Understanding your insurance premium

By MAS Team | 13 March 2024

Every insurance policy has a premium, but what factors contribute to the cost and why does the cost need to change? Here, we cover some of the basics.

An insurance premium is the amount you pay to an insurance company to protect your asset (e.g. house, car, contents, business) against certain risks. The cost of your premium takes in a wide range of factors, including the type of item insured, the amount of coverage you require, and the likelihood of the insured event occurring.

Premiums can be paid annually, or the cost can be spread monthly or fortnightly, depending on your agreement with your insurer.

Insurance premiums are made up of 2 main components:

Every insurance premium consists of a base premium. At MAS we call this the ‘Society Premium’. The base premium is the amount of your premium that goes to your insurance company. It covers your insurer’s costs for providing protection for your asset and paying claims in the event of a loss. This is the amount your insurer needs to charge to cover the risks it may be exposed to for protection of your asset, reinsurance costs (more on that below), plus the general cost of operating a business and providing service to its customers.

The base premium covers the changeable aspects that differ depending on the individual and the asset.

Depending on the asset insured, the rest of your premium cost is made up of tax (GST) and levies that are set out by the Government, rather than your insurer.

For example, if you insure an asset that could be damaged by a fire, your premium will include the Fire and Emergency New Zealand (FENZ) levy. Your insurer passes this levy payment onto FENZ. If you are insuring a home, your premium will include an EQCover premium, also referred to as a levy. This levy provides natural disaster insurance for residential homes and land up to a certain square meterage. Your private insurer collects this levy, which is paid into the Natural Disaster Fund managed by Toka Tū Ake Earthquake Commission to pay EQCover claims up to $300,000 for domestic dwellings. Essentially, it’s a fee that ensures EQCover is available to you when needed.

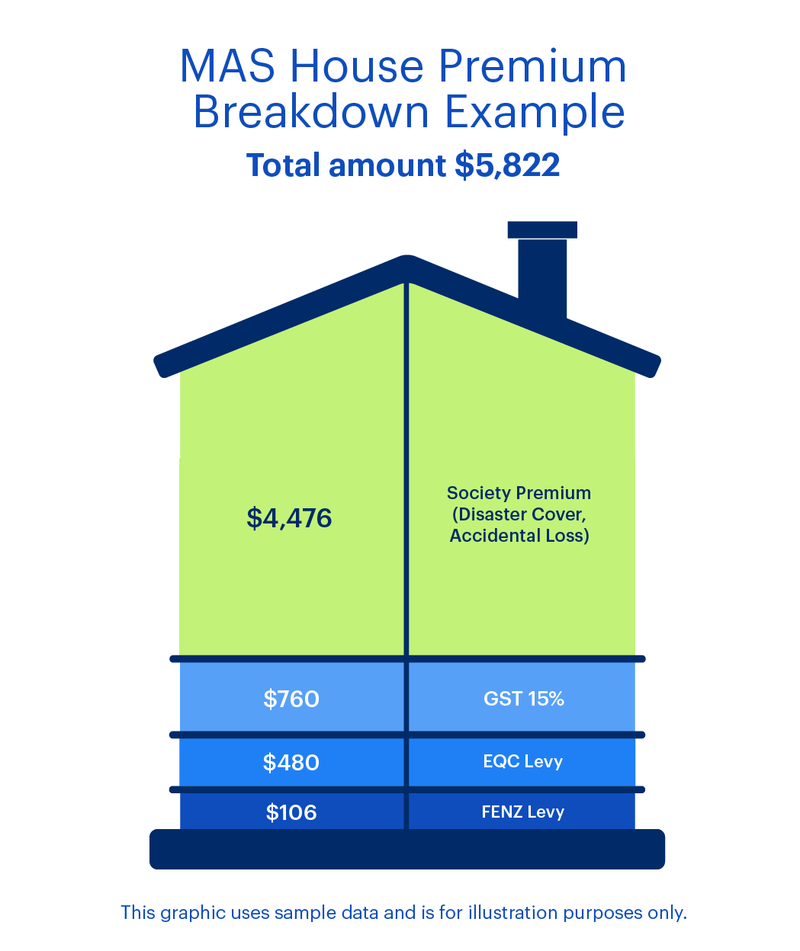

Here’s an example of the way a premium is calculated for a MAS Member with a MAS house insurance policy. The Society Premium for this house is $4,476, which is what the MAS Member pays to cover the risk to MAS from a house claim on this property relating to a natural disaster or accidental loss. The balance of $1,346 is what MAS collects for taxes and levies that get passed on to the relevant government agencies.

This is quite a complex topic as each situation is unique depending on the type of risk being insured.

One of the key factors in determining the cost of your premium is the risk associated with covering the costs of protecting your asset. Risks include a broad range of categories, with a number of sub-categories that can vary depending on the individual or the asset. For example, with home insurance, the location of your home would determine its level of risk. But delve a little deeper, and that risk level also takes in factors like the gradient of your land, access to the property, rivers and waterways nearby, and its proximity to fire services if the property is in a rural area.

