What you need to know about insurance as a new landlord

By MAS Team

By MAS Team

Updated 13 September 2023

Becoming a landlord for the first time is a learning process and can be both rewarding and demanding. The experience will vary greatly depending on your property, your tenants, and how you choose to manage and protect your new investment.

There’s certainly a lot of information to get your head around. New Zealand has recently introduced several legislative changes aimed at improving housing conditions and tenants' rights. One is the Healthy Homes Standards, which set minimum requirements for heating, insulation, ventilation, moisture and drainage. There are also amendments to the Residential Tenancies Act, which aim to provide greater protections for tenants.

Along with all your new responsibilities, you’re also taking on new risk, so it’s important to make sure you have the right level of insurance cover.

From deliberate damage or theft by tenants, to unexpected disruptions in your rental income, you need to ensure your valuable asset is insured for a range of scenarios. You also need to understand your new obligations and where to go for help if things go wrong.

Here’s everything you need to know about insuring yourself as a new landlord.

In a nutshell, landlord insurance covers everything that home insurance covers such as fire, theft or natural disasters – but also a whole lot more.

For example, if you own a rental property, landlord insurance protects you against things like loss of rent if your tenants leave without giving the required notice period. Many Tenancy Tribunal disputes in New Zealand involve rent arrears, so making sure you’re protected is a smart move for new landlords.

Another way to think about landlord insurance is that it covers the actions of other people, not just yours as the owner. When you rent a property to people you don’t know, you’re taking on a whole lot of extra risk compared to if you were living there yourself. Landlord insurance protects you against all those extra risks so that your rental asset is secure.

MAS offers insurance for landlords with our Residential Rental Insurance, to cover risks you may be exposed to when owning a rental property.

Yes, it does. Landlord insurance provides coverage for a range of incidents that can occur in a rental property. This includes accidental and unforeseen damage, like red wine on the carpet or a wayward football through a window. With Residential Rental Insurance, glass breakage claims are covered without any excess and landlord’s contents is covered up to $20,000.

For incidents that aren’t so accidental, landlord insurance also provides protection against deliberate damage to the property. Residential Rental Insurance protects you by offering up to $25,000 for loss caused by an intentional act of theft or vandalism by a tenant or guest of a tenant.

A whole lot of things, from locks and keys to burglary and tree removal. Speak to any seasoned landlord and chances are they’ll have a catalogue of stories about unexpected events that ended up being very expensive.

When it comes to potential financial risks for landlords, losing out on rent is high on the list. Whether it’s a sudden accident that makes the house unliveable or tenants leave without adequate notice, insurance for landlords protects property owners from being out of pocket due to a loss of rental income.

Residential Rental Insurance automatically provides up to $15,000 cover for loss of rent, as well as up to $5,000 for rent loss due to lawful eviction or tenant abandonment.

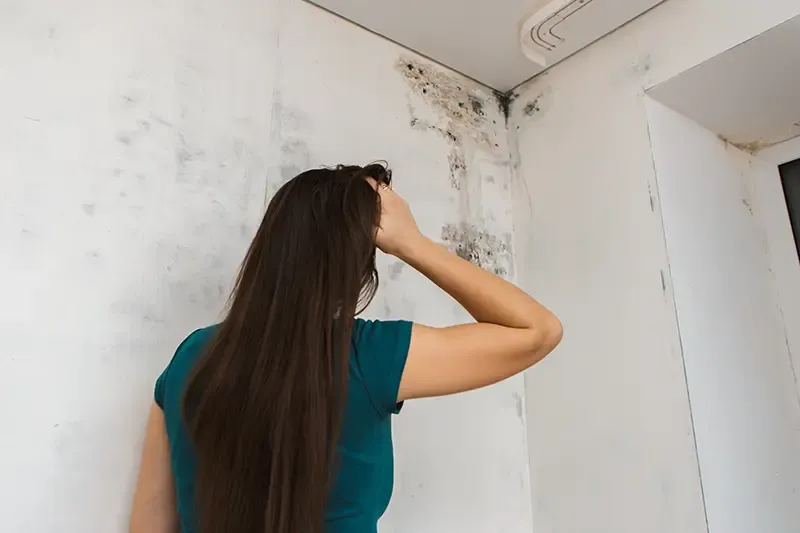

Other benefits include up to $5,000 coverage for repairing damaged lawns and hedges, as well as protection against gradual hidden damage like mildew and internal leaks, up to a limit of $2,500. There’s also cover for the replenishment of fire-fighting equipment used to protect the property from loss.

