Investing made easy

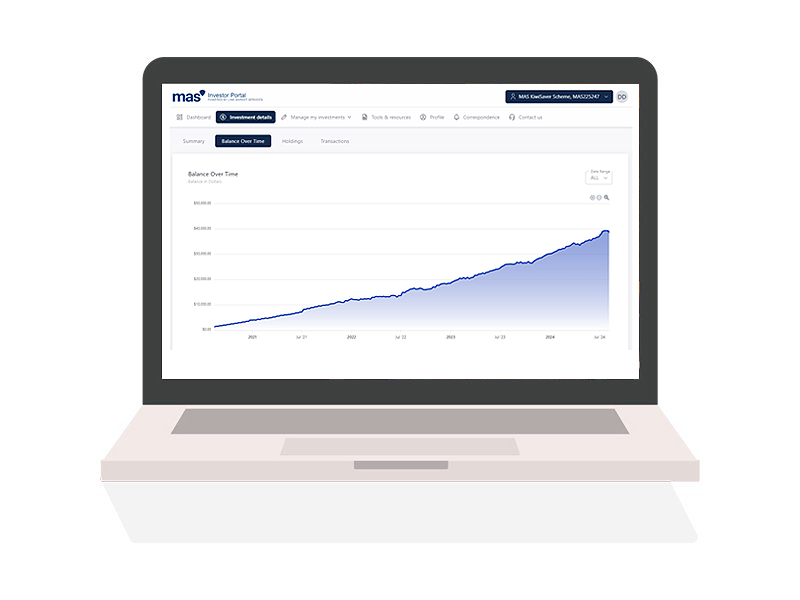

You can check your balance, switch funds, update your details and more in our MAS Investor Portal*. We also have a network of Advisers to help you create the financial future you want.

Make contributions

You can contribute money to your investment account to help it grow faster with voluntary lump sum or regular payments via online banking.

Make withdrawals

With MAS Investment Funds you can withdraw money whenever you want. With the MAS KiwiSaver Scheme and MAS Retirement Savings Scheme you can withdraw money if you meet certain conditions, like if you want to buy your first home or have reached the required retirement age.

Switch funds

If you decide you would like to switch funds or change how your future contributions are invested* it's easy, you can do so inside the MAS Investor Portal. Our Fund Finder can also help find the Fund that best aligns with your risk appetite and investment timeframe.

Transferring schemes

Have you moved to New Zealand from the UK or Australia? The MAS Retirement Savings Scheme is a Recognised Overseas Pension Scheme (ROPS), which means it can accept money transferred from certain UK pension schemes. Also Members with retirement savings in complying Australian superannuation schemes are able to transfer their funds to a New Zealand KiwiSaver scheme. You can also transfer from other NZ KiwiSaver or retirement savings schemes to MAS.

Performance and insights

The long-term performance of your investment funds makes a big difference to growing your savings, which is why we take an active investment approach. You can see how our funds perform and what your money is invested in.

*MAS Investment Funds entity accounts cannot transact online.

Medical Funds Management Limited is the issuer and manager of the MAS KiwiSaver Scheme, MAS Retirement Savings Scheme, and MAS Investment Funds. The Product Disclosure Statements are available at MAS KiwiSaver Scheme PDS, MAS Retirement Savings Scheme PDS, and MAS Investment Funds PDS. If you would like to talk to a MAS Adviser, phone 0800 800 627 or email info@mas.co.nz.