The quarter was another one characterised by volatile financial markets as investors’ expectations that inflation was near its peak see-sawed between optimism and pessimism. These changing expectations drove big swings in interest rates and share markets.

The quarter began with falling interest rates and rising share markets as investors took heart from tentative evidence that the pulse of inflation was beginning to ease. Therefore, market expectations were that a peak in official interest rates was near and lower inflation could be engineered without undue damage to economies.

But this view was challenged in early February with data showing that not only were economies and labour markets generally proving resilient to central bank interest rate hikes, but inflation in major economies wasn't slowing as much as expected. This in turn saw central banks, notably the US Federal Reserve, state that they anticipated official interest rates to rise significantly further and to remain elevated for a prolonged period.

Following these developments, long-term interest rates in many economies rose sharply, while share markets fell. But the volatility of the quarter was not over yet.

In early March, the rapid collapse of mid-sized US bank, Silicon Valley Bank triggered a rush by depositors to withdraw money from other banks seen as vulnerable. Within about a week, two more mid-sized US banks were in trouble and the contagion spread to Europe where major Swiss bank Credit Suisse, was forced into a merger with its main rival, UBS.

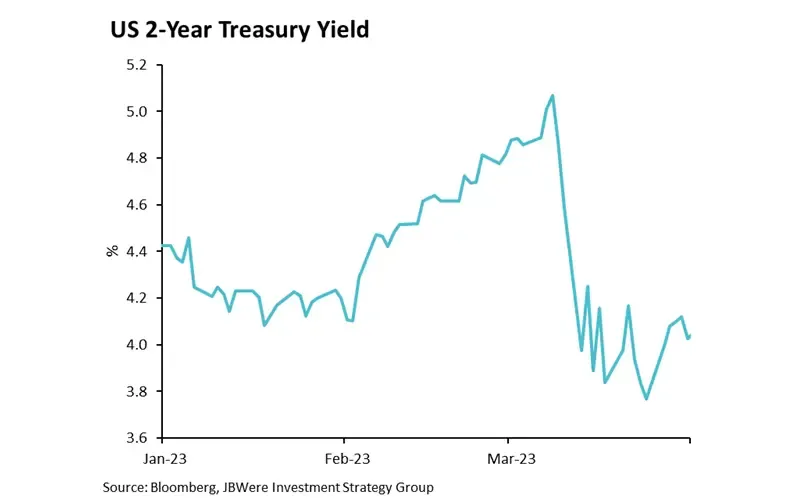

In response, investors feared that there might be a full-blown international banking crisis. Given this risk, expectations for official interest rates rapidly changed and markets began pricing in the likelihood that official interest rates had peaked and would be cut within a few months. This saw a big fall in longer term interest rates. The roller coaster ride for interest rates over the quarter is illustrated in the chart below.

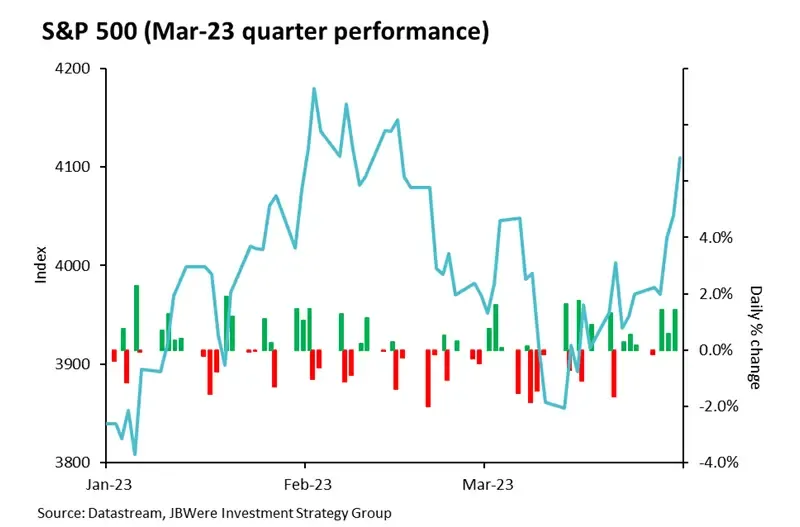

Global share markets, after initially falling in early March due to news of the bank troubles, generally recovered these losses over the remainder of the month. It appears that investors are taking the view that significantly lower interest rates will offset the risk of further bank failures while also keeping economic activity (and profits) at healthy levels. The path of share markets over the quarter is illustrated in the chart below for the key US share market.

