Small changes now can make a big difference to your retirement

Whether you believe in resolutions or not, the start of a new year is a good time to review your finances. We've put together some tips to help you make the most of your savings as we kick off 2021.

Review your investment fund

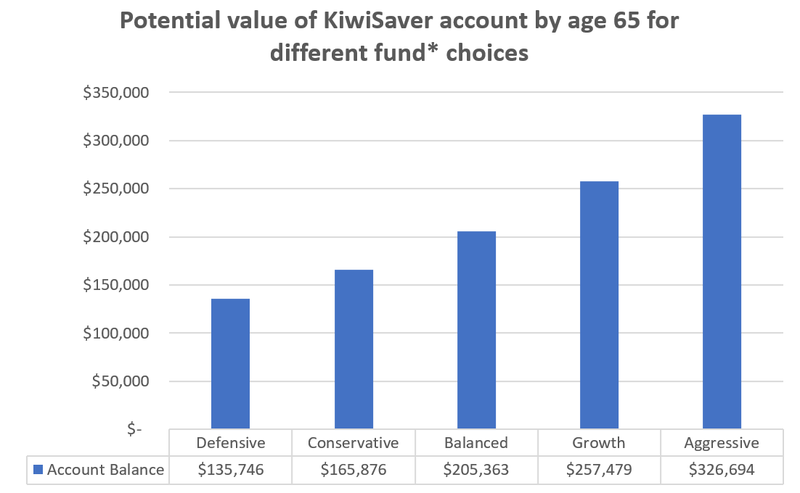

Make sure your KiwiSaver contributions are going into the right type of fund for your circumstances. Choosing the right fund can make a big difference to your savings over time.

You can see the effect different funds have on your savings in the table below. These calculations are for a 25-year-old with a starting salary of $45,000 making the minimum 3% contributions (matched by their employer) with annual salary increases of 3.5% and the maximum annual government contribution.

*Note: Fund names are as per the Sorted website terminology. This differs in some cases from that used by MAS.

We've produced this table using the retirement calculator on the Sorted website. The table assumes you will continue contributing to the same fund over the course of your career. In practice, you may decide to switch funds at various points in your career, depending on your changing circumstances. The most important thing is to get financial advice tailored to your particular needs.

You can get an insight here into what may be a suitable MAS KiwiSaver Fund.

And if you decide you want to switch Funds, you can switch here.

There is currently no switching fee.

Are you contributing enough?

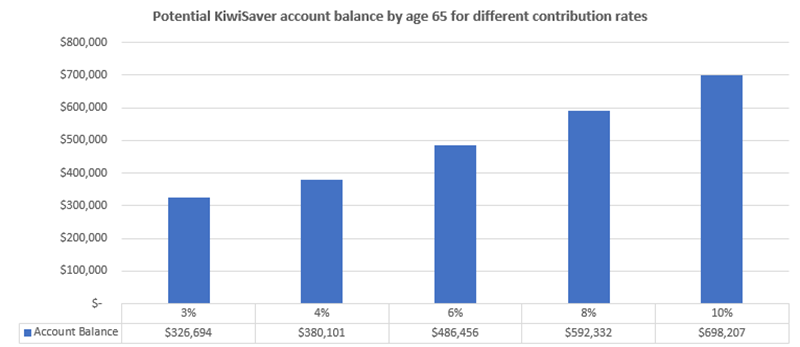

The more you contribute towards your savings now, the better off you'll be when you retire. The minimum contribution you can make to KiwiSaver is 3% of your salary, which your employer will match. But that doesn't mean you can't choose a higher rate if you want to.

In the table below, you can see what could happen to your KiwiSaver balance when you contribute at a higher rate. These calculations are for a 25-year-old with a starting salary of $45,000 contributing to an Aggressive Fund, with employer contributions of 3% and the maximum annual government contribution, assuming salary increases at 3.5% per annum. As you can see, putting aside a little bit extra from each pay packet can make a big difference when you get to your 65th birthday.

We've produced this table using the retirement calculator on the Sorted website. Find out more about the assumptions built into these calculations and to try the calculator for yourself here.

Check your tax rate

The return you make on your investment is subject to tax, and the amount of tax you pay depends on your prescribed investor rate (PIR). If you haven't let us know which PIR should apply, you will be taxed at the highest level of 28%.

If you're unsure about your PIR or wish to change it, you can find out more here.

Maximise your Government contribution

Did you know the Government will contribute to your KiwiSaver account, as long as you meet the relevant eligibility requirements?

If you have a KiwiSaver account and you're aged between 18 and 65, then the Government will put in 50 cents for every dollar you contribute up to $521.43 each year.

That means you'll need to contribute $1,042.86 a year yourself or about $20 per week to get the maximum Government contribution (as well as meeting all the relevant eligibility requirements for the full annual period).

Find out more here on our website.

To find out more about how to get the retirement you want, you should get customised financial advice. Our advisers aren't paid a commission and, as a Member, you don't have to pay for their advice. To arrange a meeting with a MAS adviser, simply contact us and we'll be in touch.

More news

Report on fund investment performance for the quarter ended 31 December 2020

27 January 2021 - News of the approval of several vaccines for COVID-19 propelled international sharemarkets to record levels, boosting returns for the MAS funds and closing out an extraordinary year on a positive note for investors.

MAS receives Consumer NZ People’s Choice Award for fifth consecutive year

17 December 2020 - MAS has been awarded the Consumer NZ People’s Choice Award for its house, car, contents and life insurance – for a fifth consecutive year.