, we remain happy maintaining our cautious investment stance. But recent developments also remind investors of the importance, even with heightened risks, of maintaining an appropriate level of exposure to growth assets relative to strategic asset allocation targets. It rarely pays to take extreme asset allocation views. The past six months is a testament to this.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of members.

At times like these, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice. To book an online or phone meeting, please complete this form and we will be in touch.

We also have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form:

MAS KiwiSaver Scheme: KiwiSaver Documents and Forms

MAS Retirement Savings Scheme: Retirement Savings Scheme Documents and Forms

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

MAS KiwiSaver Scheme: KiwiSaver Funds

MAS Retirement Savings Scheme: Retirement Savings Scheme Funds

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

STONZ and MAS working together to support RMOs

17 July 2023 - STONZ (a union advocating for and run by resident medical officers) and MAS have agreed to work together to support RMOs throughout New Zealand.

Annual Reports 2023 – the MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme

03 August 2023 – The MAS KiwiSaver Scheme and the MAS Retirement Savings Scheme have launched new tools and been recognised for responsible investing.