Key: The blue line represents the S&P500 Index (Left axis). The vertical lines represent the daily percentage change in the index (right axis). Green means a positive change while red means a negative change.

Here in New Zealand in February, despite the shocking damage caused by Cyclone Gabrielle and the floods in Auckland, the Reserve Bank increased the official cash rate (OCR) from 4.25% to 4.75% and signalled that the OCR was likely to increase to 5.50% during 2023. Of course, since that announcement, much has changed in the global financial market environment. As at the date of this report, market expectations are for the OCR to reach 5.5% around the middle of the year, starting to fall soon after, reaching about 4.7% a year later. This implies that the market believes that following its aggressive hikes to the OCR, the Reserve Bank will be able to start cutting the OCR later this year as the New Zealand economy slows and potentially falls into recession.

What this all meant for returns

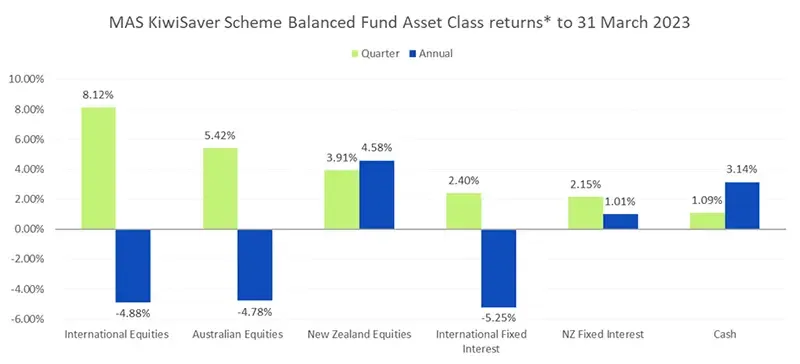

The differing fortunes of various asset classes are illustrated in the chart below. This shows returns for asset classes in the MAS KiwiSaver Scheme Balanced Fund. Returns for asset classes in other MAS funds are very similar.

Note: *The return for International Fixed Interest is after third party manager fees. Otherwise returns are shown before fees and tax. For illustrative purposes the Australasian equities asset class has been separated into Australian equities and New Zealand equities.

Key points to note in the chart above are:

- While all asset classes produced positive returns for the quarter, only half did over the full year.

- NZ and international fixed interest had similar returns for the quarter, but they were very different for the year. This primarily reflects the earlier start by our central bank to raising the Official Cash Rate (which reduces returns from existing fixed interest securities in the short term) and hence the higher likelihood that they have finished, compared to other central banks.

- The relatively defensive nature of the New Zealand share market has seen it do better than international share markets for the year – recovering some of its underperformance over the past couple of years when international (predominantly US) technology companies were in vogue.

What this means for our funds

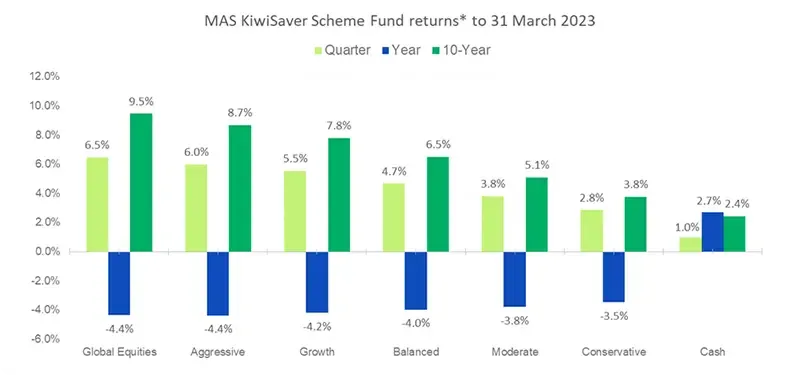

The chart below shows returns to 31 March 2023 for all funds in the MAS KiwiSaver Scheme.

Note: *Returns are after total annual fund charges and before tax. The returns for 10 years are annualised returns.

Key points to note from the chart above are:

- No fund other than the Cash Fund had a positive return for both the quarter and year.

- Despite the Cash Fund’s recent outperformance, its return over the long-term (10 years) is well below that of our other funds. In other words, investors in those other funds for the full past 10 years have been rewarded for taking on additional risk.

The outlook

We asked JBWere, our lead investment manager, for their outlook for financial markets for the remainder of 2023, and their commentary is outlined below.

