Sharply higher inflation is driving interest rates higher

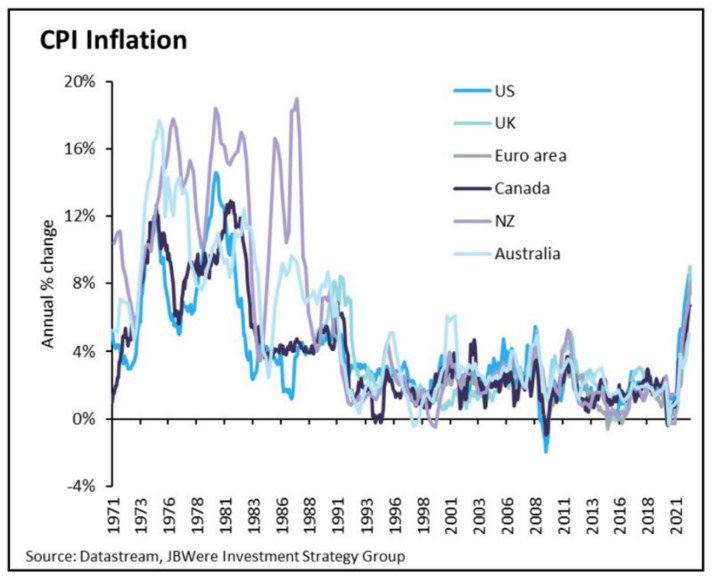

Before we address what rising interest rates mean for fixed interest investors, let's first look at why interest rates have risen sharply over the past year or so. The simple answer is that inflation has surged to multi-decade high levels as the chart below illustrates to 30 September 2022.

The spike in inflation has primarily been caused by central banks and governments being too slow to withdraw the unprecedented stimulus they provided to economies to soften the blow of COVID-19 related disruption. Economies have been quick to recover, but authorities have been slow to react. As a result, in many markets demand has outstripped supply, and pushed up prices. In addition, disruption to supply chains has pushed up costs, while the war in Ukraine has led to an enormous increase in energy prices in Europe, with flow on effects to other countries, including New Zealand.

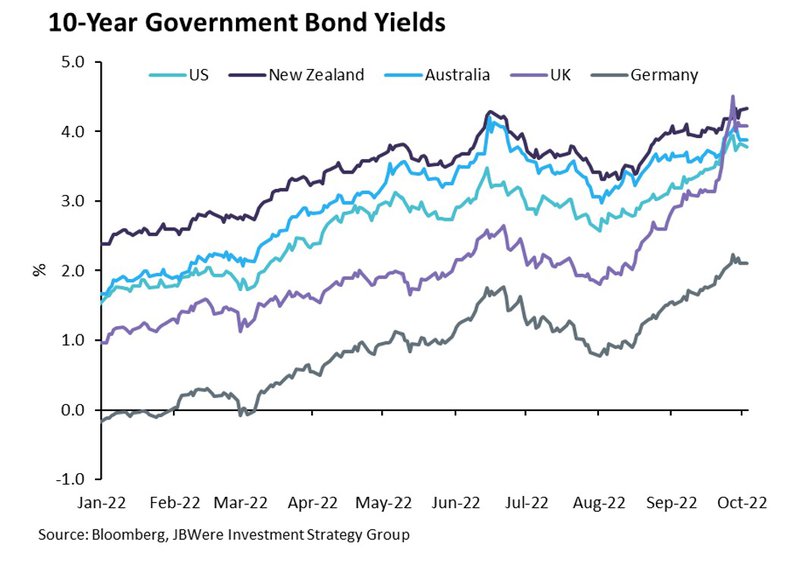

Central banks have belatedly reacted to higher inflation by raising official interest rates to slow economies in an effort to reduce demand and in turn inflation. However, inflation has proven persistent and central banks have had to raise official interest rates much more than was expected a year ago. The central banks have also threatened that there may be more rate hikes to come, as inflationary pressures show few signs of easing. These actions have led to an unprecedented increase in interest rates (yields), which the chart below illustrates for the first nine months of this year.

A primer on bond pricing

Before we look at what rising interest rates means for returns from fixed interest, we first need to understand how bond prices are calculated.