If you’re renting your property unfurnished, then you probably don’t. Your landlord insurance policy will typically include some level of cover for contents that stay in the rental but belong to you. For example, the oven, whiteware or occasional pieces of furniture. With Residential Rental Insurance, you’re automatically covered for up to $20,000 worth of landlord’s contents.

If you’re providing your rental property fully furnished, you can choose to boost your level of cover by purchasing a separate Contents Insurance policy.

Remember that these policies do not cover your tenants’ personal property. They will need their own contents insurance to cover this.

This comes down to how often you stay in your rental. For example, if it’s a house by the beach and you only drive down a couple of times a year, then Residential Rental Insurance may offer the best cover.

But if you’re spending most weekends or a large part of the year in the property and only renting it out now and again, a MAS House Insurance policy (with some added coverage for when guests are staying), may be the best option. If you have a holiday rental, call the MAS team to talk through the right insurance for you.

It’s complicated. The question of whether landlord insurance covers renting a property on Airbnb can significantly depend on the frequency with which you're planning to rent out the property.

In contrast to traditional long-term tenancies where 1 tenant or family resides in the property for a fixed duration, Airbnb's rental model involves a constantly changing roster of 'new' tenants staying for shorter periods. This distinct difference can make regular landlord insurance less applicable or suitable for Airbnb rentals.

To counter this, Airbnb provides a form of protection known as the ‘Host Guarantee’. This offers some reassurance to homeowners who list their properties on the platform. However, this guarantee comes with its own set of terms and conditions and is not meant to serve as a complete substitute for individual insurance coverage.

Typically, you’ll pay more for landlord insurance compared to standard house insurance. This is because of the greater risk profile associated with rental properties compared to an owner-occupied property.

Other factors like the size, value and location of your rental property also have an influence on the cost of your premium, so it’s best to contact your insurer for a quote that is tailored to your individual needs.

Alongside sorting the right level of landlord insurance, there are a few extra steps to keep in mind:

Keep a record of the condition of the property at the start of a tenancy, and be sure to carry out regular inspections – take photos and keep a log of any damage. This is important for identifying any issues as soon as possible, and some insurance policies require inspections to be carried out at least every 6 months.

Tackle repairs quickly to prevent gradual damage, and always make sure locks and safety features are in good working order so the home is as secure as possible. As a landlord, staying on top of maintenance tasks is important – not only for upkeep of the property but also for insurance purposes. For example, if blocked guttering overflows and leads to an internal leak, lack of maintenance could be determined as the cause of the loss and it may not be fully covered by your insurance.

And lastly, don’t forget to let your insurer know if there are any changes to your rental property. Whether it’s changes to the occupancy rate at your holiday home, you’ve added an extra bedroom to your rental, or built a self-contained granny flat on your lifestyle property, keeping your insurer up to date means you’ll always have the right cover in place to suit your current situation.

If you need to make a claim or simply want to double-check something on your policy, get in touch with your insurer sooner rather than later. Landlord insurance experts, like the team at MAS, are always happy to answer questions to put your mind at ease.

Find out more about MAS Residential Rental Insurance.

In the market for a new car? From car insurance options to fuel types, safety features and beyond, keep these tips in mind to help you make the right choice.

As the temperature drops, you need to get your home reading for any wild weather that winter may throw at it. Get your house prepared for the coldest months with our checklist of must-dos.

Buying your first home is one of the biggest financial decisions you’ll ever make. Make sure you’ve budgeted for all the expenses that come with finding and securing your house, so that the extra costs don’t eat into your deposit.