During 2017 international share markets had barely a week where they didn’t rise. For investors the year was very comfortable – a bit like sitting in your favourite easy chair. But 2018 has been significantly more volatile and in the past quarter in particular international share markets fell sharply. Many investors could be forgiven for thinking that they had swapped their comfortable easy chair for a very uncomfortable electric chair!

Our investment managers’ prediction last quarter that investors should expect increased volatility in the performance of their Funds proved accurate. After many global share markets reached record highs during the September quarter, they subsequently slumped sharply in the December quarter, in many cases below their opening levels for the year.

There was no single catalyst for the dramatic reversal in markets, but some of the more significant factors included:

- Fears that the US Federal Reserve was raising the Federal Funds Rate (the equivalent of our Official Cash Rate) too fast. This would choke economic growth in the US as well as raise the cost of borrowing in other economies.

- The escalating trade dispute between China and the US and fears that this would damage world economic growth – and thereby company profits.

- Signs that economic growth indicators around the world are beginning to slow, raising concerns about companies’ abilities to continue to grow their revenue at the recent high rates.

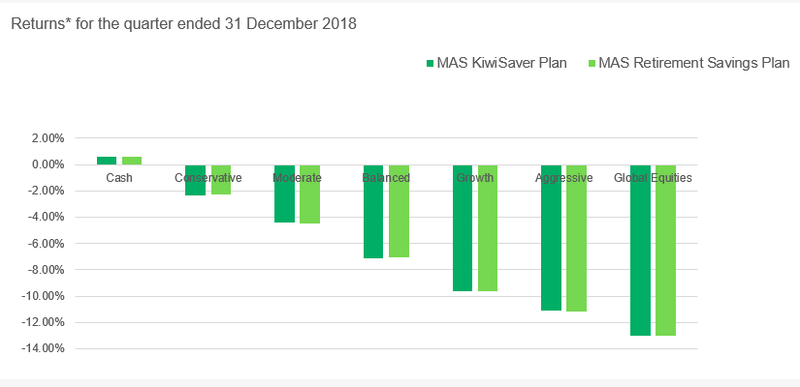

The outcome of the share market weakness was that returns for all Funds excluding the Cash Fund were negative for the quarter for the first time in more than two years. The graph below shows what this means for individual Funds.

* Returns are after total annual fund charges and before tax

Note: prior to 30 November 2018 Conservative was called Defensive and Moderate was called Conservative

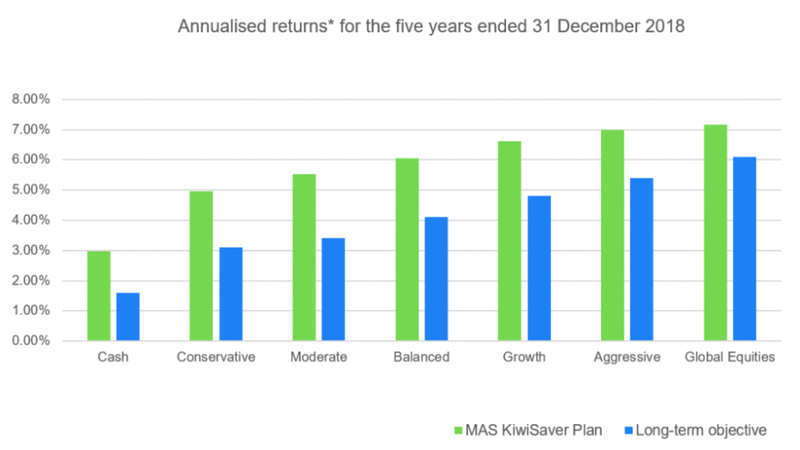

At times like this it is important to take a longer-term view. Despite the weakness in returns over the past quarter – and the adverse impact this has had on returns for 2018 – fund returns for the five years to 31 December 2018 are still above the long-term levels we expected thanks to exceptionally good returns in previous years. This illustrated is in the chart below.

* Returns are after total annual fund charges and before tax

Note: prior to 30 November 2018 Conservative was called Defensive and Moderate was called Conservative

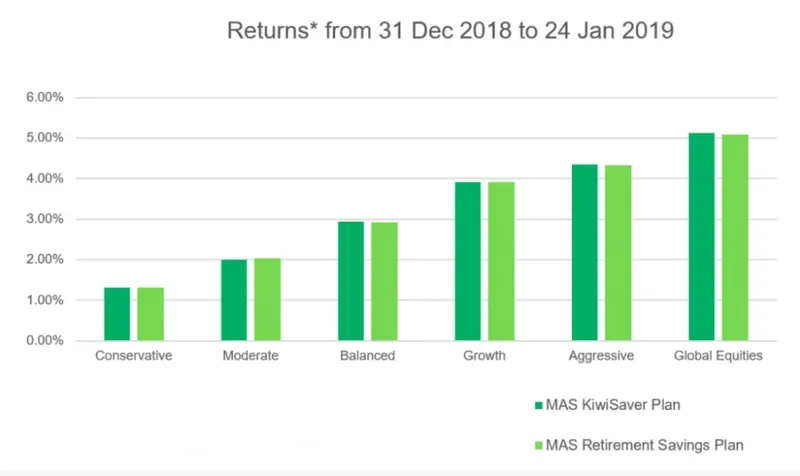

What’s happened since 31 December?

In the three weeks since quarter end international share markets have risen sharply and have already recovered almost half of what they lost in the quarter. The rebound likely reflects a view amongst investors that the sell-off was excessive. Returns for the MAS Funds are outlined in the chart below.

* Returns are after total annual fund charges and before tax

Note: prior to 30 November 2018 Conservative was called Defensive and Moderate was called Conservative

You can find the monthly updates on Fund unit prices and returns for KiwiSaver here and for our Retirement Savings Plan here.

Outlook

Our investment manager, JBWere, considers the recent slump in global share markets to be a reset, rather than the beginning of a more sustained reversal. They particularly note that while global economic growth may be slowing, it is still at relatively healthy levels. Consequently, the risk of recession, the greatest threat to share markets, is currently low.

JBWere are therefore taking advantage of lower share prices to increase the allocation of Funds to international equities, as they expect during 2019 that this asset class will outperform more defensive assets like cash and fixed interest. But they do note financial markets are likely to remain volatile for some time yet.

We can help

If you are unsure whether the Fund you are in is right for you based on how it is performing, we recommend you check your risk profile here. And if you wish to switch Funds you can by completing a switch form. We currently waive the $50 switching fee if you switch more than once a year.

We recommend you get advice. Our advisers aren’t paid commission and as a benefit of membership their advice comes at no extra cost to you. Here’s how to get in touch.

More news

MAS welcomes life insurance industry report.

29 January 2019 - New Zealand's financial sector regulators, FMA and RBNZ, have published a joint report on the conduct and culture in the life insurance industry.

Consumer NZ People's Choice 2016, 2017 & 2018

24 December 2018 - MAS was once again the top overall performing insurer, scoring top in both the 2018 and 2016 survey results.