Put simply, a bond, otherwise known as a fixed interest security, is borrowing by one party whereby they borrow capital from another party and pay that other party interest at a fixed rate and frequency (often referred to as a coupon), plus the capital back on an agreed future date.

Bonds are therefore like a bank term deposit. With a term deposit, a bank borrows capital from a depositor and then pays interest plus the initial deposit back upon maturity. The key difference between bonds and bank term deposits is that bonds are securities that can be bought and sold during the term of the bond, whereas bank term deposit cannot.

Because bonds can be bought and sold during the term of the bond, there needs to be a method by which parties agree on the price of the security for the transaction. To illustrate how this price is calculated, let's first use a bank term deposit as a simplified example.

Imagine if you were to invest $10,000 for five years at an interest rate of 2.0% p.a., payable semi-annually. Over the term of your deposit you would receive total interest of $1,000 ($100 twice a year for five years) plus the return of your $10,000 at the end of the term. If a year after making the initial deposit, term deposit interest rates had gone up and you could now invest for the remaining four years at say 2.5% p.a., you are missing out on $200 of additional interest that you could earn on your $10,000 if you were to make the deposit now for a four-year term.

Put another way, if you were asked to invest in a term deposit that paid 2.0% p.a. when the current market interest rate was 2.5% p.a., you would want to only invest $9,800 while still receiving $10,000 on maturity. That way you earn an effective interest rate of 2.5% on your deposit as the additional amount received on maturity compared to what you deposited offsets the below market interest payments you received during the term of the deposit.

The difference between the $10,000 you originally invested and the $9,800 you could now invest for the same result, is the opportunity cost of higher interest rates. But this cost is theoretical – you don't record this in your personal financial statements in any way.

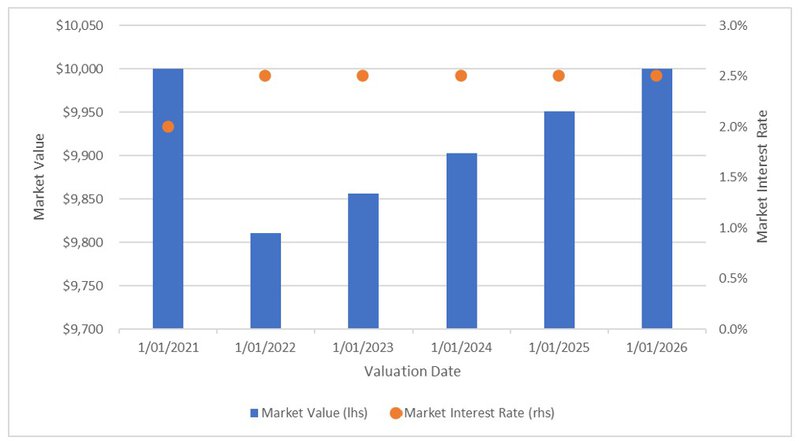

Now, imagine if instead of a term deposit you had originally bought a bond with the same characteristics. At the end of year one, if the prevailing interest rate for the remainder of the bond's term was again 2.5%, the market value for the bond would be $9,811 - $189 lower than the $10,000 originally paid. This is a little different than the simplified term deposit example above because:

-

It takes into account the interest that can be earned on the interest received during the term of the deposit.

-

The value of $10,000 in four years' time is discounted back to a present value (at 2.5% p.a.) i.e. a dollar in the future is worth less in the present.

Given the second point, as the bond gets closer to maturity, if the relevant interest rate remains unchanged, the discount to the face value becomes smaller and therefore the market value rises i.e. the unrealised loss on your purchase of the bond shrinks and at maturity is nil. This is illustrated in the chart below.

The key messages here are:

-

The price or value of a bond moves inversely to changes in interest rates because the fixed interest rate (or coupon) becomes less attractive to investors as interest rates rise, driving down the demand and price of the bond, and vice versa.

-

An unrealised loss or gain on a bond will gradually reduce to nil by the time the bond matures (assuming all contracted payments are made). If, however, you sell the bond before it reaches maturity you will realise the previously unrealised loss or gain.

What rising interest rates mean for returns for MAS funds

In our funds, investors can contribute or withdraw money daily. This means that it is necessary to value the securities within the funds each day so that a unit price can be determined for the transaction that is fair to the investors making the transaction and the other investors in the fund.