Typically, the more risk deemed to be involved with an individual or asset, or the more comprehensive the insurance cover, the higher the premium will be.

Your house premium is impacted by things like the location of the property, the flood or earthquake risk, size of the home, the age of the house, and its construction and materials. Many insurance companies use third party tools like the Cordell Calculator to help give a detailed analysis of a property and its rebuild value, which is a key factor in determining the cost of your premium.

Likewise, your contents premium is influenced by many of the same factors such as your location and fire risk. However, the biggest factor is the value of your stuff, which is referred to as your nominated sum insured. The higher the sum insured, the higher the premium. It’s also important to note that insuring at the replacement value is often a policy condition and underinsuring can prejudice a loss or claim settlement.

Factors that affect your car insurance premium

The society or base premium for your car insurance takes in aspects like the age and claims history of the driver or drivers, location of the vehicle, whether it can be locked up at night in a secure garage, the level of cover required, as well as the make and model of the car. Some areas are more prone to car thefts and some models of car are more commonly stolen. The premium on your car insurance also looks at the rising cost of labour on repairs, which is why insurance costs can rise even as your car ages and loses value.

An EQCover levy is not included as part of a car insurance premium, but it does include a FENZ levy, which is used to help pay for Fire and Emergency services at road accidents.

There are many different types of business insurance and premiums are influenced by how risky your insurer thinks it is to insure your business. For example, Statutory Liability insurance covers you if you unintentionally commit an offence against the law and are prosecuted. If that was the case, your Statutory Liability insurance would cover fines and penalties as well as the defence costs you may need to pay. The level of your premium would depend on the likelihood your insurer thinks that you would need to claim, as well as the potential size of the claim should it occur. For example, if you work in an industry that is tightly regulated and there is a high risk of you or an employee unintentionally breaking the law, then your premiums are likely to be higher than if you work in an industry where there is less regulation.

Other categories of business insurance are similarly based on the level of risk your insurer calculates you represent.

Another category is business interruption insurance. This can help pay your business costs if you can’t operate your business for a reason outside your control, such as a flood or an earthquake. If you have a business that operates expensive machinery in a factory, then the potential cost of a business interruption insurance claim would be much greater than if your business involved people working on portable laptops who could be easily relocated. This risk factor means that the factory and machinery business will pay much higher premiums for business interruption insurance.

The other significant factor in your insurance premiums is reinsurance. In simple terms, reinsurance is insurance for your insurer. An insurance company like MAS takes out reinsurance with specialist global reinsurance companies as a shield against heavy financial losses when paying out on large-scale claims.

Typically, an insurance company will buy reinsurance to protect against major nationwide disasters. When a loss impacts one customer, like a house fire for example, the insurer pays the full cost of the claim. But when the losses impact a large area or large numbers of people insured, that’s when reinsurance kicks in as a buffer against the insurance company taking on too big of a financial loss.

Reinsurance benefits all of an insurance company’s customers, because it means the company can remain profitable enough to have the cash reserves it needs to pay out on the thousands of claims that are not covered under the insurer’s reinsurance program.

Every insurance company carries out regular reviews to determine the cost of premiums, and this can mean your premiums become more expensive over time. Common reasons for premiums to rise include:

There are several ways you can reduce your insurance premiums:

Some insurers, like MAS, offer discounts for customers who have multiple different insurance policies with them. At MAS members qualify for a multi policy discount if they hold 2 different MAS policies out of house, contents or private motor vehicle insurance. MAS Members are eligible for an even greater Goldshield discount if they hold house, contents and motor vehicle insurance with MAS.

Most insurers, including MAS, offer reduced premiums if you choose a higher voluntary excess. Your voluntary excess is the amount you agree to pay yourself in the event of an insurance claim. For example, if you choose a $500 excess on your car insurance, and you make a claim for panel beating that costs $1,000, then your insurer will pay $500. If however, you choose an excess of $1,200 on your car insurance, then your insurer would not pay out anything in the event of a $1,000 repair bill. The trade-off though, is that your car insurance premium will be lower, the higher the excess you choose.

Depending on your insurer, not making a claim for a number of years will also mean you pay lower premiums. This is a simple risk calculation that your insurer makes - if you make no claims, you are deemed to be a less risky insurance prospect than someone who is more accident prone.

Choosing the right level of insurance cover and the right type of policy for you and your family can be tricky. If you’d like to discuss options or have any questions about your premiums, email us at info@mas.co.nz or call us on 0800 800 627.

This article provides general information only and is not intended to constitute financial advice. Before taking out any insurance product, you should carefully consider the terms and specific policy wording. Underwriting criteria will apply.

29 November 2018

These tips can help safeguard your holiday home from some of our most common claims caused by water damage, stormy weather or burglars.

7 December 2021

Choosing between an actively and a passively managed KiwiSaver fund will depend on your own financial goals and priorities. Both strategies have their pros and cons, so it's important to understand their differences.

7 December 2020

Even the most diligent savers among us could still be missing out on financial security without a plan to ensure they are financially resilient. It's essential to have a personalised financial plan to maintain - or establish - financial resilience.