On one level, it shouldn’t come as a surprise that strains within financial systems have now emerged after one of the most aggressive and coordinated global central bank tightening cycles ever. There is a saying in financial markets that central banks tighten monetary policy until something breaks. Indeed, perhaps the bigger surprise has been that, with the possible exception of the issues within the UK pension sector last year and sporadic problems in the cryptocurrency space, there were very few signs that anything had broken yet. Certainly, economies and labour markets have generally proven resilient in the face of the sharp tightening in financial conditions.

But that has clearly now changed. The recent US and European banking sector issues highlight that there are consequences associated with aggressive central bank actions. That is not to argue that those actions were unjustified by the inflation backdrop, however recent events increase uncertainty. They muddy the waters when thinking about the path forward from here for economic growth, inflation, central bank policy and ultimately financial markets and optimal positioning for investor portfolios.

The situation is fluid, but we don’t believe we are on the cusp of another global banking crisis similar to what we saw in 2008. For one, so far the response from policymakers has been significant. Also, unlike in 2008, concerns focus on deposit stability, not asset quality, making central bank liquidity interventions more effective. Ultimately, banking systems are better capitalised and better regulated than they were 15 years ago. While it is quite possible that more challenges will emerge, especially in some of the weaker US regional banks, and volatility is likely to increase, we believe that current concerns will ease. Recent market price action has been encouraging in this regard.

Even so, these recent issues will still have real economic consequences as credit availability is further curtailed, influencing economic growth and sentiment, and skewing risks further to the downside. That said, it shouldn’t be forgotten that weaker economic growth is exactly what central banks have been attempting to engineer to sustainably lower inflation. All else being equal, tighter credit conditions are seen as necessary by central banks to reduce the number of interest rate hikes. But whether central banks can quickly pivot to lowering official interest rates later this year (as is currently priced in many markets), remains to be seen. We suspect that unless the economic growth picture shows more obvious signs of major deterioration, stubborn inflation may tie policymakers’ hands for now.

Ultimately, there are many ways this could play out from here. However, we see little reason to alter the relatively cautious positioning for the MAS Funds already in place. For some months we have been holding higher levels of cash and a reduced exposure to international shares relative to the Funds’ long-term targets, and we remain comfortable with this stance. Additionally, we retain our preference for quality companies and sectors within equity portfolios, as another way to potentially cushion predicted market volatility in future.

What does this all mean for you?

Financial markets are unpredictable, and your investments will perform differently over time. So, it's reassuring to know that our skilled investment managers are closely monitoring developments in financial markets and actively making decisions to try to protect and grow the capital of Members.

At times like these, it’s important to keep the long-term in mind and see past any shorter-term peaks and troughs. It’s reassuring to know that you can speak face-to-face to your dedicated MAS Adviser who will work with you to develop a sound investment strategy and help you stick to it during challenging times. There is no additional cost to speak to a MAS Adviser and because they are not paid commission, you can trust their advice. To book an online or phone meeting, please complete this form and we will be in touch.

We also have useful online tools to help you:

- Our Fund Finder can help you see if you're in the right fund for your circumstances.

- Our KiwiSaver Retirement Calculator can help you understand if your retirement savings are on track.

If you decide to change your fund after reviewing your risk profile or meeting with a MAS Adviser, you will need to complete an investment strategy change request form:

MAS Retirement Savings Scheme.

There is no fee for switching.

You can see weekly updates on fund unit prices and returns on our website:

Disclaimer

This article is of a general nature and is not a substitute for professional and individually tailored advice. Medical Funds Management Limited, JBWere (NZ) Pty Ltd and Bancorp Treasury Services Limited, their parent companies and associated entities do not guarantee the return of capital or the performance of investment funds. Returns indicated may bear no relation to future performance. The value of investments will fluctuate as the values of underlying assets rise or fall.

MAS only provides advice on products offered by its subsidiary companies. Advice is provided by MAS or by its nominated representatives (who are all MAS employees). Our financial advice disclosure statement is available by visiting mas.co.nz or by calling 0800 800 627.

The Product Disclosure Statement for the MAS KiwiSaver Scheme is available here.

The Product Disclosure Statement for the MAS Retirement Savings Scheme is available here.

Medical Funds Management Limited is the issuer and manager of both of the Schemes.

More news

Annual statement and tax certificates for the year ended 31 March 2023

3 May 2023 - Frequently asked questions: Annual statement and tax certificates for the year ended 31 March 2023.

Investment performance commentary for the year ended 31 March 2023

25 May 2023 - The dominant theme for financial markets during the year was the efforts of central banks to bring multi-decade high inflation under control and the risks that this presented to economies.