Using our bond example above, the requirement to revalue securities daily means that even if a bond held in our funds is not actually sold and a loss realised, its value will fall if the relevant market interest rate increases. If the fall in value of the bond is greater than the interest it has earned that day, the overall return from that bond will be negative which in turn lowers the fund’s unit price and the value of an investor’s holding in the fund.

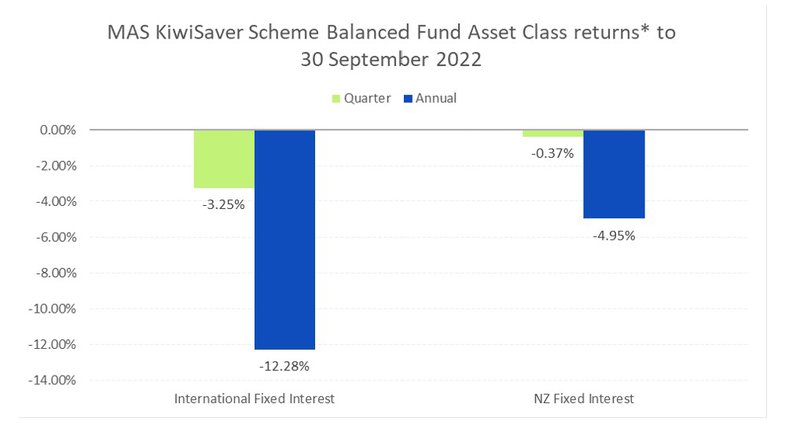

Given the sharp rises in interest rates this year and the inverse relationship between interest rates and the price/value of bonds, returns for both New Zealand and international fixed interest markets have been negative over both the quarter and the year as the chart below illustrates.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax.

How unrealised losses on bonds are recovered

While returns from fixed interest have been negative for a protracted period, it’s important to understand that most of the reduction in value of the bonds held by our funds are temporary – caused by daily revaluations, rather than by our investment managers selling the bonds and realising the losses. This means that if the bonds are held to maturity and make their expected payments, their values will gradually return to their original purchase price and the unrealised loss depressing the fund’s unit price and return will be gradually reversed.

Importantly though, unlike shares, interest rates do not need to return to their levels from a year ago for MAS funds to recover the associated unrealised losses. Even if interest rates stay at the current elevated levels, over time the unrealised losses will be gradually recovered if the bonds perform as contracted.

But this process will not be quick. While our investment managers have been investing for shorter terms than usual to help protect MAS funds from the adverse effect of potential rises in interest rates, on average the bonds within the MAS funds New Zealand fixed interest portfolio will mature over the next approximately three and a half years, whereas those in the international fixed interest portfolio will mature over the next approximately six years. Returns will however improve faster than the recovery of unrealised losses, as when a particular bond matures, the proceeds will be available to be reinvested at the new higher interest rates, boosting the future return of the fund. Of course, if you were to exit from a MAS fund before these time frames you would be effectively realising losses that otherwise would likely be recovered in future by remaining in the fund.

Outlook

The path of interest rates (and by implication returns from fixed interest securities) from here depends on whether the expected path of hikes in central bank policy rates already factored in by bond markets are sufficient to return inflation over the medium term back to the levels targeted by central banks.

Our specialist fixed interest investment manager, Bancorp Treasury Services, judge that we are nearing a peak in the current upward cycle in interest rates given how aggressively central banks are hiking official interest rates as they fight to get inflation back under control. Peaks in official interest rates across major economies are expected over the next three to six months and current pricing of long-term interest rates reflect this. For instance, in New Zealand, market pricing is for the Official Cash Rate (currently 3.5%) to rise to nearly 5.0% by May 2023.

Of course, there remains a risk that official interest rates may have to go higher than currently expected and with that long-term interest rates rise further. However, given the magnitude of the interest rate increases seen over the past couple of years, it is not expected that any further increases in long term interest rates will be anywhere near as large.

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JB Were (NZ) Pty Ltd, and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

Our financial advice disclosure statement is available below or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both Schemes.

More news

New MAS Head of Investments and Business Development

14 October 2022 – MAS welcomed Helen McDowall into the newly-created role of Head of Investments and Business Development in late July.

Graduate dentists matched with roles at employment fair

25 October 2022 - Dozens of dentists received job offers as a result of attending the New Zealand Dental Association Employment Fair in August.